Reports

Executive summary

- Markets poised for a rollercoaster ride in 2022, but this should create opportunities for fundamentals-focused active stock pickers.

- We expect Japan’s equity market to play catch-up this year and make up lost ground relative to other developed markets.

- Support to come from cheaper valuations, a stable government and continuing easy monetary policy from the Bank of Japan.

- Dispersion between corporate winners and losers expected to widen owing to multiple headwinds, such as rising cost pressure.

- Businesses in IT-related and semiconductor sectors are ones to watch owing to the country’s “digital transformation” drive.

Equity market outlook

Despite ongoing uncertainty about the impact of the Omicron variant both on the domestic and global economy, Japanese companies continue to focus on a post-pandemic future on the back of high vaccination rates and the rollout of booster shots, as well as the emergence of new COVID-19 treatments.

There remain challenges, however. Commodity prices look likely to remain elevated due to global supply-side constraints, a negative for resource scarce Japan which mostly imports its energy and raw material needs, while costs associated with addressing ESG issues could weigh on corporate earnings. Stagflation is a distinct possibility.

Monetary policy normalisation and a tightening of excess liquidity in the US and Europe suggests that valuations may fall in 2022. But in Japan’s case, its central bank is expected to continue with easy monetary policy for the time being. As such, the country’s equity market looks set to avoid the kind of correction that is likely to hit markets where monetary tightening is taking place.

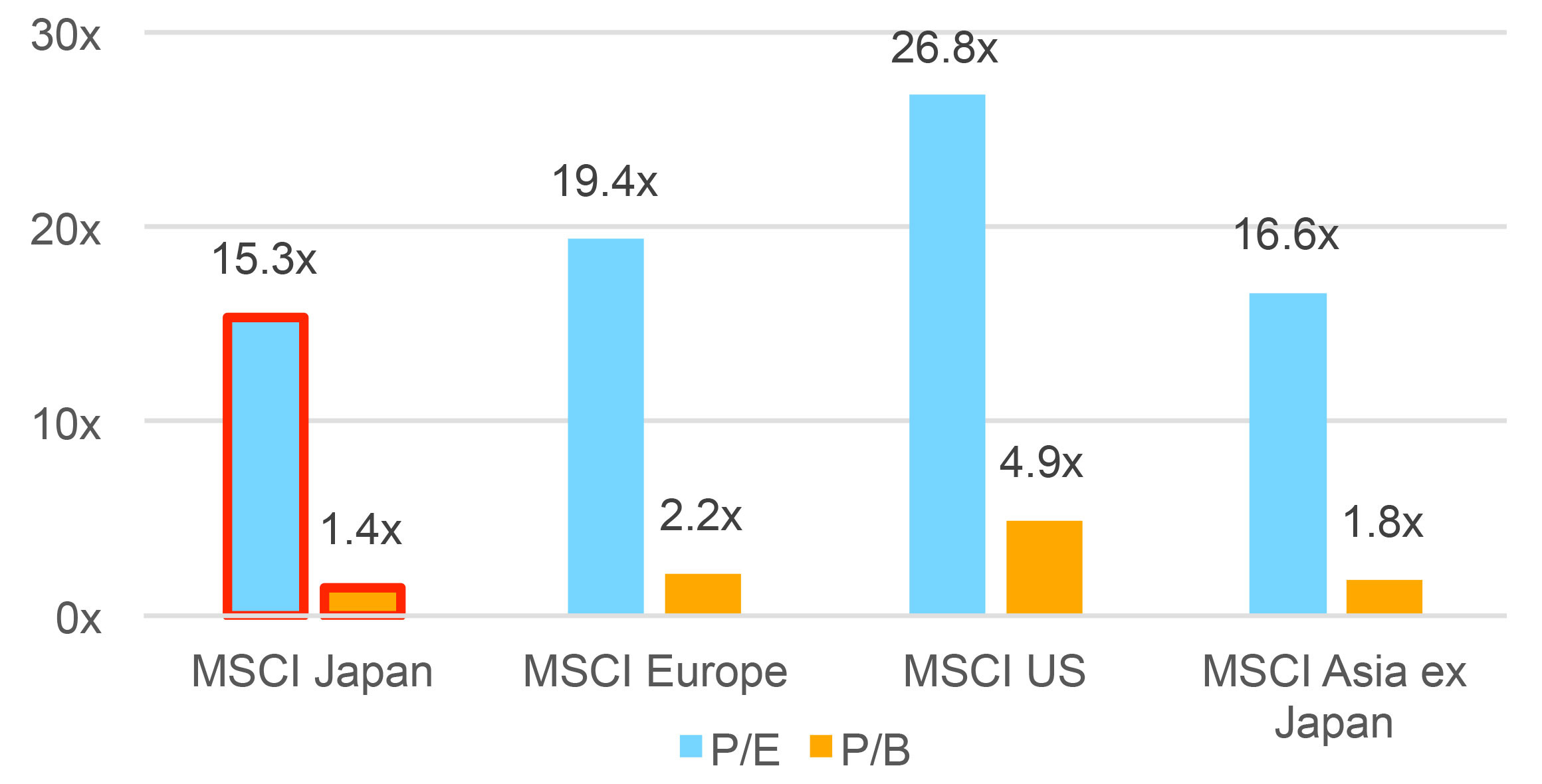

Furthermore, we feel that Japan’s economy still has room to run and recover compared to pre-pandemic levels. Valuations are not yet stretched in our view as they’ve lagged those of other major markets over the last year (see below).

On the political front, Prime Minister Kishida appears to have defied perceptions at the time of his appointment, listening to public opinion and handling issues better than his predecessors to ramp up support from voters.

