Articles

Executive summary

- Economies around the world are struggling with post-pandemic wage-price spiral fears and slowdowns, but Japan finds itself uniquely positioned for growth as it begins to shift away from an overly-conservative pandemic response, while global inflation could offer an opportunity to make a definitive break from the country’s "lost decades"

- Reopening boosts domestic demand with households still sitting on savings built up during the pandemic, weak yen good for inbound tourism and export industries

- Budding inflation to push up wages at last, with support from PM Fumio Kishida’s "new capitalism"

- Risk factors include a global economic slowdown, Fed tightening, Covid, and the geopolitical situation in Ukraine and Taiwan, but cheap valuations and steady earnings growth should underpin an overall upward trend in Japanese equity markets leading into 2023

Recovery in progress

Summer 2022 saw Japan experience its seventh wave of the pandemic – by far the biggest in terms of case numbers – but this time with no government-mandated restrictions in place, as the nation gradually shifts towards the “living with Covid” policy already adopted by many other countries. This move away from the earlier peak cutting approach will eventually ease the impact the pandemic has had on even the hardest-hit industries, such as travel and hospitality.

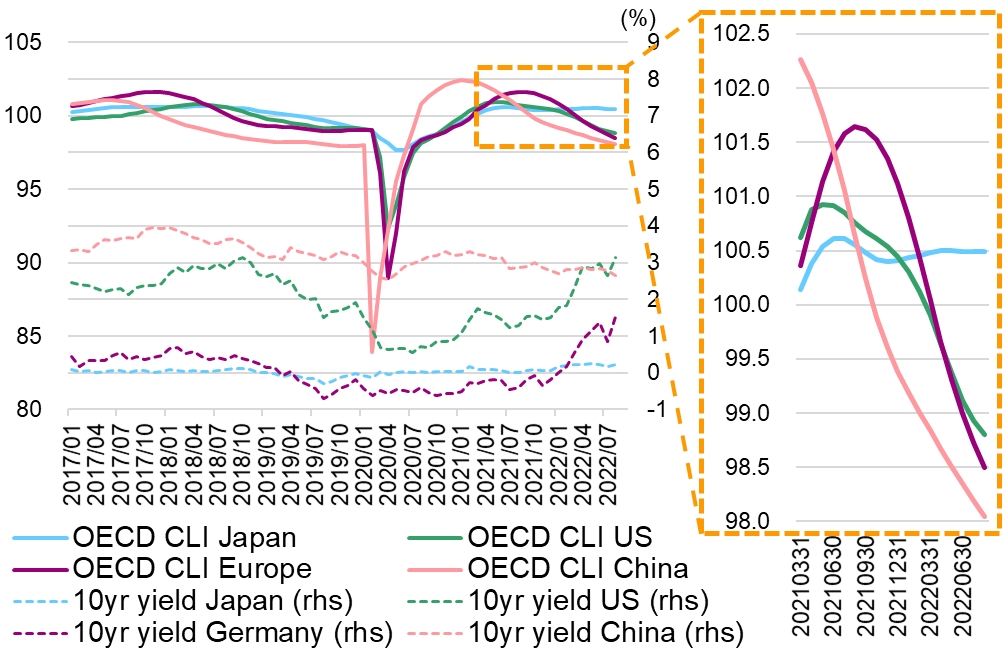

April-June quarter GDP figures indicated that Japan’s economy is on the path to recovery: in contrast to negative growth already seen in the US and forecast to come in Europe, the Japanese economy is recovering at a slow, steady pace, as shown in the OECD’s composite leading indicators. Recovery has been slower partly due to a more conservative reopening policy, and also because of the structural nature of an economy that has been minimising the downside impact at the cost of growth. This difference is most clearly reflected in the BOJ’s starkly different monetary policy stance.

