Asia Ex-Japan Equities

Tokio Marine Asset Management International Pte. Ltd. (TMAMI) was established in July 1997 in Singapore and is owned by Tokio Marine Asset Management Co., Ltd, (TMAM), a leading Japanese asset management firm.

TMAMI provides investment management and advisory services to institutional and accredited investors. TMAMI is a Capital Markets Services (CMS) license holder with the Monetary Authority of Singapore, and is a member of the Investment Management Association of Singapore (IMAS).

Explore Asia Ex-Japan Equities With Us

Contact Us Now!WHY INVEST IN ASIA EX JAPAN EQUITIES WITH US?

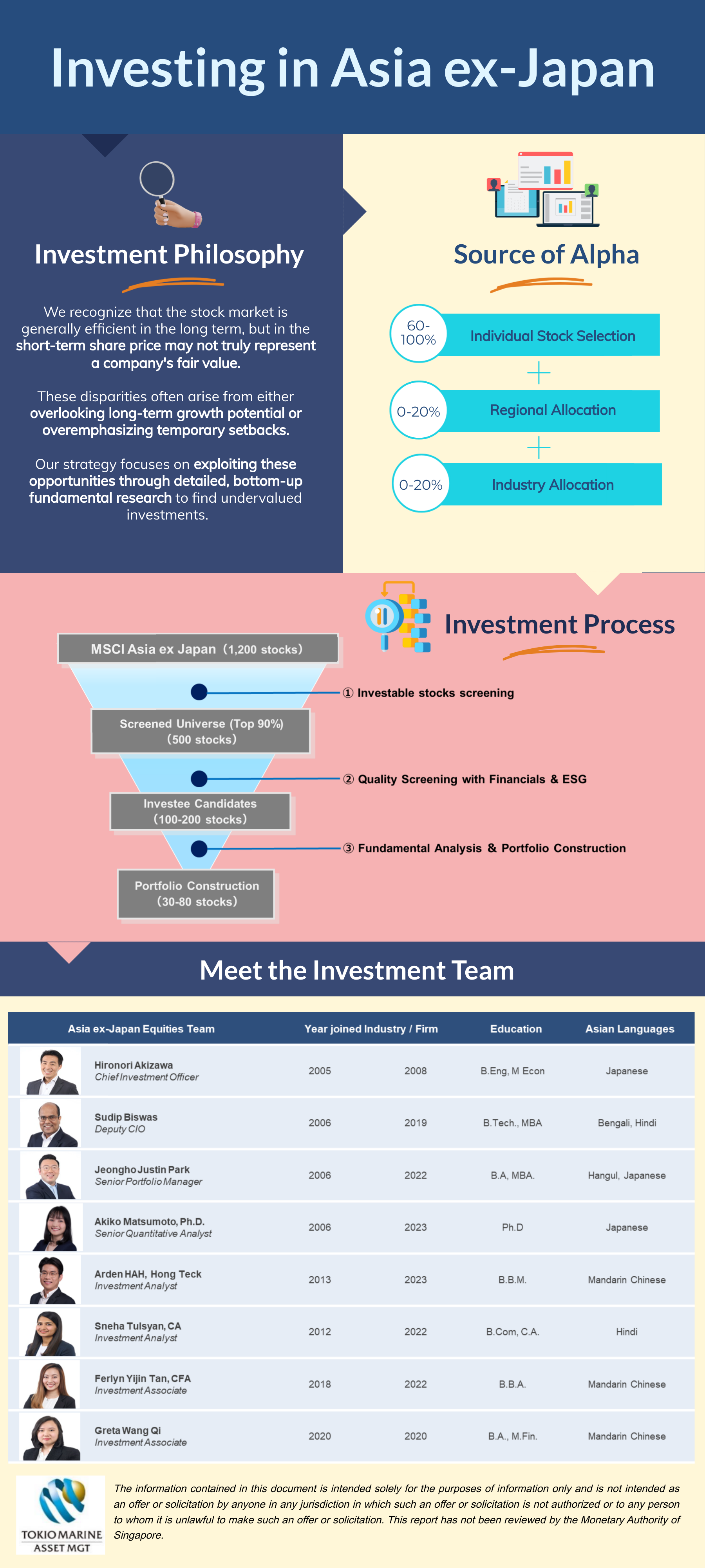

our philosophy

We recognize that the stock market is generally efficient in the long term, but in the short-term share price may not truly represent a company's fair value. These disparities often arise from either overlooking long-term growth potential or overemphasizing temporary setbacks. Our strategy focuses on exploiting these opportunities through detailed, bottom-up fundamental research to find undervalued investments.

in-depth regional expertise

Our Asia investment team offers extensive coverage across the Asia ex-Japan region with deep local insights. We leverage this knowledge to identify key investment opportunities and effectively manage regional complexities. Regular site visits and interactive online meetings help us maintain strong relationships with investee companies, enabling our analysts to make informed investment decisions.

expert market insights and research

Our team delivers a comprehensive perspective across Asian markets, providing strategic insights that empower informed investment decisions. By leveraging complex data with advanced analytical tools, we identify critical market trends, potential risks, and emerging opportunities.

Our track record

With more than 25 years of experience in Asia, our seasoned investment team, with an average of over 12 years of individual experience, possesses deep expertise across all major equity markets in Asia. Our proven track record demonstrates our profound understanding of the investment landscape in Asia, ensuring we make well-informed, strategic investment decisions.