The outcome of the Upper House election in the summer will indicate how successful his new capitalism policies have been. Cementing his majority would be another tailwind for the market.

What’s next for corporates?

Despite numerous challenges – many of them not made in Japan – it is business as usual for companies able to maintain high levels of corporate earnings while working to improve productivity and lessen the impact from wider economic issues, such as the drive for carbon neutrality.

This should mean a widening gap between corporate winners (driving earnings growth themselves through innovation and pricing power) and losers (with little pricing power and dependent on government policies for growth) this year.

We expect investment in IT infrastructure to grow steadily as part of Japan’s “digital transformation” push, an area the country has lagged its peers in recent times. Earnings prospects of companies in this field are relatively bright, given the need to boost productivity in an ageing country with a declining workforce.

A by-product of the digital shift is an increase in data traffic and a need for large data centres, which in turn require a large quantity of semiconductors. Hence, we have a positive outlook for chip-related businesses as earnings become less reliant on the regular demand cycle for hardware products, such as smartphones, in future.

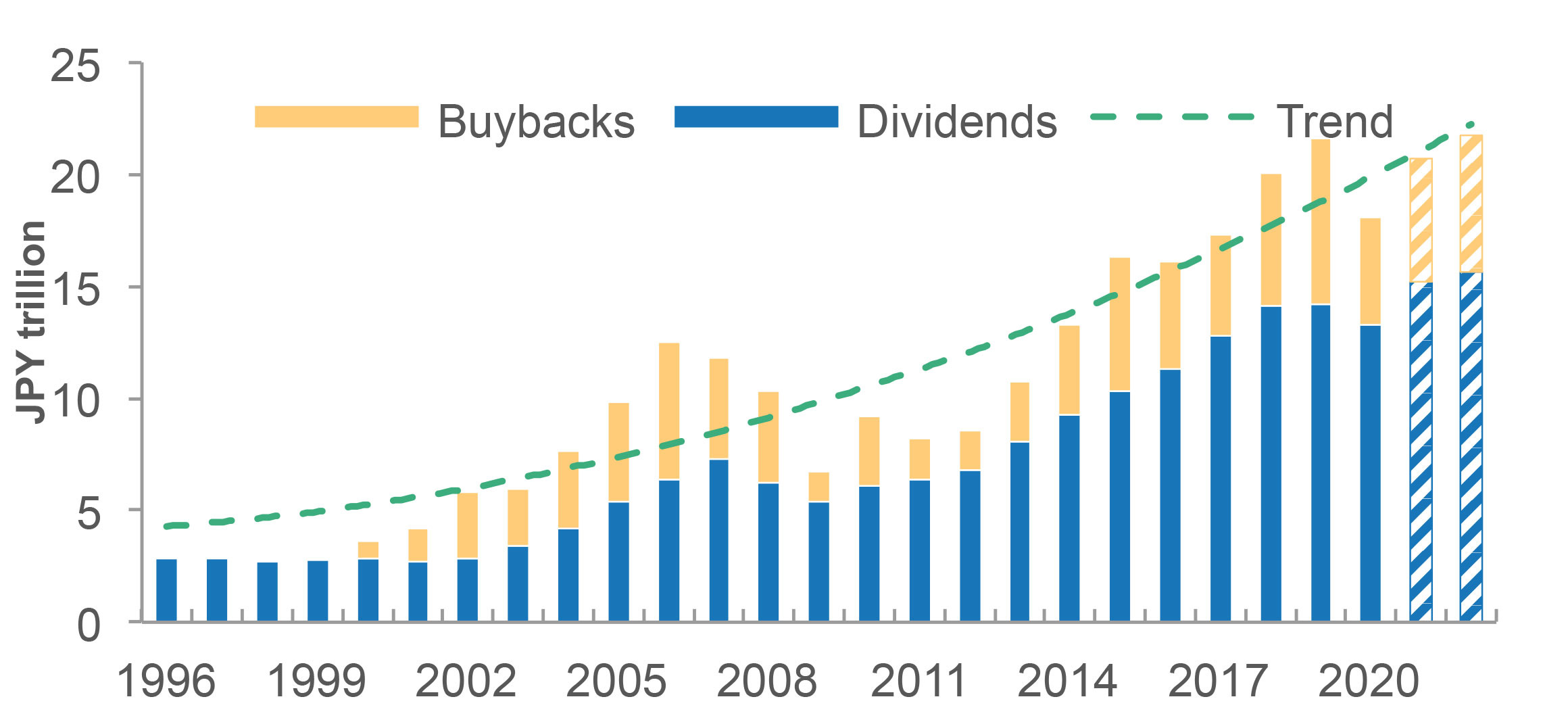

We will also be keeping a close eye on corporate governance developments, especially the approach of individual companies to shareholder returns, which have continued to improve behind the scenes generally (see below).

The much-hyped Tokyo Stock Exchange market reclassification has not caused the revolution that we had hoped for, with more than 84 per cent of the over 2,000 First Section listed companies set to be listed in the new Prime Market. This exercise, however, has made companies rethink corporate governance policies. Cross shareholdings look set to be pared back to meet new requirements, for example.

Domestically, consumption remains weak, but there is clear potential for upside as the economy reopens at last, with the expected return of the government’s “Go To” travel subsidy campaign set to support the badly hit tourism industry. This should be further boosted by foreign tourists once they are finally able to travel to Japan again.

In all, we expect 2022 to be a turbulent year as the world comes out of the pandemic phase of the coronavirus disease, but at the same time, we believe that Japan’s equity market will offer attractive entry points to higher quality, resilient businesses with strong earnings growth potential and pricing power.

Disclaimer

Note: The above figures (as applicable) are past performance and do not guarantee future results.

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

This report has not been reviewed by the Monetary Authority of Singapore.