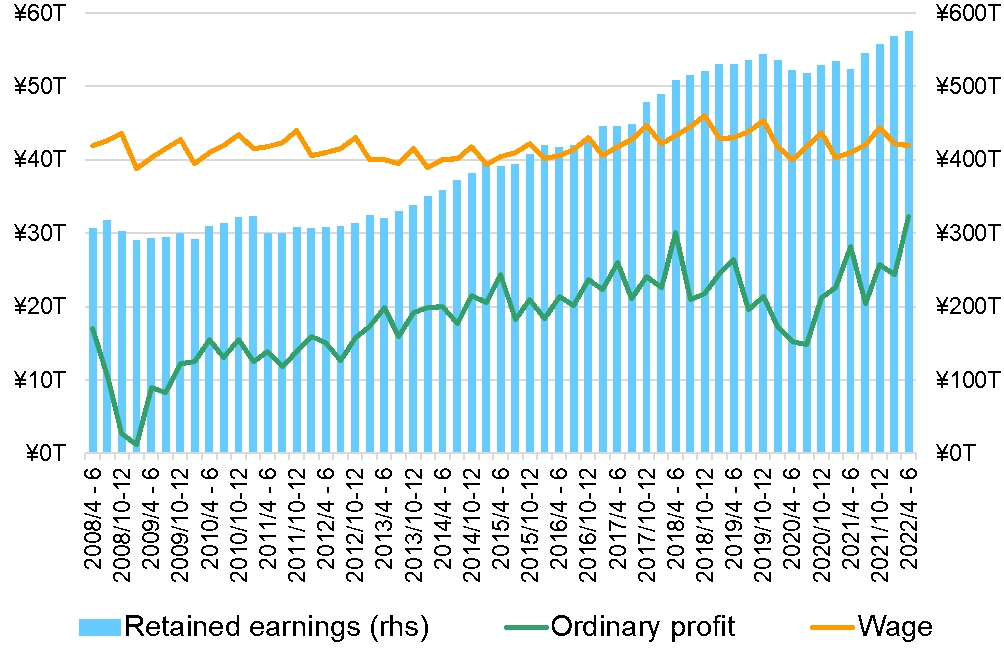

Consumption and capex in the April-June quarter led the recovery toward pre-Covid levels, and while this trend will continue, we may see a slacking off over the coming quarters as the initial reopening surge levels off and global economies slow down. The waxing and waning of Covid case numbers will continue to influence personal consumption, but current levels remain far below disposable income, and household savings built up during the pandemic will also help. The impact of a full recovery here from current depressed levels is estimated to be around 1.3% of Japan’s GDP. Capital expenditure, meanwhile, is recovering faster amid an easing in supply chain constraints, underpinned by a strong appetite for investment and ample retained earnings. Japan has historically invested less in intellectual property products such as software and R&D than other economies, but the recent recovery points the way to positive impacts on productivity growth in the future.

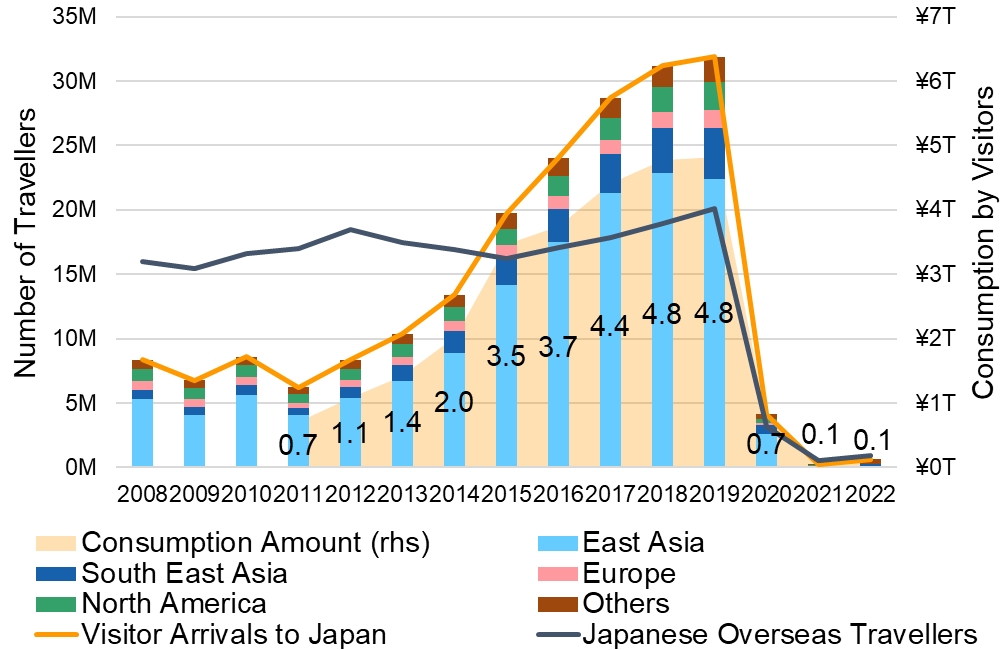

Inbound tourism recovery prospects are another longer-term positive for the economy. While border controls are still in place, and it will be some time before visitor numbers return to pre-pandemic levels of 30 million per year, a rapid recovery is expected once Covid eases in Japan and China , buoyed by attractive prices amid a weak yen and relatively low inflation.

