Executive summary

- Japan’s economy and equity market have gone through a major turnaround in recent years, with structural change continuing to drive a shift away from deflationary-era labour market and pricing behaviours.

- Weak consumption is a concern, but positive real wage growth expected in the second half of 2024 will underpin the “virtuous cycle” of prices, wages, consumption and corporate earnings.

- Monetary policy normalisation has started in response, with the BoJ expected to maintain a cautious, measured pace.

- Corporate earnings still solid with high single-digit earnings growth in coming years; capex in digitalisation and productivity improvement will most obviously benefit IT and software sectors, while semiconductors continue to grow on globally strong demand.

- Evidence points to a more conducive environment for growth stocks: US easing on the horizon at last, narrower valuation gap following an overcooked value rally, higher earnings growth for growth names – and indeed a shift in focus even among value names to improving earnings growth.

- While risk factors include the pace of normalisation, JPY appreciation, and the US election, Japanese equities hit an all-time high in July 2024 and are poised for further growth in 2025, on steady earnings growth and favourable supply/demand.

- Structural change thus far has laid the foundations for serious further growth going forwards, but distinguishing winners from losers as the market finds its second wind will require good active management combining experience with a fresh perspective, founded on in-depth research and analysis.

From expectation to realisation

Japan’s stock market performed well in the first half of 2024 after a relatively modest second half of 2023. A fresh wave of inflows from overseas investors pushed TOPIX up by 17.8% in the first six months of the year (and subsequently through the 2900 ceiling in early July) amid signs of an escape from decades of deflation; most notable among these were a second consecutive year of significant wage hikes and continued inflation above the target rate of 2%, serving to indicate that a normal cycle of rising prices, wages, consumption and corporate earnings is taking root once more. The question during the second half of the year will be whether this virtuous cycle can be sustained; an affirmative should push Japanese equities further into record territory in 2025.

Virtuous cycle continues

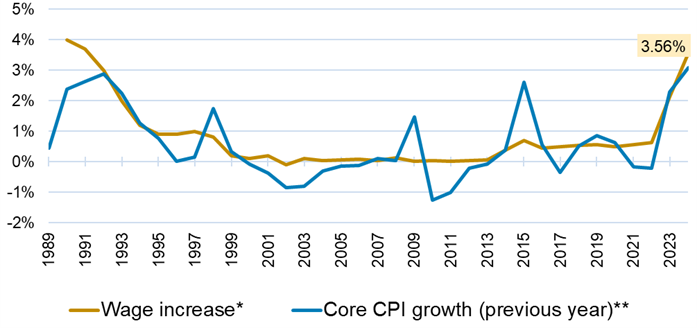

The signs certainly look promising. 2024’s annual spring pay negotiations took place against a background of continued CPI growth above the Bank of Japan’s 2% target, together with a structurally tight labour market, and resulted in pure wage growth north of 3.5% – up from last year’s 2.1% increase and on a scale not seen for three decades. This will feed through into pay packets toward the summer, pushing up personal disposable income.

Prices are climbing at a lower but still stable pace as rising costs are reflected in end prices, more notably in services than in goods. While the rate of inflation is gradually easing, we forecast CPI growth of around 2% over the coming quarters.

One part of the cycle failing to live up to expectations is consumption, with household spending in real terms declining for four quarters. One reason is negative real wage growth since early 2022, which has led consumers to tighten their belts following a post-Covid recovery. In the second half of 2024, however, slower CPI growth and strong wage hikes will bring real wage growth into the black, which alongside a one-off tax rebate designed to cushion the impact of recent cost of living rises will gradually lead to firmer consumer spending.

Monetary and fiscal policies still supportive

As import prices shift from being the primary component of inflation to a secondary one behind wage growth – the so-called “virtuous cycle” of prices and wages – the BoJ finally began the process of normalising its monetary policy in the spring of 2024. We forecast another rate hike in the second half of the year; the central bank will be in no great hurry, given currently weak consumption and downgraded CPI growth forecasts for 2025 and 2026, but the fact that it has made its first move is welcome news for Japan’s economy and stock market.

