Articles

Executive summary

-

Japan’s small cap segment as a whole is boiling with potential: diversification benefits amid low foreign ownership, enhanced corporate governance, attractive valuations and strong earnings recovery potential.

Opportunities exist for firms providing innovative solutions to structural issues both in Japan and abroad, where small cap names are able to dominate global niches

Stock-specific factors and low sell-side coverage necessitate an active approach, with extensive research on the ground key to picking winners.

Small but significant

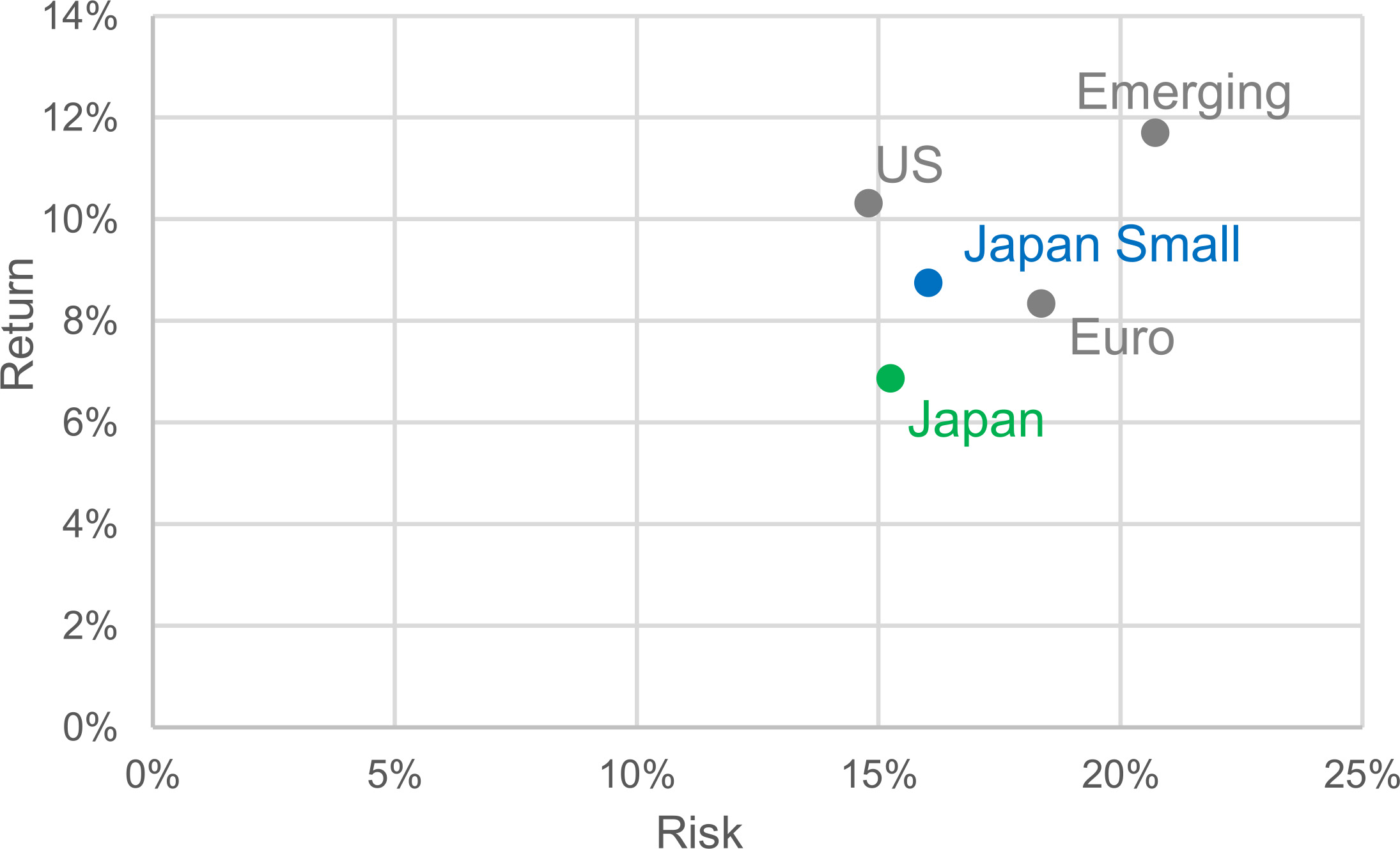

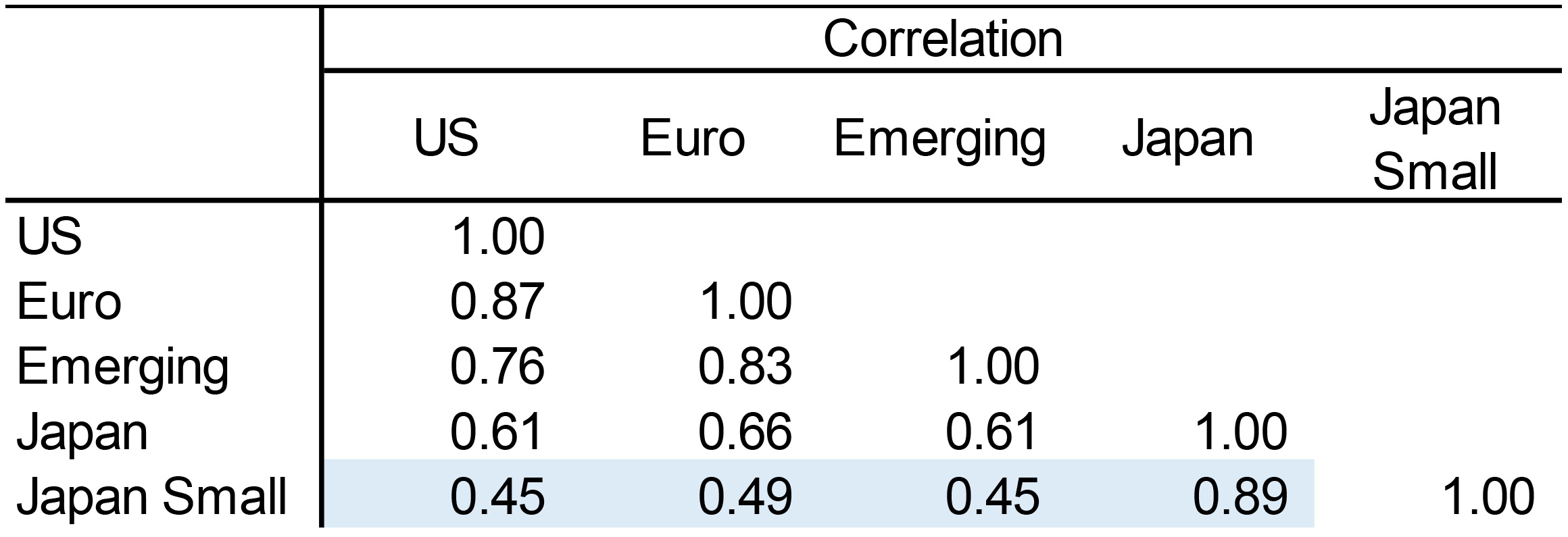

It has often been said that diversification is the only free lunch in investment; and according to Hiro Kasai, Economist at Tokio Marine Asset Management (TMAM), Japanese small caps may be the perfect side dish. Japanese small cap equity, as an asset class, is a good diversification to investors’ portfolios because of its low correlations with other equity markets (Figures 1, 2). This is partly because Japanese small caps are less exposed to global economic cycles than large caps, and partly down to lower ownership by foreign investors.

Figure 1: Japanese small caps offer an attractive risk/return profile

Historical risk/return (2002-2021, USD). Source: MSCI. Past performance is not an indication of future returns.

Figure 2: Low correlation provides good diversification to equity portfolios

Historical correlations (2002-2021, USD) between MSCI equity indices. Source: MSCI.

Past performance is not an indication of future returns.

