Reports

Executive summary

- 2022 saw indices fall worldwide, despite moderate global growth, but Japan looks attractive in the year ahead even against a widely expected global slowdown; positives include a continuation of pent-up household demand and inbound tourism following the country’s softly-softly approach to reopening the economy

- Monetary policy remains accommodative despite the BoJ’s December surprise, with the central bank looking for wage hikes as PM Kishida pushes for greater investment in human capital

- Other government policies include promoting public-private partnerships in strategic industries – even as Japan Ltd. invests in reshoring high value-added production – and fresh incentives for individuals to shift from saving to investing

- Japan offers unique potential for investors amid global uncertainty in 2023, but extensive local research and active management hold the key

Japan maintains post-pandemic bounce

2022 was a difficult year for equity markets across the globe, with hawkish central banks and economic slowdown driving negative returns – largely as a result of price/earnings and other valuations contracting after years of ultra-easy monetary conditions. The first quarter of the year saw good reason to be pessimistic: surging inflation pointed directly to tighter monetary policy, with economic slowdown set to follow; Russia’s invasion of Ukraine was the year’s biggest news story, but by no means the only geopolitical talking point. The global economy managed to achieve moderate growth, however, beating expectations. This was largely due to a post-Covid reopening and recovery in the areas of consumption, inventory, and capital expenditure, as well as wealth built up during the pandemic.

