Articles

Japan’s GDP shrinks, growth rate rises

Japan’s GDP fell by 0.4% in the fourth quarter of 2023, marking a second consecutive contraction and indicating a technical recession. Will this stop the Bank of Japan from moving to normalise monetary policy this year? Unlikely, says TMAM senior strategist Hiro Kasai.

Late 2022 to early 2023 saw the economy grow as the country reopened from the Covid pandemic, and this has been followed by a certain level of stagnation, as the latest GDP data reaffirms. Sentiment indicators are showing signs of improvement, however, and it seems that the post-reopening pullback is coming to a close; a gradual pick-up is in sight as social and economic activity normalises, partly thanks to a stronger than expected US economy and a slowdown in inflation, in line with the global trend.

And while the contraction in GDP means that Japan has slipped behind Germany as the world’s third largest economy, preliminary figures released by Japan’s Cabinet Office suggest that the country's nominal growth rate has overtaken that of China for the first time since 1977. Newly deflationary China saw nominal growth of 4.6%, while Japan posted 5.7%, in yet another sign that the country is finally escaping the deflationary spiral of recent decades.

Ueda’s not for turning

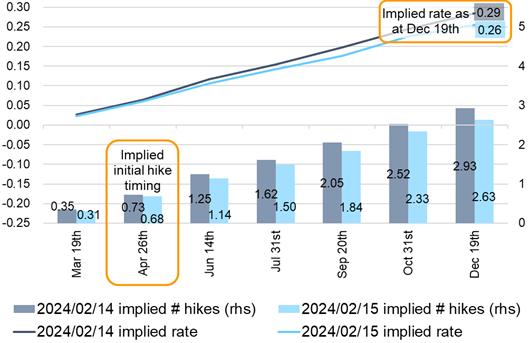

BoJ governor Kazuo Ueda has consistently noted that the country needs to achieve sustainable inflation (and more specifically, a virtuous cycle between wages and prices) before the central bank is ready to make a move in the direction towards normalisation, and at first glance, GDP weakness suggests the possibility of delays. But past performance is famously not a reliable indicator of future returns, and markets don’t appear to see this past GDP data as having a significant impact on the future timing of the BoJ lifting its negative policy rate. The implied number of hikes before the April policy meeting has dropped only slightly from 0.73 on February 14th ahead of the GDP data release to 0.68 the following day, making this still the most likely timing for an initial hike from a negative to a zero interest rate.

While weak October-December GDP data came as an unwelcome surprise to many, wage and CPI data remains solid enough to support market confidence that the BoJ remains on course to normalise; we continue to look for an end to negative interest rates at the April policy meeting.

About the author

|

Hiro Kasai, Senior Strategist

A founding figure in TMAM’s investment process, with three and a half decades’ experience in asset management, including spells as CIO of TMAM and CEO of its New York subsidiary, as well as head of Asian investment for the Tokio Marine Group. When not providing macroeconomic and market insights, Hiro enjoys onsen trips and countryside walks. |

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.