Articles

Executive summary

- Japan's economy is less vulnerable to economic doom seen globally, thanks to a more conservative pandemic response and a later recovery

- Fiscal and monetary policy remain supportive, and a weak yen is not without its own benefits

- Careful streamlining by individual companies during hard times has improved margins ahead of economic reopening, while long-awaited and much-needed structural changes also afford ample investment opportunities

- Growth stocks starting to bounce back after a heavy value bias in 2022, but a research-based, active stockpicking approach offers better prospects for capturing the real winners in the post-Abenomics era

A tale of two macroeconomies

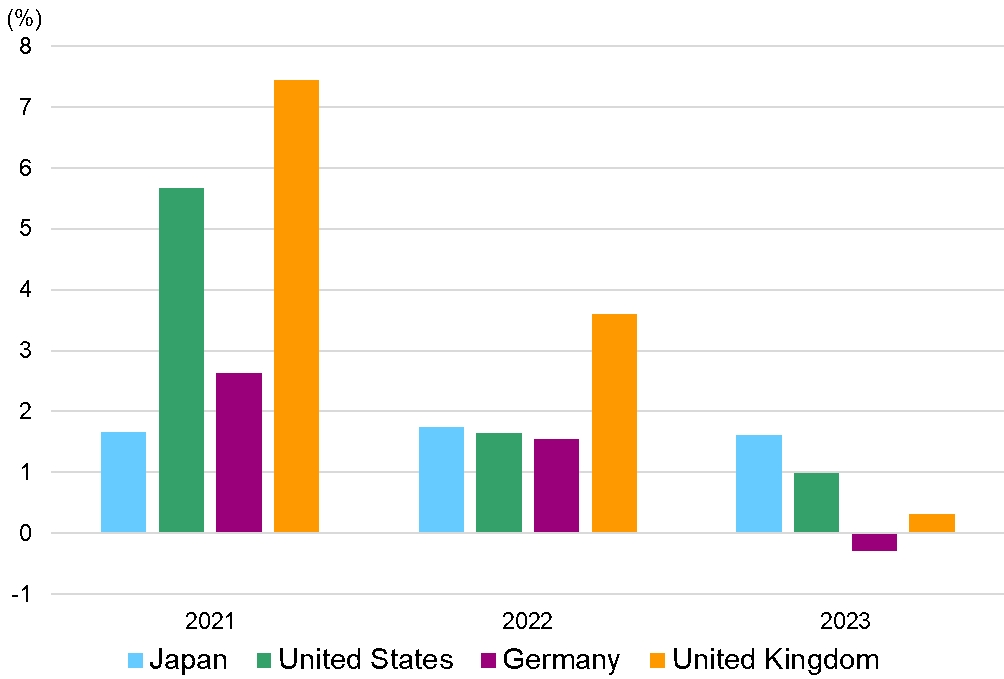

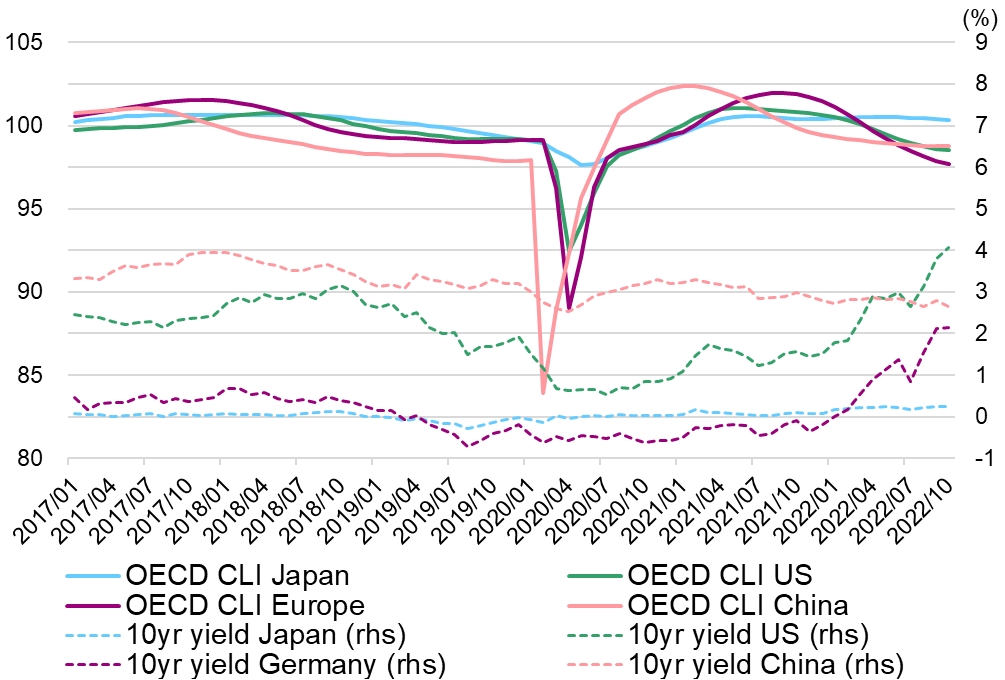

Around the world, inflation rockets, central banks tighten, leading indicators sink, and recession looms. Meanwhile, Japan remains steadily above the 100 watermark in the OECD's composite leading indicators (CLI), while the IMF forecasts GDP growth of 1.6% in 2023, outstripping the US for the first time since 2013 and leading among the G7 economies. Not the best of times, perhaps, but clearly not the worst of times: so just what the dickens is going on in Japan?