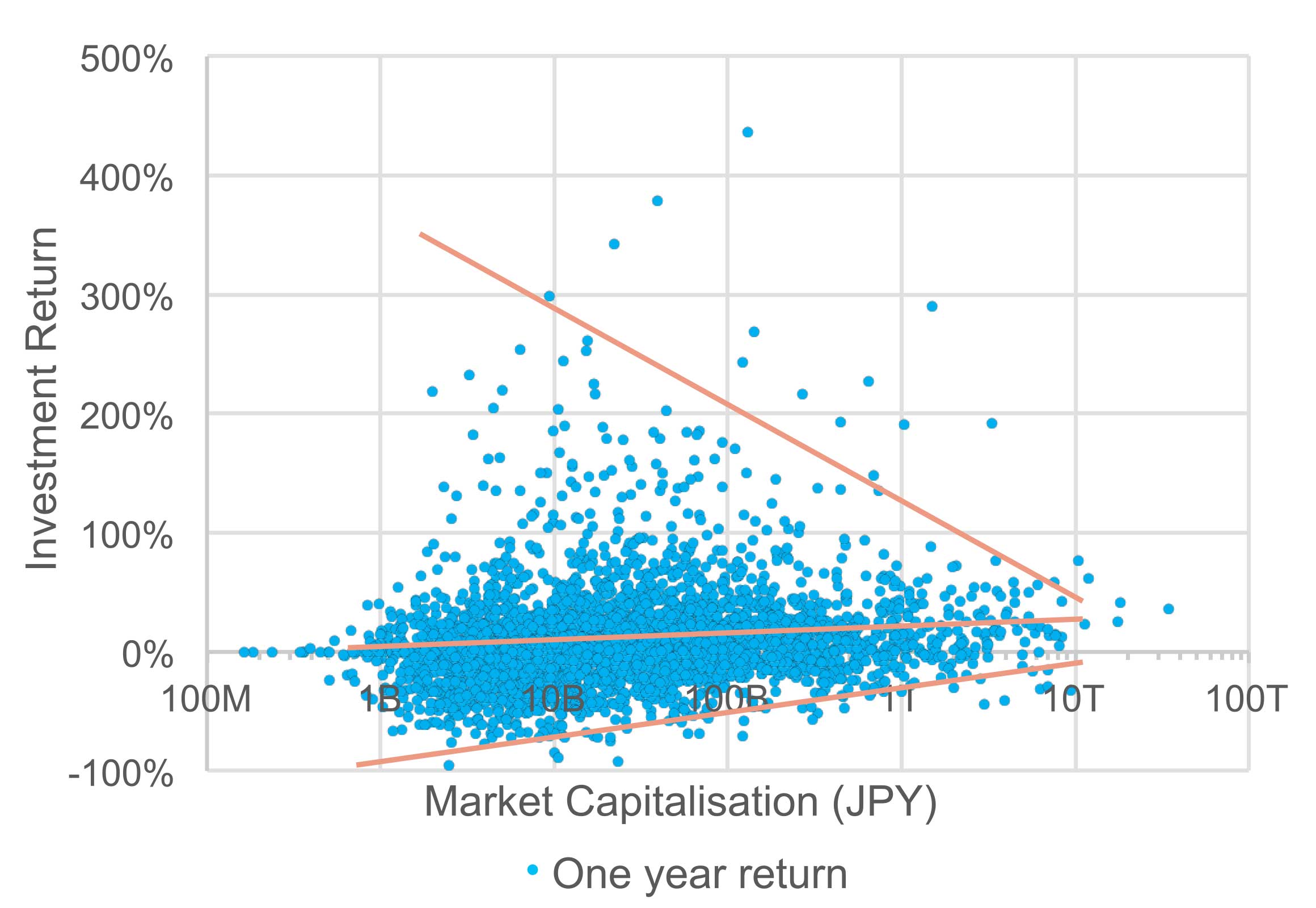

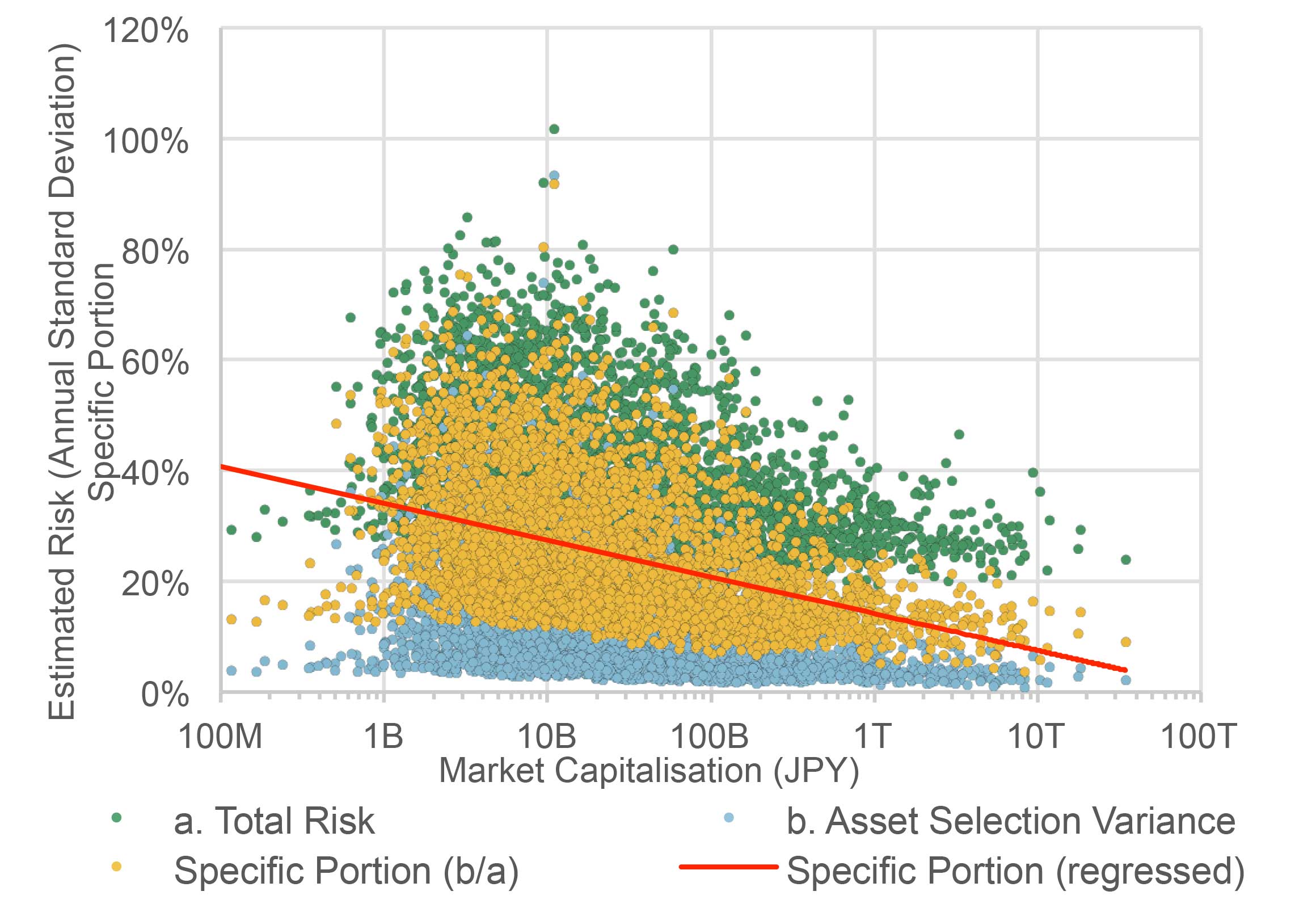

More importantly, however, small caps tend to have more disperse returns, with stock-specific elements outweighing market factors (Figures 3, 4). This means that superior research and portfolio management capability offer every chance of generating outperformance in the Japanese small cap segment, which has historically proved an attractive playing field for active managers.

