Articles

Executive summary

- In a surprise move, the Bank of Japan raised the range for the 10-year JGB rate to 0.5%, explaining that the aim is to address the distorted yield curve and improve market functioning

- Governor Kuroda restated that he has no intention of hiking rates under current circumstances, and the existing scheme will be maintained for now with a slightly elevated yield curve

- The move may, however, be considered an indication of the beginning of the end of the ultra-loose monetary policy era

- Uncertainty over the possible timeframe of BoJ normalisation will impact equity markets in terms of valuations, as well as corporate profits amid currency fluctuations

What did the BoJ announce?

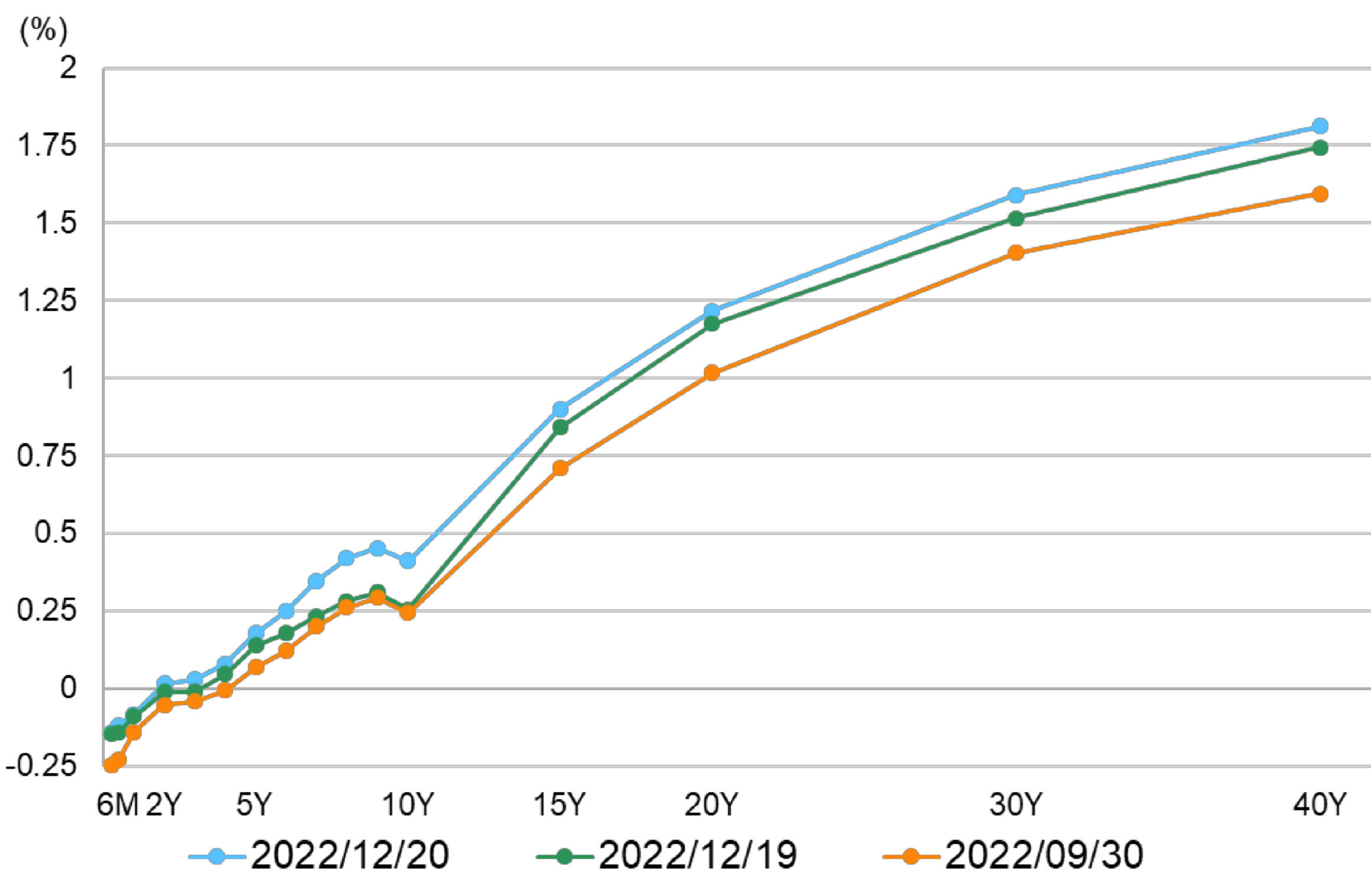

The Bank of Japan took markets by surprise at its Monetary Policy Meeting on December 20th, tweaking its target range for the 10-year JGB rate from 0% +/-25bps to +/-50bps. The central bank states that the change is “in order to improve market functioning and encourage a smoother formation of the entire yield curve, while maintaining accommodative financial conditions,” meaning the aim is to address the side effects of its yield curve control (YCC) policy and resulting distortions in the JGB curve – not a response to rising prices and economic conditions.

Governor Haruhiko Kuroda stressed that the goal is to make YCC and easy monetary policy work better, and should not be taken as a signal of a shift towards a tighter stance. He added that tightening is not in sight at this point in time, with CPI growth projected to slow in fiscal 2023 to a level below the bank’s target of 2%. The short-term interest rate is unchanged, at -0.1%.

The BoJ also announced an increase in JGB purchases from JPY 7.3 trillion to JPY 9 trillion per month at various points along the yield curve, with the twin goal of avoiding a sharp hike in rates and of suggesting a guidance level of the curve.

What does the move signify?

While it is too early to conclude definitively that the BoJ’s action is a first step towards tightening, it does represent a change in messaging from Kuroda, who previously claimed that he had no intention of expanding the 25bps YCC range, as to do so would only serve to hurt the economy. His new position, meanwhile, stresses that the new 50bps range will do no harm, and will instead improve market functioning.

The current scheme will be maintained for the time being with a new 0.5% cap on the 10-year rate. The BoJ will not change monetary policy until certain specific conditions are achieved – notably wage increases and continued inflation – which is unlikely at least before the end of the governor’s tenure in April 2023.

Despite the central bank’s comments, however, many market participants cannot help but suspect this is a move to revise the joint statement of 2013 by the BoJ and the Abe government. Modifying this pledge, which has served for close to a decade as a blueprint for fighting deflation, would lay the groundwork to drop YCC and negative interest rates in a post-Kuroda transition – effectively phasing out Abenomics. The government may have already started to lobby the BoJ to follow such a course.

All eyes will now be on the question of Kuroda’s successor, wage hikes for FY 2023, and the timing of lifting the negative short-term rate.

The bond market reacted with a surge in yields, while stocks fell and the yen climbed. A stronger currency will reduce input costs for Japanese companies, but hurt the profits and reduce expected upward revisions of exporters. Uncertainty over any further move by the monetary authority under a new governor may put pressure on equity market sentiment. For the time being, we expect the market PER to stay around its current discounted level of 12x – below the long-term average – until the BoJ’s stance becomes clearer and US rate hikes peak out.

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.