Government policy is also supportive. Historically low approval ratings for Prime Minister Fumio Kishida and the ruling Liberal Democratic Party are disturbing, but ultimately immaterial: even with a change in administration, we expect to see a continued policy line supportive of an escape from Japan’s lost decades and growth in a new non-deflationary era.

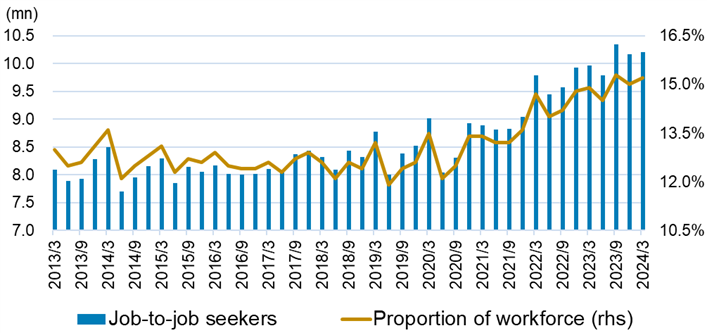

Labour market reforms, for example, are a key plank of Kishida’s “new capitalism” policy, including reskilling for increased labour productivity and higher wages, shifting from generalist-oriented to specialist-oriented employment patterns and higher job mobility. Japan’s ageing demographics make such policies a structural necessity, however, to be continued whoever is in power.

Steady corporate earnings

On the corporate side, fiscal 2023 was a good year with double-digit profit growth, partly thanks to a weak yen. This upward trend is expected to continue at a slower rate in the higher single digits in fiscal 2024 and 2025.

While the yen continues to influence corporate profits – albeit less than a decade ago – the BoJ is taking a softly-softly approach to normalisation and the Fed is in no apparent rush to ease monetary policy. Japan’s “digital deficit” – paying for software usage and other services in foreign currency and thus leading to selling of JPY – adds to this ongoing divergence. But at least this means that Japan Ltd. can take comfort from a likely modest pace of yen appreciation.

Meanwhile, a new environment in which firms can set higher prices for better products will promote more investment in both human and physical capital. Japan has for many years underinvested in both human capital and intellectual property, resulting in stagnant productivity growth, with the need for labour-saving investment further underlined by structural labour force shortages going forward. Companies are set to invest more to improve productivity and absorb rising input and labour costs, benefiting software and labour-saving equipment sectors. Geopolitical considerations and a broader trend for supply chain diversification will also underpin capital investment, as seen in the semiconductor fabs reviving Japan’s semiconductor industry.

The other ongoing good news story at Japanese corporates is the improvement in shareholder-conscious management, where progress remains slow but steady. Dividends are expected to climb to a record high of some JPY 18 trillion for fiscal 2024. Share buybacks announced so far this year are already approaching JPY 9.3 trillion1, just shy of 2023’s full 12-month total of JPY 9.6 trillion. This is mainly thanks to growing current profits and ample retained earnings, but we also see companies responding to the Tokyo Stock Exchange’s March 2023 request for improved capital efficiency.

Tailwind for growth stocks on the horizon

In terms of style, value stocks have outperformed growth stocks significantly since US tightening came into sight in late 2020, following a period of growth name dominance, especially at the height of Covid. This is partly because value stocks looked particularly cheap when adjusted for growth, and partly because higher interest rates globally tend to favour value names. The TSE’s capital efficiency push also accelerated the outperformance of companies with low P/B ratios.

The headwind to growth stocks now looks set to ease, however: valuations have adjusted over the course of three and a half years, while growth companies are looking at improved earnings growth prospects in fiscal 2024 and 2025. The Fed has kept monetary policy tight for longer than initially expected, but the eventual arrival of rate cuts will be a further tailwind for growth names going forwards. The final piece of this particular puzzle is that while value names looking to respond to the TSE’s calls to improve capital efficiency have already picked the low-hanging fruit by reducing unnecessary capital, investors will be expecting these to take further steps to focus on earnings growth.