Figure 3: Greater return dispersion in smaller caps

Return dispersion relative to market cap (2021). Source: MSCI Barra. Past performance is not an indication of future returns.

Figure 4: Smaller cap returns more driven by stock-specific factors

Stock-specific risk not explained by common market or industry factors, relative to market cap (as at December 2021).

Source: MSCI Barra.

Past performance is not an indication of future returns.

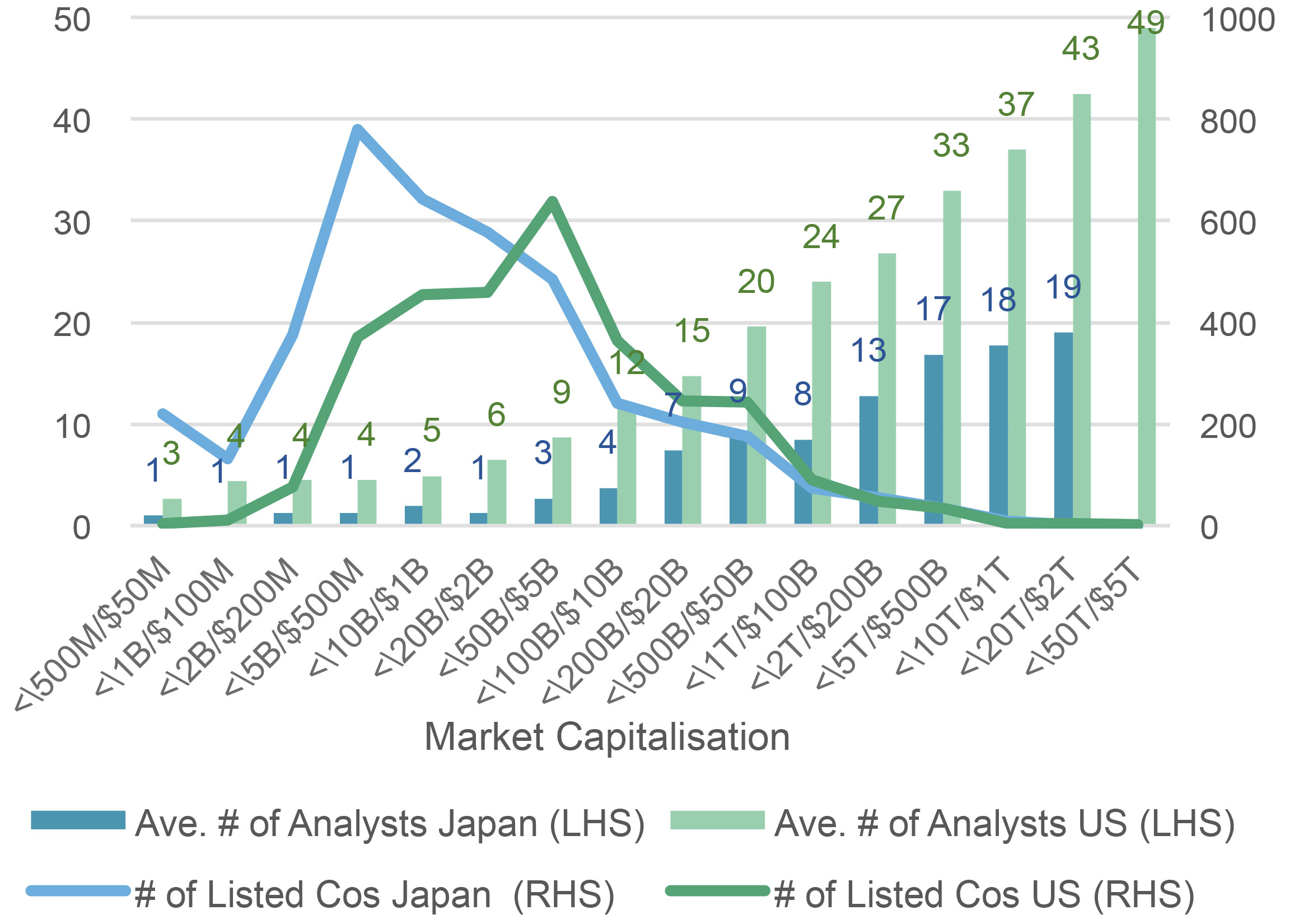

Indeed, opportunities in the segment are rife – for those who know where to look. Of circa 3800 names listed on the Tokyo Stock Exchange, Russell/Nomura includes in its Small Cap Index some 1200 companies constituting the bottom 15% of the market. Capitalisations range from USD 6 billion down to USD 100 million, with around 70% trading over USD 1 million every day on average, which gives a broad and deeply liquid pool of stocks compared with other small cap markets. Crucially, these companies are relatively under-covered – both within Japan and relative to US small caps – allowing highly skilled active stock pickers to find “hidden gems” (Figure 5).

Figure 5: Low sell-side coverage of small caps

Low sell-side coverage of small caps in Japan is more pronounced than in the US. Japan: Names listed in Tokyo Stock Exchange and JASDAQ, US: Russell 3000 constituents, as at December 2021. Source: Bloomberg

Solutions to structural issues

Taku Yoshida, PM of the Tokio Marine Japanese Equity Small Cap fund, sees opportunity in structural issues facing the country, including an ageing population and low productivity: “We can find lots of interesting companies with high earnings growth that provide solutions to or take advantage of these issues and subsequent changes.”

Like (2462) is a comprehensive care provider for both the young and the old, which benefits from increasing demand for elderly care and increasing female workforce participation. Ageing infrastructure is another major concern in earthquake-prone Japan. Construction machinery manufacturer Giken (6289) combines low-noise, low-vibration piling technology with operational know-how for innovative, environmentally friendly construction for infrastructure such as roads and breakwaters. Even existing technologies, when properly combined in a changing environment, can produce innovative products and services. Recognising structural changes and demands arising from social issues, Yoshida identifies hidden innovators that can create value through combinations of technologies and skills – but notes that this is only possible through extensive research on the ground.