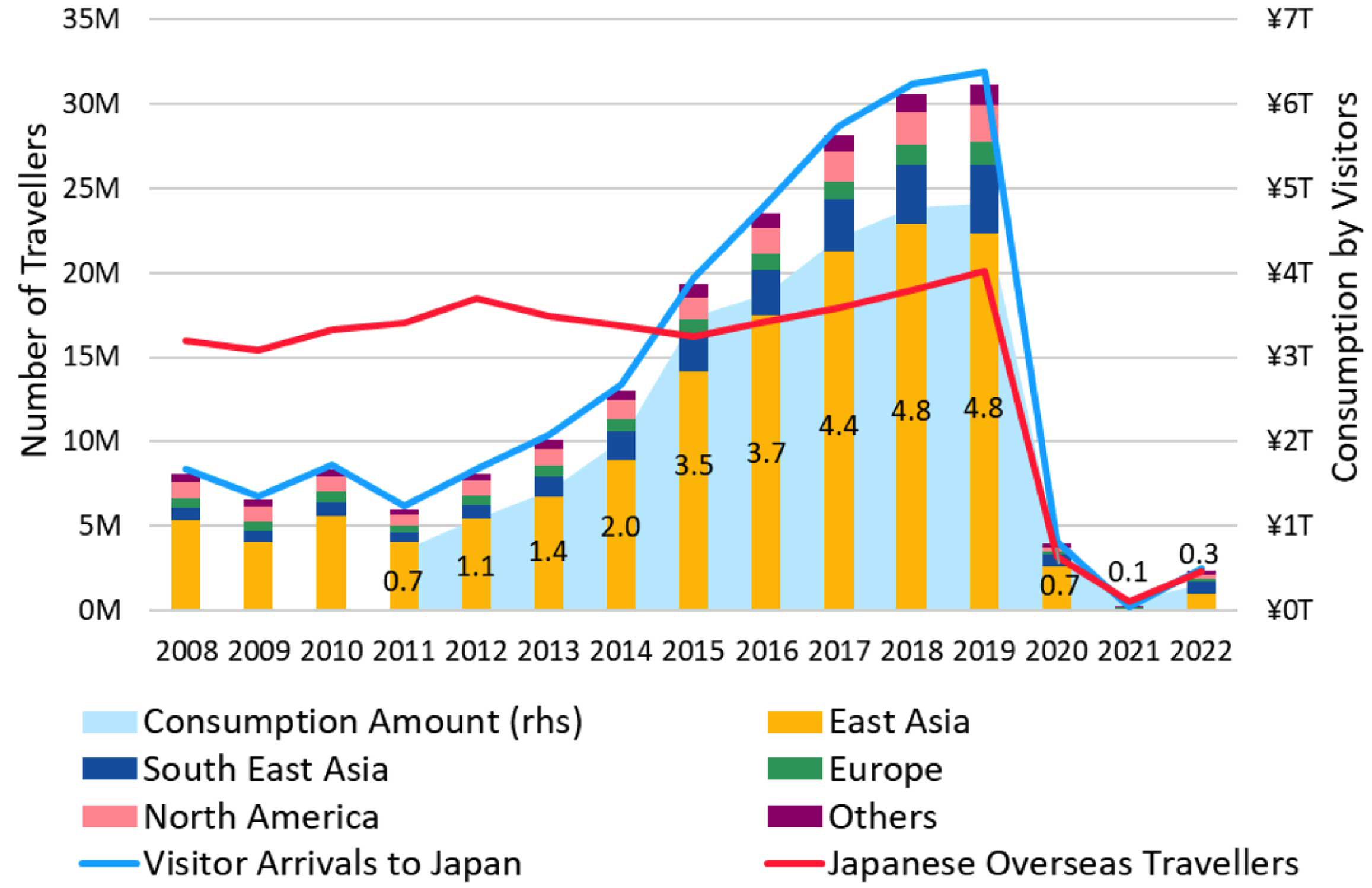

While 2023 will see a general tailing off worldwide in many of these fields, some looks set to continue in economies including Japan, where pent-up demand in household consumption remains propped up by a high level of savings built up during the pandemic. Global slowdown fears notwithstanding, the corporate sector is pushing ahead with capex spending, notably in Japan’s ongoing (and indeed long-overdue) digital shift, as well as its transition to a greener economy. Inbound tourism has been on the increase since the easing of border restrictions in late 2022; the return of visitors from China following the end of that country’s zero-Covid approach will have a major impact in 2023, possibly as early as the first half. Japan’s government is aggressively pursuing an ambitious target of JPY 5 trillion – 0.9% of the country’s GDP – in spending by travellers from overseas.

Fiscal and monetary stimulus to continue

With government spending still supportive and the economy continuing to reopen, Japan looks set to outgrow other advanced economies in 2023. Corporate profits for the fiscal year beginning in April are expected to grow, albeit at a moderate pace, despite a wider global slowdown.