Risks

While healthy wage growth in response to price hikes and labour shortages is conducive to a post-deflation return to a normally functioning economic cycle, weak consumption so far remains a potential pain point, and markets will continue to monitor whether positive real wage growth can encourage households to spend more. A slowdown in the US economy is another risk factor, as is November’s US presidential election.

Stock market at record high – with room to grow

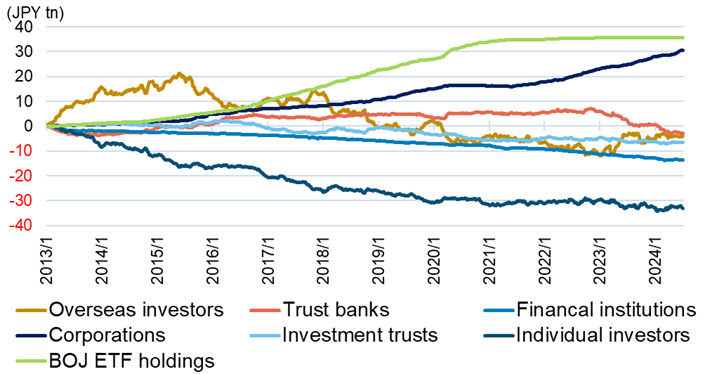

The demand/supply story looks to favour the stock market overall. Overseas investors have increased exposure to Japan since 2023 and are now pausing to time their next move, but Abenomics-era purchases suggest they have the potential to invest up to USD 100 billion once they gain comfort that Japan is indeed normalising out of its long deflationary era. Japan’s NISA investment savings scheme, revamped in January with improved tax incentives to encourage individual investors to shift some of their USD 7 trillion cash and deposits in household assets from savings to investments, is off to a good start and will support the stock market in the long run. Corporations are increasingly liquidating cross-held stocks2 , but nonetheless remain net buyers as share buybacks continue to gather pace. Financial institutions appear to be the only structural sellers of Japanese equities – also due to the liquidation of cross-shareholdings – with the Bank of Japan also a potential seller.

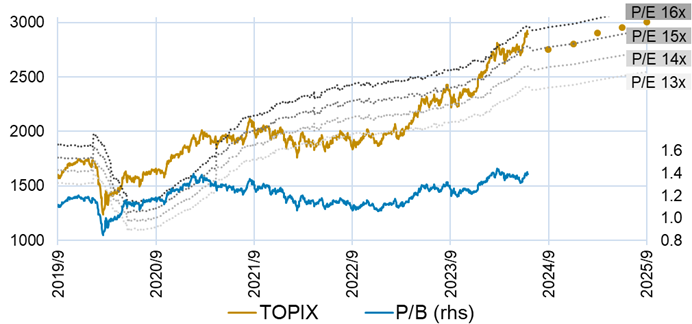

P/E is expected to stay at its currently reasonable level of around 15 times, and the stock market looks set to maintain its upward trajectory towards 2025 reflecting modest corporate earnings growth. TOPIX hit a historical high above 2900 in July, and we forecast high single-digit EPS growth supporting similarly high levels towards 2025.

Active investment a must in Japan

The shift to a non-deflationary regime means that Japan’s economy and equity market are primed for longer-term growth in a way they have not been for decades. Successful companies will charge more (for good products), pay more (for scarce labour) and invest more (in both physical and human capital, to improve productivity – with these investments in turn boosting smart solution providers leveraging AI or supporting digitalisation efforts, for example). Losers, meanwhile, who cannot pass on rising costs and suffer from squeezed margins will underperform or be subject to M&As and restructuring. This polarisation will offer greater rewards to investors who come off the fence and take an active, fundamental research-driven approach to picking winners as Japan gets ready to go into overdrive.