Articles

Executive Summary

- Economic sanctions against Russia unlikely to have major repercussions for Japan’s economy, notwithstanding some auto industry exposure

- EPS to take a short-term hit from oil prices, bounce back later in the year

- Kishida administration expected to keep one eye on Chinese response

- Ukraine situation joins Covid-19 and US monetary policy as key sources of volatility

Initial equity market reaction

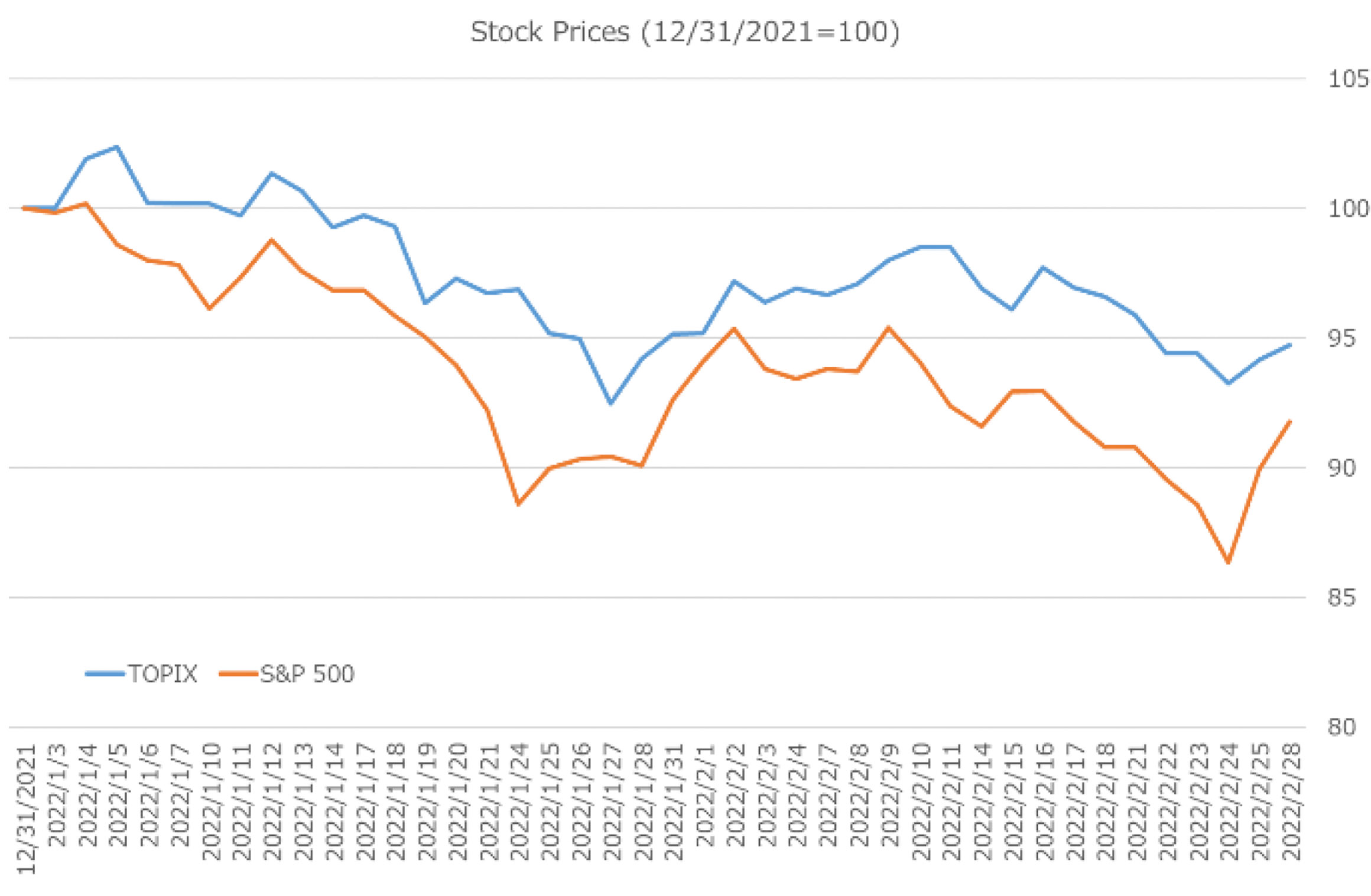

The Japanese stock market (TOPIX) continued to decline by 2.5% during the week of 23 February, in pace with other markets, after Russia’s incursion into Ukraine. Growth stocks performed better than value stocks in Japan, as elsewhere, in view of slower pace of interest rate hikes.

Possible impact on Japan’s economy

-

Japan’s government has announced economic sanctions, including export controls on semiconductors and other high-tech products and restrictions on access to the SWIFT system.