Still-modest inflation and BOJ policy

CPI growth in Japan remains modest compared with the US and Europe, especially when excluding energy and fresh food. While headline and core figures have risen above the BOJ’s 2.0% target since April, the central bank sees this as being mostly driven by external energy prices, and continues to keep tabs on inflation spreading and eventually pushing up wages to help the country escape decades of deflation.

With the economy still in a gradual recovery phase and inflation at current levels, the BOJ is maintaining its easy money stance with 10-year JGB yields capped at 0.25% under the policy known as Yield Curve Control (YCC). BOJ Governor Haruhiko Kuroda, whose term expires in early April next year, is expected to spend his final months watching the outcome of a decade of ultra-easy monetary policy under his tenure, awaiting signs that the deflationary era is at an end, but uncertainty remains.

Input prices are rising, with import prices and CGPI climbing year on year at a pace of 30–40% and 8–10% respectively since the beginning of 2022, but CPI growth is much lower. This is because other inputs – labour costs and profits, for example – are growing slowly enough to dilute the rising cost of input materials against the total output price. SPPI , where labour costs play a major role, are also growing only at a modest 1–2% pace. This has been a structural factor underlying Japan’s “lost decades”. What the BOJ is aiming to achieve is a virtuous cycle of prices and wages increasing together – a positive spin on the wage-price spiral so feared by central bankers elsewhere.

Drilling deeper down into the CPI numbers to look at mode, trimmed mean and weighted median, we start to see signs of inflation spreading to broader consumer goods; many companies, meanwhile, have scheduled price hikes for autumn. If CPI figures rise into 2023 and wages increase in tandem, it will be easier for an incoming BOJ Governor to lift YCC and raise real interest rates into positive territory.

Currency

As a result of the BOJ’s loose monetary policy in a global inflationary environment, the interest rate differential drove the yen down around 20% against the US dollar over a period of four months. Another contributing factor may be deteriorating trade and service balances due to high commodity prices. Hedge unwinding as Japanese institutional investors repatriated funds in March/April and a large shift out of JPY assets by China’s foreign reserve are also estimated to have pushed the currency down.

A weaker yen has been generally positive for corporate earnings and the TOPIX index, although the correlation has eased in recent years as Japanese companies shift operations overseas. Beneficiaries include autos, steel & metals, and machinery, while the weak JPY hurts utilities and retailers.

Given the BOJ’s continued easy stance and the Fed’s hawkish position on inflation at Jackson Hole, a narrowing in the interest rate differential looks unlikely for some while: either until the market sees the Fed pivoting towards easing in 2023 or the BOJ recognises an improvement in the deflationary environment and lifts YCC. Moving beyond the world of monetary policy, a slowdown in the US or falling commodity prices could lead to a weaker US dollar and a yen recovery.

Kishida's "new capitalism"

In conjunction with the BOJ’s stimulative monetary stance, government policy plays an important role in maintaining a recovery in the Japanese economy to escape the long years of deflationary stagnation. Wages continue to be an essential indicator, and indeed wage hikes and a higher minimum wage are an area for focused investment under PM Fumio Kishida’s proposals for a new form of capitalism . The aim of the policy is to promote investment in human capital, providing support for business reconstruction and increased productivity. The government will promote vocational training, recurrent education and lifelong learning in active support of labour and job mobility, an area where Japan is severely lagging . As a first step, a government panel in August recommended raising average minimum wages by 3.3% – the largest hike since 2002 – building on momentum from the previous year. Annual spring wage negotiations in 2022 resulted in an average 2.2% increase; key events to watch going forwards will be year-end bonus and 2023 spring wage talks.

The new capitalism policy also includes investment in science, technology and innovation, startup companies, and green and digital initiatives. Plans to attract JPY 150 trillion in public-private investment in the next decade to achieve a carbon-neutral society are to be kickstarted by issuing JPY 20 trillion in green transition bonds. Other fiscal measures should also become clear towards the end of the year once the FY2023 budget plan is finalised; we will be closely monitoring the effectiveness of these investments, given their potential to lift the Japanese economy out of deflation.

