Reports

2024 Japanese Equities Outlook

Executive summary

- Deflation coming to an end as Japan sees a normalisation at last in the cycle of prices, wages, consumption and corporate earnings; monetary and fiscal policy to remain supportive until sustained price and wage growth can be confirmed

- Corporate earnings still solid amid recovering consumption and increase in capex, with beneficiaries to include digitalisation and productivity improvement, as well as semiconductors

- Headwind for growth stocks to dissipate as US tightening ends, while value stocks turn focus to improving growth

- Supply/demand benefits from more overseas investors, revamped NISA

- Japanese equities poised for an all-time high in 2025, but active management crucial to separate winners from losers

2024 lays foundations for 2025 record high

2023 was an important turning point for Japan’s economy. Signs indicated that the country was finally escaping decades of deflation, and re-establishing a normal cycle of rising prices, wages, consumption and corporate earnings. Overseas investors picked up on this and became net buyers of Japanese equities for the first time since an Abenomics-driven 2015 peak. Further buoyed by solid corporate earnings, the Japanese stock market performed well, with TOPIX rising 25.5% in 2023 as at the end of November. 2024 will be an important year for the Japanese economy and stock market to watch whether this “virtuous cycle” can be sustained, laying the foundations for Japanese equities to escape the shadow of 1989’s bubble-era high and climb to record levels in 2025 – thus evidencing a shift to a new non-deflationary regime.

Virtuous cycle gets into gear

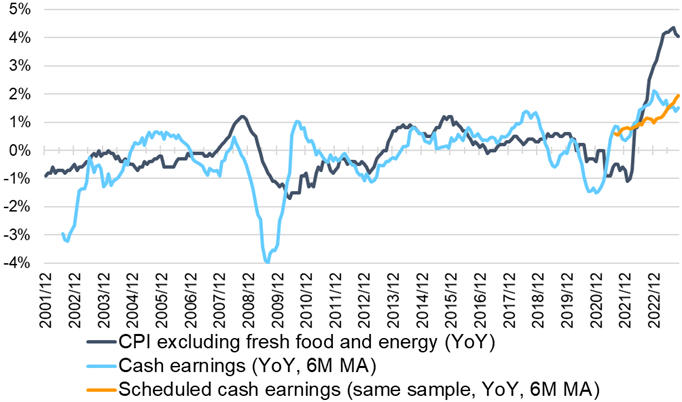

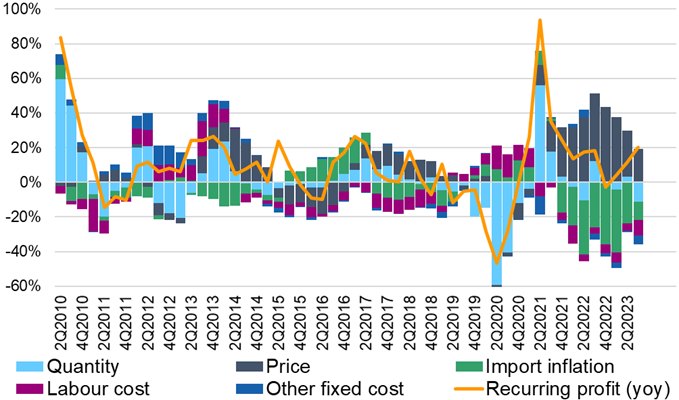

The era of globalisation has been an era of deflation for Japan; a broad offshoring of production to lower cost countries such as China created disinflationary pressure in general, accelerated by some Japan-specific factors after the country’s economic bubble burst at the beginning of the 1990s. The Abenomics policy of the 2010s was an attempt to escape this deflationary era through aggressive monetary policy; now, helped by global inflation after the pandemic, prices are finally rising in Japan. Companies are passing on rising input costs to maintain margins, rather than curbing costs and investments as in recent decades, when raising prices was not an option. Wages grew 2% in 2023’s annual spring pay negotiations, a level not seen in 30 years, supported by 3.0% CPI growth in fiscal 2022 and a tightening labour market with less than 3% unemployment. Small companies in particular have felt the labour squeeze, and followed large firms in hiking pay packets.