According to Hiro Kasai, Senior Strategist at Tokio Marine Asset Management, the major difference is how the country responded to Covid-19, and the timing of its recovery. Summer 2022 saw Japan's government finally move away from its relatively conservative stance on reopening, with a gradual lifting of restrictions on domestic and international travel. Consumption is expected to increase in the October-December quarter as the government subsidises domestic travel, further boosted by a rapid recovery in tourists from overseas. Elsewhere, the Bank of Japan's business survey indicates that capital expenditure will bounce back at last, although a global slowdown remains a concern.

Fiscal policy continues to support the economy - unlike in the US and more so than in Europe - with a forthcoming supplemental budget to include subsidies for electricity and gas in addition to those already introduced for petrol and wheat to mitigate the impact of price hikes. And on the monetary policy side of the equation, the BoJ looks set to maintain its current easy stance until we see signs that wages are rising, in addition to CPI inflation. Even at the peak of the pandemic, Japan avoided any snap shutdown - the economy was officially always open - while worker layoffs were kept to a minimum; recovery has accordingly been slow and gradual, resulting in a delayed reopening, with the growth phase decoupled from other economies.

Corporate profits under these circumstances have remained relatively steady. The weak yen benefits exporters - albeit not to the same extent as a decade or two ago - with generally higher margins, despite a global slowdown reducing volumes. Domestic-oriented names are enjoying the fruits of reopening, although high commodity prices and the same currency weakness is squeezing margins here. Lower wage growth is moderating cost increases, and it will take some time for Japanese companies to pass prices on to consumers. Domestic inflation is gradually spreading, however, pushing core CPI growth to 3%. Conscious efforts over the last decade to invest and expand overseas operations are paying dividends, meanwhile, as repatriated profits also benefit from currency weakness.

Global inflation is helping Japan to escape decades of deflation, but it remains a slow process, and it will be a while before we see the wage hikes that the BoJ expects to drive economic growth. Cultural preferences - not to mention the country's lost decades - have seen stable employment prized over higher remuneration, but PM Fumio Kishida's administration has now announced policies to increase job mobility and pay. Year-end bonuses and wage negotiations next spring will be closely monitored, and are also expected to affect BoJ monetary policy under a new governor, due to take office in April 2023.

Growth expectations

Shinji Watanabe, portfolio manager of the Tokio Marine Japanese Equity Focus strategy, sees ample opportunities for achieving growth in this reopening economy, and particularly in companies that have laid the right groundwork during hard times. “A straightforward example is discount retailer Pan Pacific International Holdings (7532), which has become more profit-oriented by curbing excessive discounting, properly managing inventory, and expanding its range of generic own label products. The firm can look forward to a recovery in both domestic and inbound demand - especially once China relaxes its zero-Covid policy - bolstered by improved margins. It can also benefit from the overseas operations it has built in recent years.”

A similar story holds for car parking/sharing service provider Park24 (4666), which saw demand hurt by the pandemic; renegotiated ground rents mean better margins in the post-reopening period and the firm looks set to generate record profits in fiscal 2023. Another big post-pandemic winner should be Relo Group (8876), whose services range from company housing to employee benefit schemes, expanding revenues as corporates look to outsource non-core business operations, with record profits expected as employees take advantage of travel perks.

Reopening is not the only show in town, however: Shinji also sees growth potential in structural changes. Digital transformation and productivity is an important theme for Japanese companies, and demand is strong for skilled workers in this area. Job mobility in Japan has lagged relative to the US and Europe, but the government is now pushing efforts to reskill workers and bring about a shift from lifetime employment to a more flexible, more productive workforce. A key beneficiary of this trend is Visional (4194), operator of recruiting website BizReach, which is enjoying demand for skilled workers and employee education. An ageing demographic has long been recognised as a major issue for Japan, and bolstering a shrinking working-age population through increased participation from sidelined groups such as women and the over-60s has its limits: employers now need to find younger (or even post-retirement age) workers, or bring part-timers on full-time to meet growing demand as the economy reopens. Newer attitudes to work-life balance, greater diversity in employment patterns and longer lifespans can all be expected to create knock-on growth in leisure, education and labour markets.