-

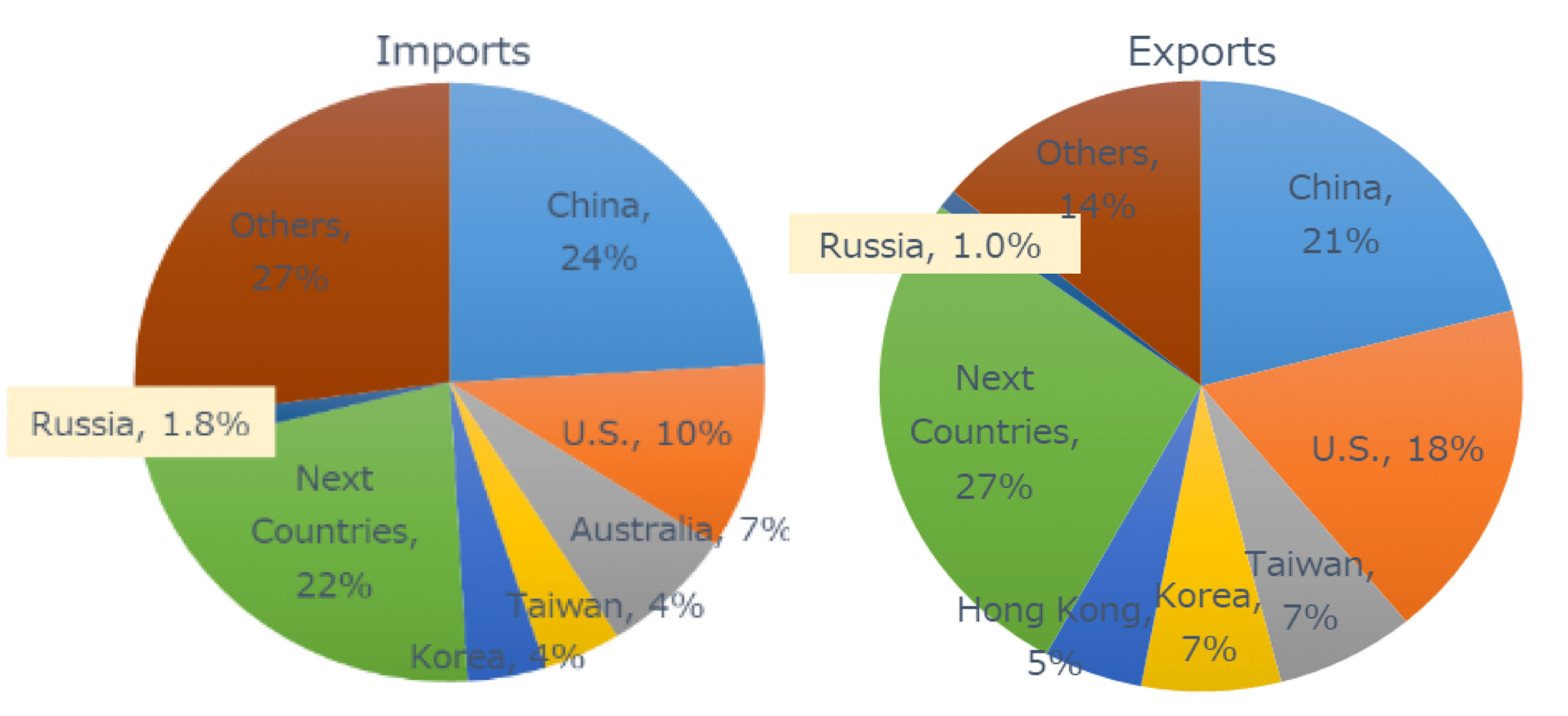

Trade with Russia accounted for 1.0% of Japan’s exports and 1.8% of its imports in 2021, limiting any direct impact on the economy. Automobiles, auto parts, and auto-related products are relatively high exposure, with 3% to 5% of exports from these sectors going to Russia.