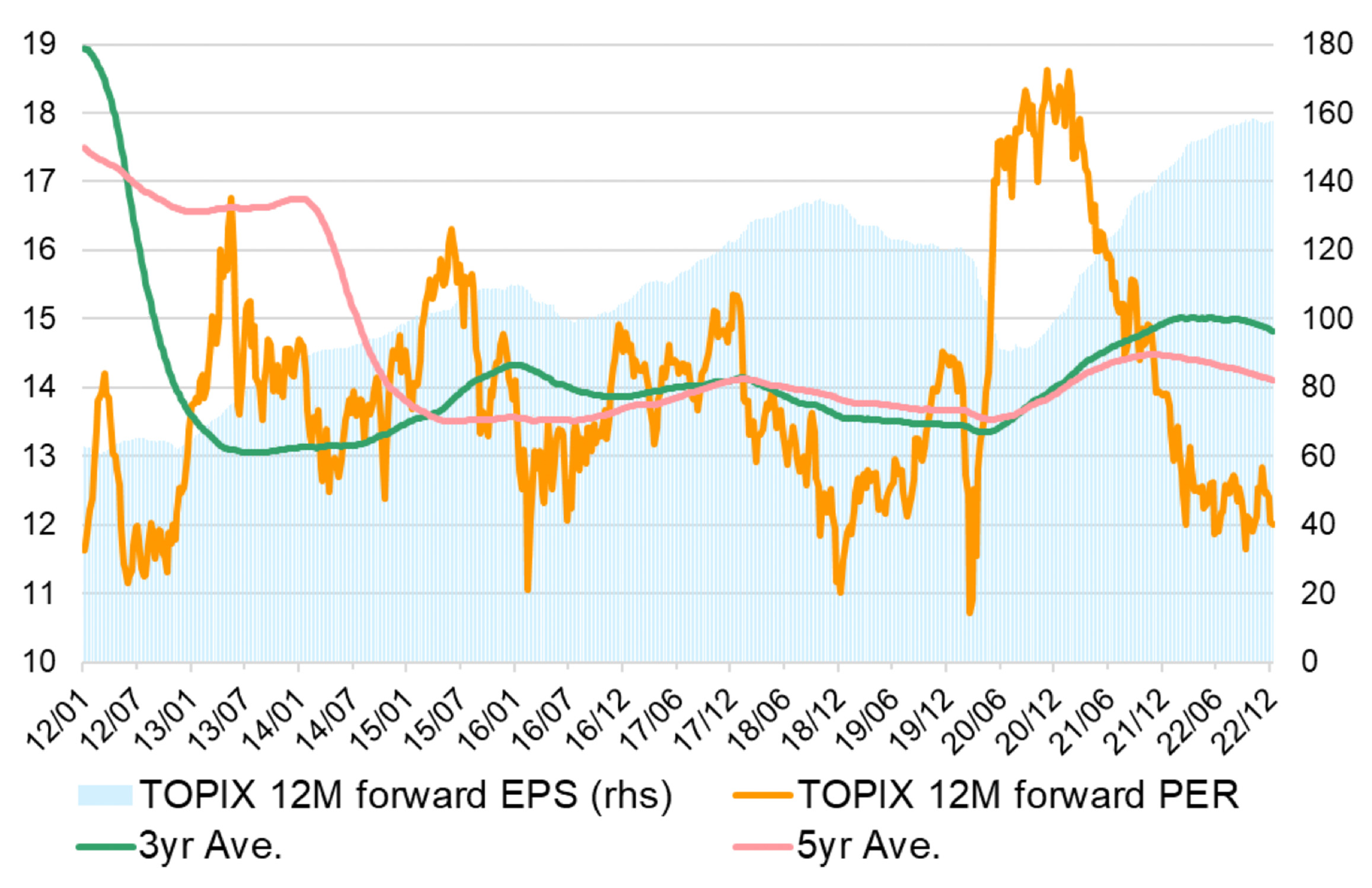

Monetary policy will also remain accommodative, even after the BOJ’s surprise move of raising the 10-year rate ceiling in December 2022. Import prices are peaking and the yen rebounding from its October 2022 nadir, which will make it difficult for year-on-year CPI growth to stay above the 2% target. Government subsidies to tame energy prices will also cap inflation. Wage hikes will be key: Prime Minister Fumio Kishida is pushing for increases, and the central bank has signalled that there will be no start to normalisation without higher pay levels. Wage hikes will also affect service prices, with labour costs set to push up CPI constituents more broadly. Larger Japanese companies in particular are expected to raise pay levels, but should they choose to hedge against the current global slowdown and its impact on earnings – not to mention downward rigidity of wage in Japan – there is no guarantee that hikes will suffice to cover inflation and sustain the cycle. Markets will remain nervous for the first half of the year on the potential for a BOJ policy shift, including the possibility of further moves under a new governor from April; this uncertainty will serve to suppress market valuations.

Given this economic and monetary environment, we forecast a soft equity market in the early part of the year, with conservative corporate profit forecasts for the fiscal year ending March 2024 and a depressed market valuation. Once global inflation peaks and the end of US tightening comes into sight, we expect to see a valuation recovery towards year end.