Big players in global niches

While small cap names tend to be domestically oriented, plenty are able to compete on the global stage. A few years ago, Japan’s Ministry of Economy, Trade and Industry (METI) created the “Global Niche Top Companies Selection 100”, a list of firms operating in markets that are not particularly large, but where they hold an overwhelming share. Chemical specialist Tayca (4027), for instance, is at the cutting edge of micronising and surface-coating technology, with a 60% worldwide share of micro titanium dioxide for suncare cosmetics offering best-in-class ultraviolet ray screening, visible light transmission, and safety. It has also adapted the technology to produce piezoelectric composites for medical ultrasound probes, where it has a 50% global share. “Companies like this play important roles in global supply chains, which gives them the pricing power to maintain profit margins – even in an inflationary environment of rising costs”, explains Yoshida.

Rising tide of governance lifts all boats

Last but not least, broader improvements in corporate governance and engagement since the introduction of Japan’s Stewardship Code and Corporate Governance Code several years ago are now spreading beyond large cap companies and into the small cap segment. This April saw the Tokyo Stock Exchange reorganise its listing sections into three buckets – Prime, Standard and Growth – with many small cap names upending market participants’ original expectations by opting to abide by the higher liquidity and corporate governance standards required to make it into the Prime section. Higher insider ownership is common among smaller companies, and good governance and engagement should prove effective in improving corporate performance across the board. And with stock-specific factors continuing to offer disperse returns above and beyond the broadly rising tide, active managers get the best of both worlds.

Given all the ingredients in place – low foreign ownership, enhanced corporate governance, attractive valuations, and strong earnings recovery potential – we believe Japanese small caps deserve more attention.

Disclaimer

Note: The above figures (as applicable) are past performance and do not guarantee future results.

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

This report has not been reviewed by the Monetary Authority of Singapore.