Source: Nomura Securities

Source: Nomura Securities -

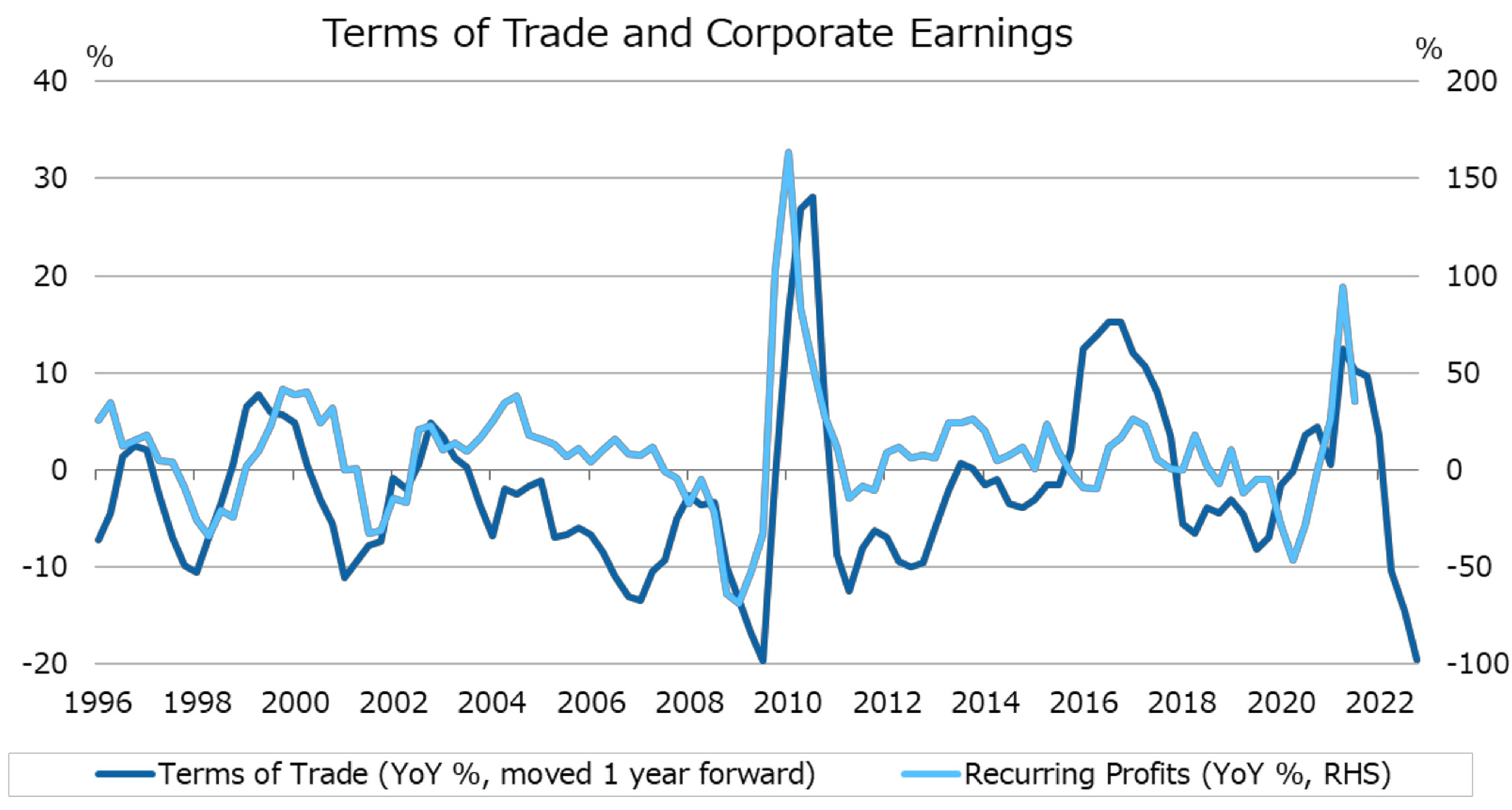

The most direct impact will come from elevated oil prices accelerating deterioration of terms of trade, which is usually followed by a drop in corporate earnings.

It is estimated that a $10/barrel increase in oil price will lower TOPIX EPS by 2.3% through reduction in both margin and volume. We forecast, however, that EPS will bounce back in the second half of the year. Source: TMAM with Financial Statements Statistics of Corporations by Industry and Datastream

Source: TMAM with Financial Statements Statistics of Corporations by Industry and Datastream China’s response will also need to be watched as a geopolitical factor in the longer term; Prime Minister Fumio Kishida has described the invasion as not only a European issue, but a matter of concern for Asia and international society, stating that Japan cannot overlook the invasion from the point of view of its own national security.

Ukraine constitutes a new source of volatility in addition to Covid-19 and US tightening; we will be closely monitoring the impact of these factors for the time being.

Comments from our Portfolio Managers for our individual strategies

- Autos, machinery, trading companies and banks all have exposures to Russia but represent small portion of their overall businesses.

- For our GARP, Focus and Small Cap strategies, there are more concerns about indirect implications from economic sanctions, commodity price increases and global economic downturn. With an increase in worsening terms of trades, companies with pricing power are the ones to watch and invest.

Mr Yoshihisa Nakagawa, CMA/CIIA - GARP strategy

Mitsui & Co, MUFG and SMFG have exposures to Russia.

