Articles

Bank of Japan policy announcement

The Bank of Japan decided at its monetary policy meeting on 19th March to:

- Lift the negative policy rate of -0.1% and encourage the short-term interest rate (uncollateralised overnight call rate; a new policy target) to remain at around 0 to 0.1% by applying an interest rate of 0.1% to excess reserves

- Remove the reference upper bound for 10-year JGB yields and end the Yield Curve Control (YCC)

- Discontinue purchases of exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs). Gradually reduce purchases of CP (commercial paper) and corporate bonds and stop purchases completely within a year.

The decisions are in line with market expectations, with no major surprises or market reactions.

The Bank recognises that “the virtuous cycle between wages and prices has become more solid” and “its large-scale monetary easing measures, including the negative interest rate policy and the yield curve control, have fulfilled their roles”.

It is eight years since the negative interest rate was introduced in early 2016, and 17 years since the central bank last raised its policy rate. We have recently seen some signs of escape from decades of deflation, including price and wage growth. Price growth triggered by external inflation has now spread to domestic prices and wages, as indicated by the recently reported first results of the spring wage negotiation (discussed below).

Going forward, we think the pace of rate hikes will be very gradual as the bank needs to confirm whether the “virtuous cycle” can be sustained under likely slower CPI growth. The bank says that “it anticipates accommodative financial conditions will be maintained for the time being, given the current outlook for economic activity and prices”, and the market expects the policy rate to rise somewhere above 0.25% by the end of the year. Governor Ueda also added that current accommodative policy will continue until we see sustained 2% CPI growth.

No specific comment was made on the sale of the ETFs on the Bank’s balance sheet and this will be considered at some point after the Bank stops buying JGBs in or after 2025.

As a whole, the normalisation move is a confirming step in the transition process of Japan’s economy out of deflation and can be considered good news for the country’s economy and equity market. Let’s keep watching whether the shift is sustained.

Update on wage growth

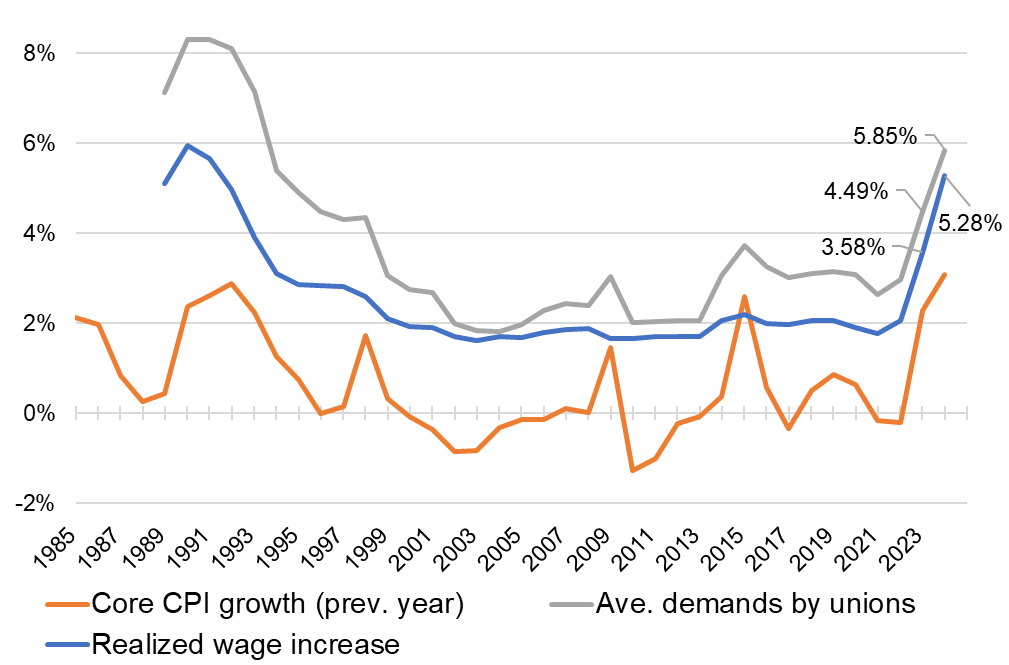

The first results of the annual negotiations for FY2024 wages have been announced by the Japanese Trade Union Confederation. While the current figure is still the result of less than 20% of participating unions (representing about 50% of members), the average wage hike was 5.28% (including regular annual pay hikes, or 3.70% excluding these for the subset of unions who show the breakdown). The numbers usually come down as the tally progresses but they are expected to stay around 5% (or 3.5% excluding regular annual pay increase).

The results are higher than last year’s 3.58% (final results) and higher than economists’ forecasts. This indicates that the behaviour of companies is continuing to change. Governor Ueda said that the strong result affected the BOJ’s decision to normalise.

Wage hikes were 4.42% (including regular annual pay increase, 2.98% excluding) for smaller companies, which is encouraging.

About the author

|

Hiro Kasai, Senior Strategist

A founding figure in TMAM’s investment process, with three and a half decades’ experience in asset management, including spells as CIO of TMAM and CEO of its New York subsidiary, as well as head of Asian investment for the Tokio Marine Group. When not providing macroeconomic and market insights, Hiro enjoys onsen trips and countryside walks. |

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.