Articles

Executive summary

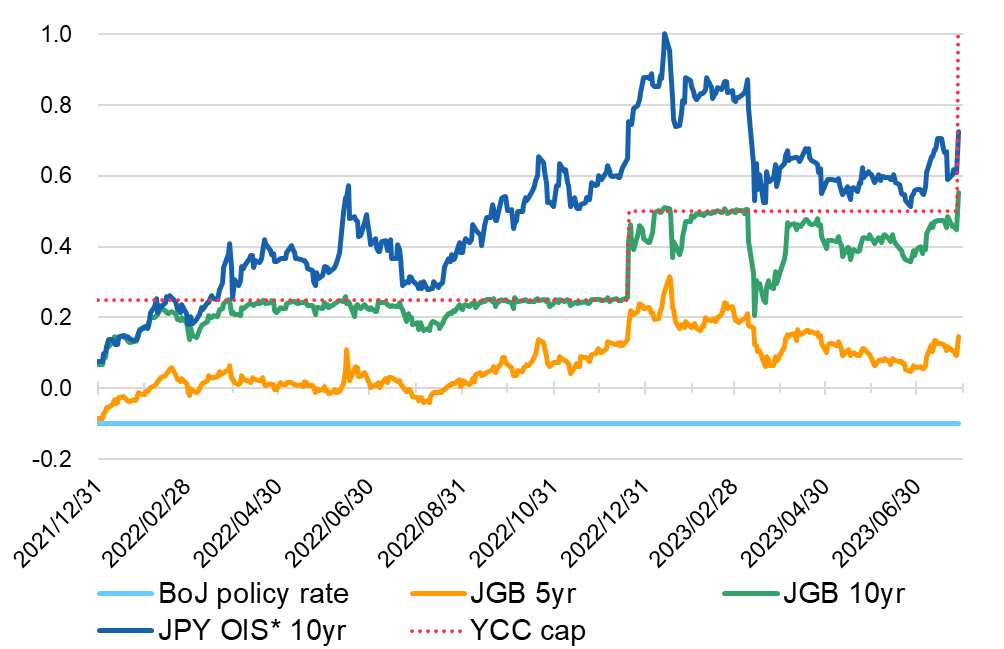

- BOJ revises yield of fixed-rate bond buying operations, effectively expanding YCC cap from 0.5% to 1.0%; short-term rate unchanged at −0.1%

- “Not a tightening” according to Governor Ueda, but more in preparation for rising cost of living risk, with a backdrop of higher-than-expected inflation

- Impact on financial markets modest, but JGB yield climbed more than 10bp to 0.57% on July 28th

- All eyes now on where JGB rates will settle, but Japanese equity markets will be more free to focus on fundamentals – strengthening the hand of active growth managers

What did the BOJ announce?

Following its policy meeting on 27-28 July 2023, the Bank of Japan announced that it has revised the yield of fixed-rate bond buying operations on 10-year JGBs from 0.5% to 1.0%, while maintaining the yield curve control (YCC) range cap at 0.5%. In practical terms, this can be seen as actual expansion of the YCC cap to 1.0%. The short-term interest rate has been kept negative, meanwhile, at −0.1%.

Governor Kazuo Ueda told a press conference following the announcement that this was not a tightening, but a means to effectively and sustainably maintain current easy monetary policy. The backdrop to this revision in YCC operations includes a recent uptick in inflation, alongside wage hikes, and an underlying shift in corporate Japan’s attitude to wage and price-setting behaviours. The BOJ raised its FY2023 CPI forecast from 2.5% to 3.2% (excluding fresh food and energy), while maintaining FY2024 and FY2025 forecasts at 1.7% and 1.8%. Board members noted upward risks in CPI and Ueda says the revision aims to address this risk in advance, but with the YCC range itself unchanged as future prospects are still below the target level of 2%. The BOJ does not currently see the long-term rate approaching 1.0%, but we believe it may move in that direction depending on future fundamental changes, and the Bank will deal with excessive market fluctuations by using JGB buying operations.

What does the move signify?

Despite the popular narrative (rejected by the BOJ) that this move is a step toward normalising monetary policy in the future, there seems to be still a long way to go before the next step of revising the negative interest rate. Unlike what happened last December when then Governor Haruhiko Kuroda raised the YCC cap, however, the response of equity and currency markets, as well as the bond market, was modest. With market functions in recovery and a certain degree of volatility now allowed in the JGB market, the level of long-term interest rates looks to be returning to the hands of market participants.

Japanese equity markets will be keeping one eye on prices, wages (with longer-term trends to be clarified by FY24 spring wage negotiations), and exchange rates, but with expectations for a distinct shift to tighter monetary policy receding, the focus for now looks set to be more on corporate earnings.

About the author

|

Hiro Kasai, Senior Strategist

A founding figure in TMAM’s investment process, with three and a half decades’ experience in asset management, including spells as CIO of TMAM and CEO of its New York subsidiary, as well as head of Asian investment for the Tokio Marine Group. When not providing macroeconomic and market insights, Hiro enjoys onsen trips and countryside walks. |

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.