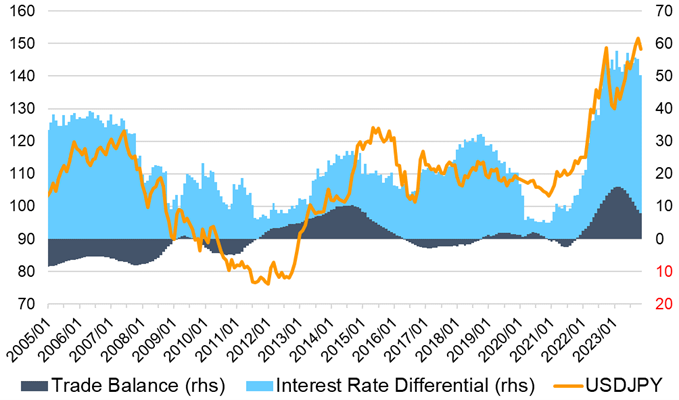

Along with the benefits of a weaker yen and a more gradual post-pandemic demand recovery than in other economies, these shifts herald what the Bank of Japan has termed a “virtuous cycle”: one where companies can charge more, invest more, and pay more to prompt further consumer spending.

Whether this cycle can be sustained, however, remains to be seen. Price growth continues to be driven more by the delayed passing on of higher input costs rather than wages and consumption. Real wage growth is still negative and putting downward pressure on consumption. Machinery order numbers are not as strong as companies’ fixed investment plans might suggest.

This is why the central bank continues to maintain an ultra-easy monetary policy despite forecasting CPI growth close to its 2% target for fiscal 2023 and 2024 . The bank will be looking closely at wage growth in the coming spring pay talks – as well as domestic consumption, US growth and other Japanese and global economic indicators – as it considers when to make a move. While timing may vary depending on economic circumstances, our view is that the BoJ will most likely begin the process of normalisation by lifting the negative interest rate after summer 2024, albeit at a very gradual pace. Hikes are not intrinsically bad news for the stock market, however, especially given the BoJ’s softly-softly approach on confirming sustained price growth and the virtuous cycle. Fiscal policy is also supportive, with the government enacting a package of measures including temporary tax cuts, renewed subsidies for fuel costs and greater tax incentives for small companies to raise wages.

The weak Japanese yen, which has positively worked for corporate earnings since 2021, will stop depreciating as the interest rate gap between the US and Japan narrows. We expect the currency to appreciate in 2024, albeit modestly given the slow pace of Japanese normalisation and a structural increase in trade deficits for tech and other services in particular driving real demand for the US dollar.

Risks

While monetary and fiscal policy are well aligned for Japan’s economy to shift up a gear, however, we need to carefully watch how it goes in practice. One bottleneck for companies aiming to increase supply will be labour: shortages will be partly mitigated in the long run as deregulation opens up immigration, but the effect will still be limited. Japan needs to invest more to improve productivity, especially in digitalisation and labour-saving systems and equipment. Another risk for sustained growth is a slowdown in economies overseas – be it cyclical decline in the US and Europe, or structural issues in China, which faces deflationary pressure from ageing demographics, oversupply in the real estate market, and local government debt.

Steady earnings, stock market trend continues

Trends such as greater shareholder awareness and constructive dialogue between companies and investors will continue; the Tokyo Stock Exchange’s request for improved capital efficiency and growth will be positive for companies with low P/B ratios in particular.