Key trends to watch

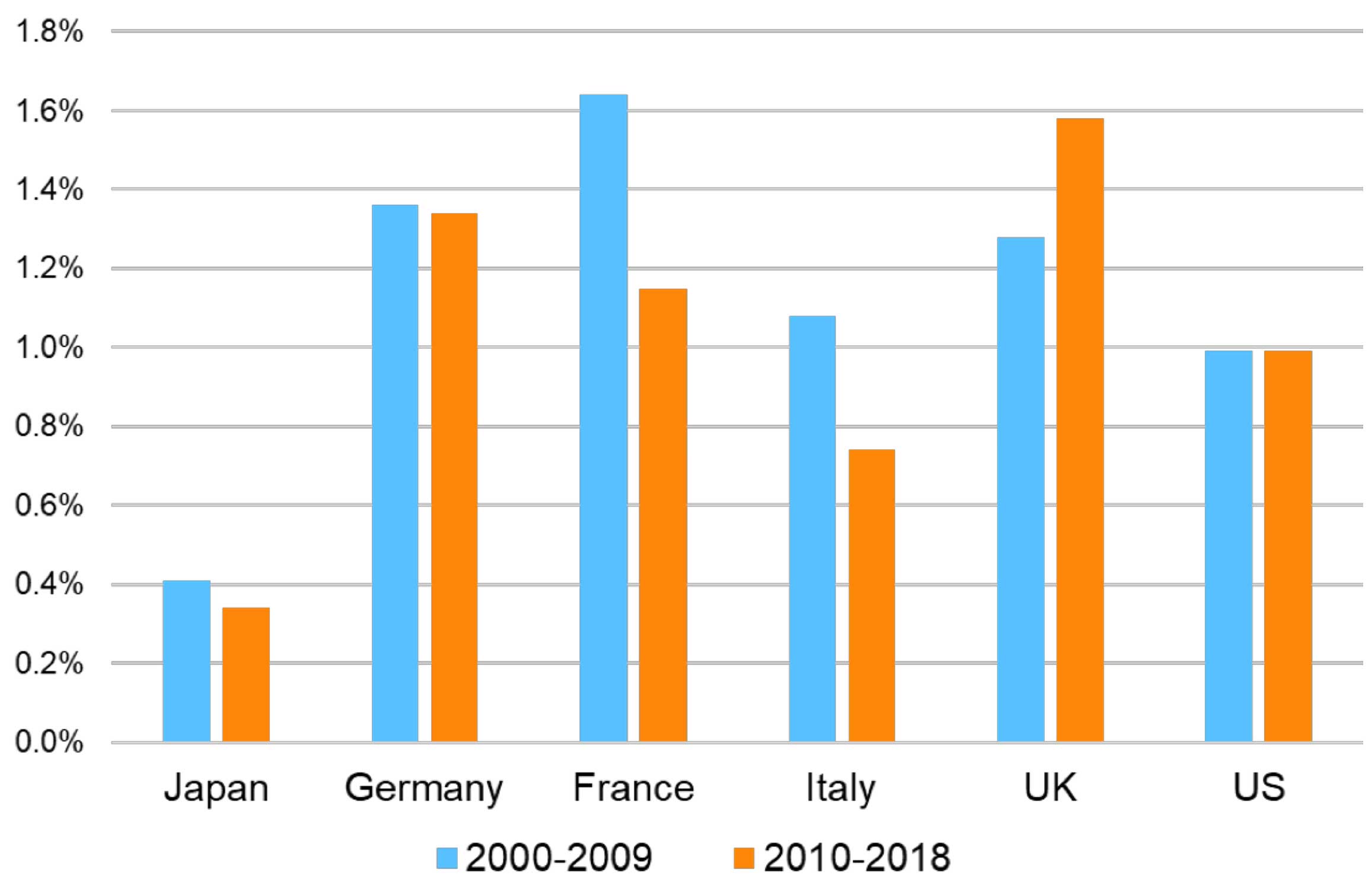

As mentioned, wages will be a key factor for investors to look at both in macroeconomic terms and from a monetary perspective, but will also be worth watching from a corporate Japan productivity viewpoint. Some companies have already introduced new employment patterns and compensation schemes to attract and retain talent and meet demand for innovation. Kishida’s vaunted “new capitalism” should play a role in gradually spreading this trend, increasing job mobility and driving up wages. Japan has historically underinvested in human capital, affecting productivity and growth. Change will not happen overnight, but the country’s labour market is certainly worth keeping an eye on.

Deglobalisation is another trend affecting Japanese companies. Mounting geopolitical risk and the experience of supply chain issues have brought the challenges of fully offshoring production to save money into sharp relief. Cutting costs by investing less in intellectual property and human capital has hurt Japanese companies from a standpoint of new value creation and competitive edge, but currency weakness and relatively low wage levels now are beginning to drive production back into the country. Indeed, with exports from Japan shifting towards higher value-added products, it makes increasing sense to produce domestically and export, although this shift will take some years to materialise. The government, meanwhile, is playing a role in supporting capital investment in a next-generation economy by establishing strong public-private partnerships in strategic industries, including semiconductors, artificial intelligence, quantum computing, biotechnology and clean energy.

Another key plank of Kishida’s new form of capitalism is to promote a shift away from saving – bank deposits and similar account for over half of the country’s JPY 2,000 trillion in household financial assets – to investing in equities and other securities. In an echo of the “income doubling plan” that ushered in Japan’s economic miracle in the 1960s, the policy aims to double the investment income of individuals by, for example, upgrading its NISA tax-free investment programme. The other key question in this arena will be whether markets see a return of overseas investors, who have been net sellers in the post-Abenomics era.

Subtle tides

These trends look set to offer significant opportunities to investors. Key sectors to watch at the beginning of 2023 will be TMT (telecoms, media and technology), continuing to benefit from the ongoing digital shift; and electronics, as a cyclical upturn comes in sight. The shifting tides will be subtle, however, and change will, in many cases, be slow and gradual. Best placed to navigate the currents will be active managers with a growth perspective, able to detect the winners at company and industry levels through extensive fundamental research.

Disclaimer

Note: The above figures (as applicable) are past performance and do not guarantee future results.

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

This report has not been reviewed by the Monetary Authority of Singapore.