More immediately, however, the Kishida administration needs to address a falling approval rate, following an extended grace period since the PM took office last autumn and through the ruling LDP’s summer victory in Upper House elections. Issues include raging Covid infections, inflation, the state funeral of assassinated former PM Shinzo Abe and the LDP’s controversial links with the Unification Church. A second supplementary budget is expected to be approved this autumn once the Diet reconvenes in October, with the aim of supporting the recovery from the still ongoing Covid pandemic, taming rising prices, and promoting Kishida’s new capitalism.

Steady corporate profits and equity market into 2023

Japanese companies had double-digit sales growth in the April-June quarter, but profit growth slowed as rising input costs were not fully passed on to final prices. A deterioration in terms of trade due to higher oil and commodity prices usually pushes corporate profits down with a time lag of 12 months, and we are now beginning to see the fallout. Despite this downward pressure, however, and the impact of an economic slowdown overseas, FY2022 will see steady earnings growth underpinned by the weak yen and a recovery in domestic demand as the economy reopens. Markets have already priced in the terms of trade slump, which will ease up into 2023, and if we can assume a soft landing in the US and elsewhere, we expect earnings to continue growing.

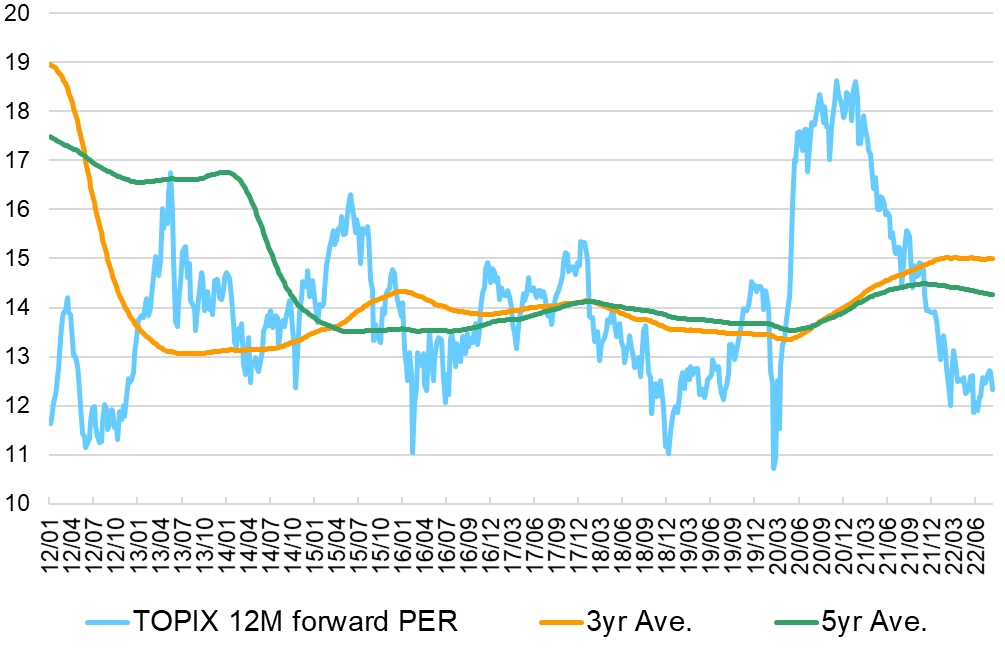

Equity market valuations have dropped in tandem with rate hikes in the US: price/earnings will remain depressed around 12x for the duration of the tightening cycle, but should bottom out toward the longer-term average of 14x as the cycle begins to wind down. Taken together with steady EPS growth, we expect an overall upward trend in Japanese equity markets into 2023.

More immediately, however, the Kishida administration needs to address a falling approval rate, following an extended grace period since the PM took office last autumn and through the ruling LDP’s summer victory in Upper House elections. Issues include raging Covid infections, inflation, the state funeral of assassinated former PM Shinzo Abe and the LDP’s controversial links with the Unification Church. A second supplementary budget is expected to be approved this autumn once the Diet reconvenes in October, with the aim of supporting the recovery from the still ongoing Covid pandemic, taming rising prices, and promoting Kishida’s new capitalism.

Economic slowdown and Fed tightening are not the only risk factors at play: market volatility may also come from the ongoing and ever-changing Covid situation, as well as unpredictable geopolitical issues in Ukraine and Taiwan.

The overall picture is positive, however: following a difficult first half of 2022, where a correction in growth stocks followed on from a major rally sparked by the pandemic. This short-term value bias is now coming to an end, and as the sudden acceleration in inflation and resulting shift to tighter monetary policy begins to fade, Japan’s public and private sectors both look to invest further in improving productivity.

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not

authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.