For Mitsui & Co, it has nearly USD4.5 billion assets and contributes USD200 million profits, but a small portion of USD10 billion profits expected for the current year. However, in consideration of the risk from Russia, we have reduced weight of Mitsui & Co and increased Marubeni.

For the 2 mega-banks, credit exposure is 0.2 to 0.4% which isn’t huge. These stocks are held for hedging against value driven markets, so we would continue to hold.

Mr Shinji Watanabe, CMA - Focus strategy

No major impacts expected from stocks held, but the following stocks have some exposures to Russia:

- DMG Mori (6141) 2% of sales are from Russia.

- Astellas (4503) max. 2-3% of total sales are from Russia

- M3 (2413) has a subsidiary in Russia (from 10-12 period) but its contribution is small.

- Hitachi (6501) has acquired GlobalLogic, a digital transformation service provider, last year. It has a big software development site in Ukraine; BCP has been enacted and staff and their families moved to Poland etc.

There is impact on Uniqlo as well. 1/4 of shops in the Europe are in Russia and Uniqlo is successful there, but probably represents only 2 to 3% of the consolidated profits.

Mr Taku Yoshida, CMA/CIIA – Small Cap strategy

No major impacts expected from stocks held, but the following stock has some exposure to Russia:

- Round One (4680); operating indoor leisure complex with bowling alleys, arcade games, karaoke, billiards, and Spo-Cha (collection of sporting activities); created a complex in Moscow but never opened because of Covid-19. Small hit on the overall profits.

Disclaimer

Note: The above figures (as applicable) are past performance and do not guarantee future results.

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

This report has not been reviewed by the Monetary Authority of Singapore.