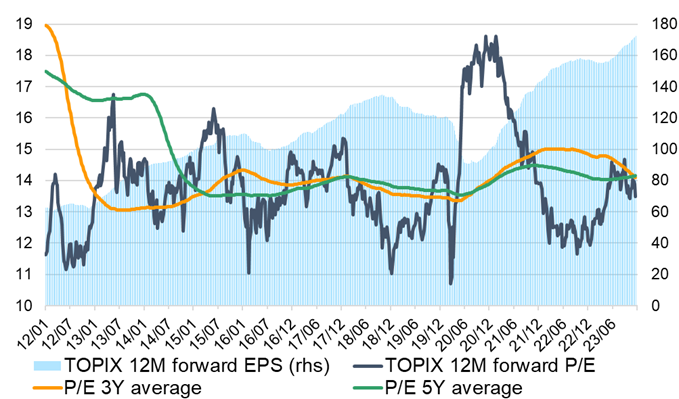

We expect solid corporate earnings growth underpinned by a steady domestic economy, improved terms of trade, and sustained price and margin growth. Consumption should improve as CPI growth settles and wages grow in real terms. P/E is expected to stay around its current level of 14 to 15 times under still accommodative financial conditions, and we anticipate solid stock market performance driven by higher single-digit EPS growth. While uncertainty will remain ahead of BoJ normalisation and the US election in early November, the TOPIX index should rise above 2600 – a double-digit return for 2024 – toward the end of the year.

Sectors to watch include software and other beneficiaries of higher demand for digitalisation and productivity improvement efforts amid tight labour conditions. We also favour semiconductor related companies, in view of strong AI, automotive and factory automation demand; the silicon cycle looks set to remain on an upswing for a few years. A shift in production and supply chains to Japan for geopolitical reasons will also help revive the country’s semiconductor industry.

Style-wise, value stocks have dominated growth stocks over the past three years, in tandem with US tightening, compounded by Japan-specific factors including the TSE’s push for value names to improve their P/B ratios. This value tailwind/growth headwind looks set to ease once US rates peak. Japanese companies trading below book value have acted to improve their ROE by buying back shares and paying out dividends, but the next step will be to improve the level and growth rate of their earnings (or P/E ratio).

Once the economy is normalised to the extent that competitive companies can raise prices, there will be a greater earnings and stock price performance gap between winners who can raise prices and invest more in human and physical capital, and losers who cannot pass on rising costs and suffer from squeezed margins. M&A activity within industry will increase, helped by recent government encouragement .

From a market supply/demand perspective, 2023 saw a first wave of inflow from overseas investors, and the market should be further underpinned by investment from longer-term players in 2024. A revamping of Japan’s NISA investment savings scheme, offering improved tax incentives for individual investors, will also be supportive in the longer term in shifting USD 7 trillion cash and deposits in household assets from savings to investment. While holding cash may have been a rational choice during the deflationary era, it looks decidedly less so as inflation takes hold. This shift will take time – younger generations are more active in allocating money to NISA and other investments, while the distribution of wealth is skewed to older generations – but the combination of a buoyant domestic stock market and a falling currency has driven an increase in retail investors buying Japanese rather than US and international equities, which had previously attracted the lion’s share of retail money.

Time for active investment in Japan

Japan is at last exiting decades of deflation and shifting to a normalised economy, and all eyes are watching whether the cycle of prices, wages, consumer spending and corporate earnings can be sustained as the post-pandemic recovery tails off. Investor confidence in this structural shift will drive the cycle of economic and stock market growth. Structural change takes time, especially in Japan; but reasons for optimism include supportive monetary and fiscal policies, and changes in corporate behaviour.

While 2023 was a turning point for Japan’s economy and stock market, we expect further progress in 2024. The transformative scale and nature of change will be far-reaching in impact, and active managers will be best positioned to tell the winners from the losers at company and industry levels through extensive fundamental research.

For a summarized version, watch the video of our 2024 Japanese Equities Outlook report: 2024 Japanese Equities Outlook.

About the author

|

Hiro Kasai, Senior Strategist

A founding figure in TMAM’s investment process, with three and a half decades’ experience in asset management, including spells as CIO of TMAM and CEO of its New York subsidiary, as well as head of Asian investment for the Tokio Marine Group. |

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.