Market tide turns

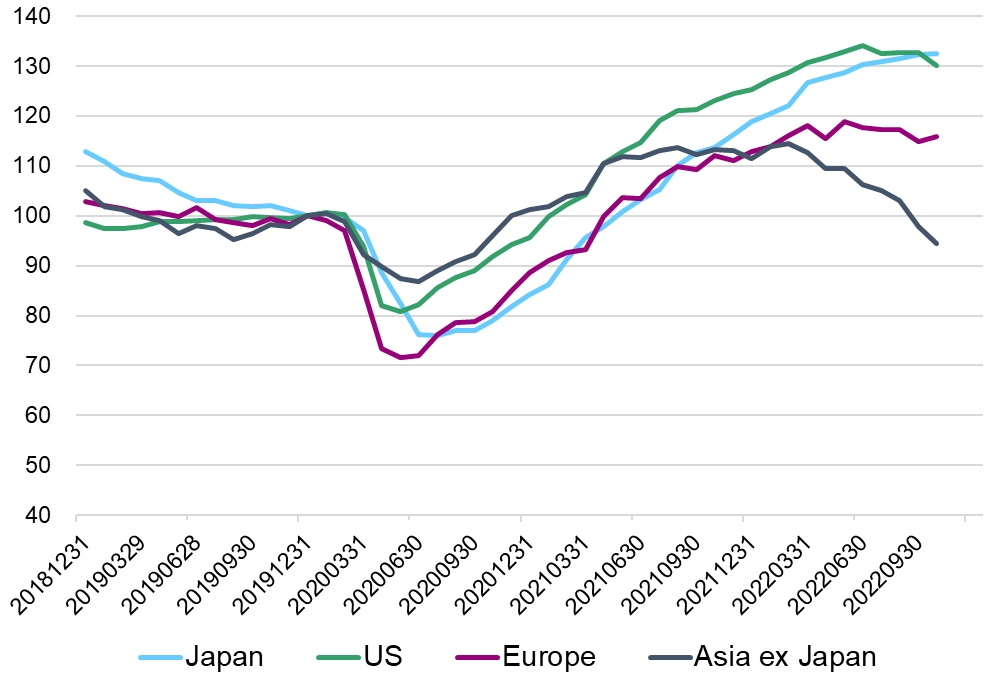

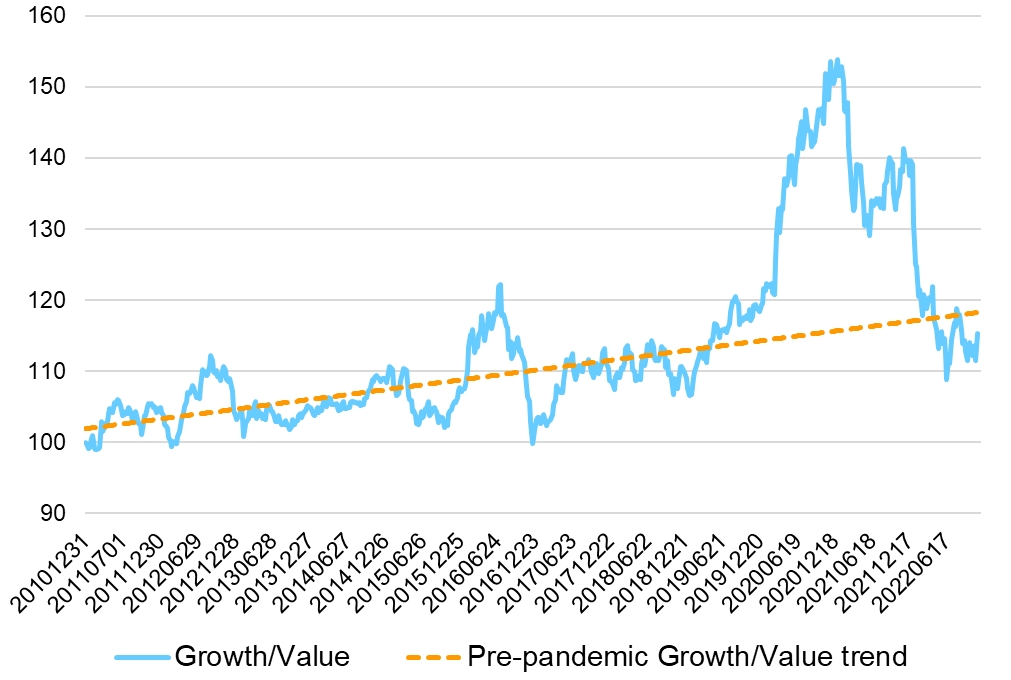

The early days of the pandemic saw central banks around the world maintaining easy money stances, fuelling strong outperformance by growth stocks; this has been followed by a rebound in value stocks since the US Federal Reserve called time on easing in 2021. Relative prices have now returned to pre-Covid levels and an end is in sight for the rate hike cycle - good news for growth names, after the value-bias headwind of late.

A common response to the kind of sharp drop seen over the last year is to treat growth stocks as a monolithic entity, regardless of individual company fundamentals, but we believe good stock selection based on thorough research can make a world of difference.

Overseas investors have reduced the Japanese equity holdings they built up during the Abenomics era, dismayed by a perceived lack of structural change in the country's economy and market. Japan has indeed been slow to change, but there have been positive advances. Stewardship and corporate governance codes introduced over the last decade to promote investor and shareholder awareness have now penetrated the market. Massive government spending to ease the pain caused by Covid-19 put the brakes on the rate of change, but the time is now ripe for policy to support further progress in a new post-pandemic era. “Structural progress may be slow,” says Shinji, “but growth opportunities are there for the taking - and take them we will.”

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is

not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.