Articles

Executive summary

- Strict border controls being eased at last, as Kishida administration reiterates Japan’s pre-pandemic target of 60 million inbound tourists a year by 2030

- Weak yen is good news for visitors, good news for domestic sectors benefitting from higher per capita tourist spending

- Smart approach to protecting travel industry workers during the pandemic means Japan is likely to avoid travel chaos plaguing Europe and the US

Inbound tourism: Overview

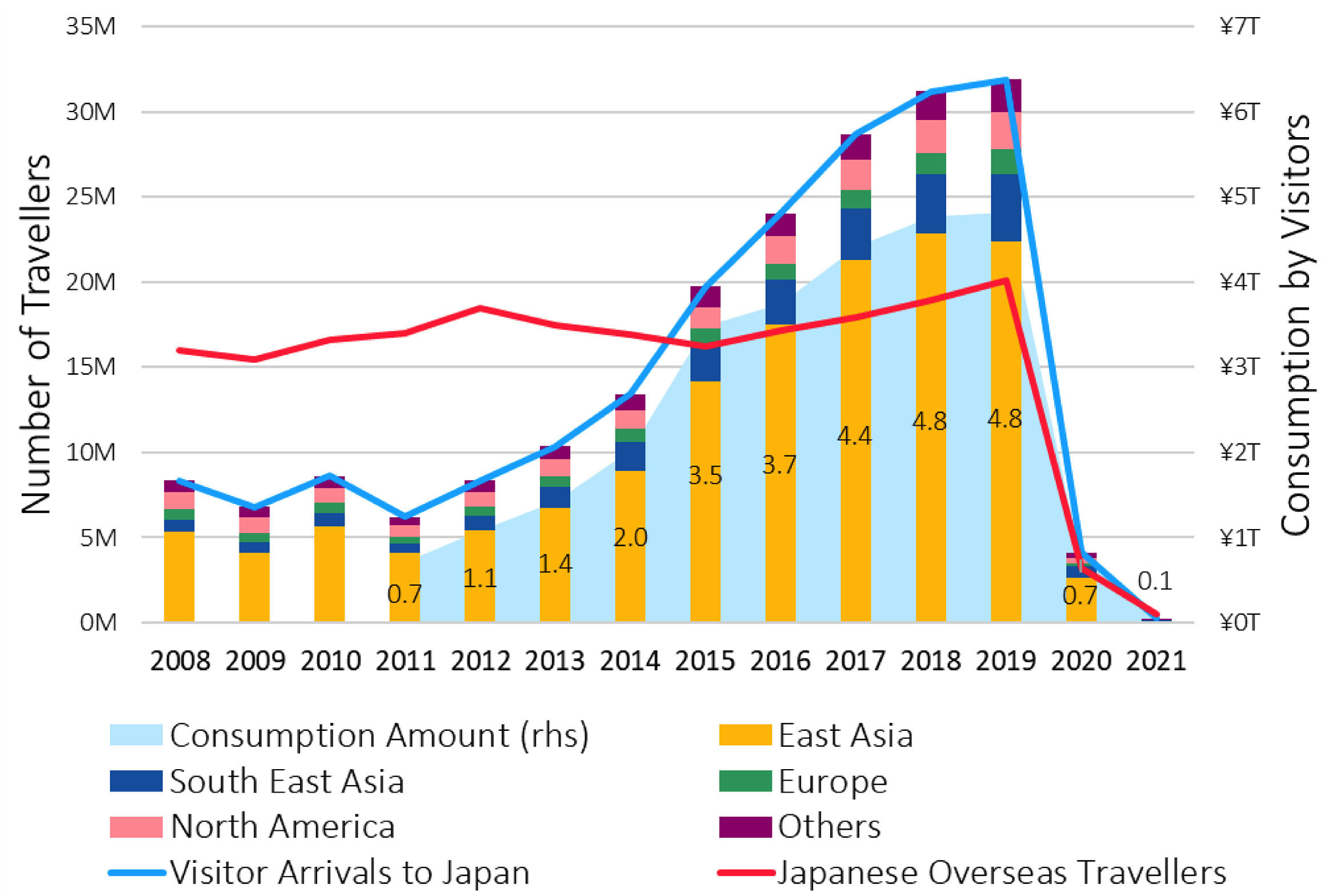

For many years, Japan was seen as a niche market for tourists from the West: too far, too expensive to reach, too impenetrable a language, and too busy serving domestic travellers to care. But with the government actively promoting inbound tourism as a matter of national policy for over a decade now, the number of foreign visitors has surged from 8.3 million in 2012 to 31 million in 2019, ranking the country 12th globally and 3rd in Asia. Everything was in place for the 2020 Tokyo Olympics to draw record crowds, but Covid-19 put everything on hold in 2020 and 2021. As of 2022, we are beginning to see the green shoots of recovery: border controls are gradually being eased to allow foreign visitors, both for business and sightseeing, but it will be some time before all restrictions are lifted and visitor numbers return to pre-pandemic levels. As at the beginning of July, sightseers are required to book package tours via a travel agency, and there remains a daily cap of 20,000 incoming travellers – including Japanese repatriates – although restrictions should be fully lifted by the end of the year. On the demand side of the equation, meanwhile, China’s zero-Covid policy will have an impact: tourists from the country accounted for 30% of visitors in 2019.

Inbound tourism: Facts and figures

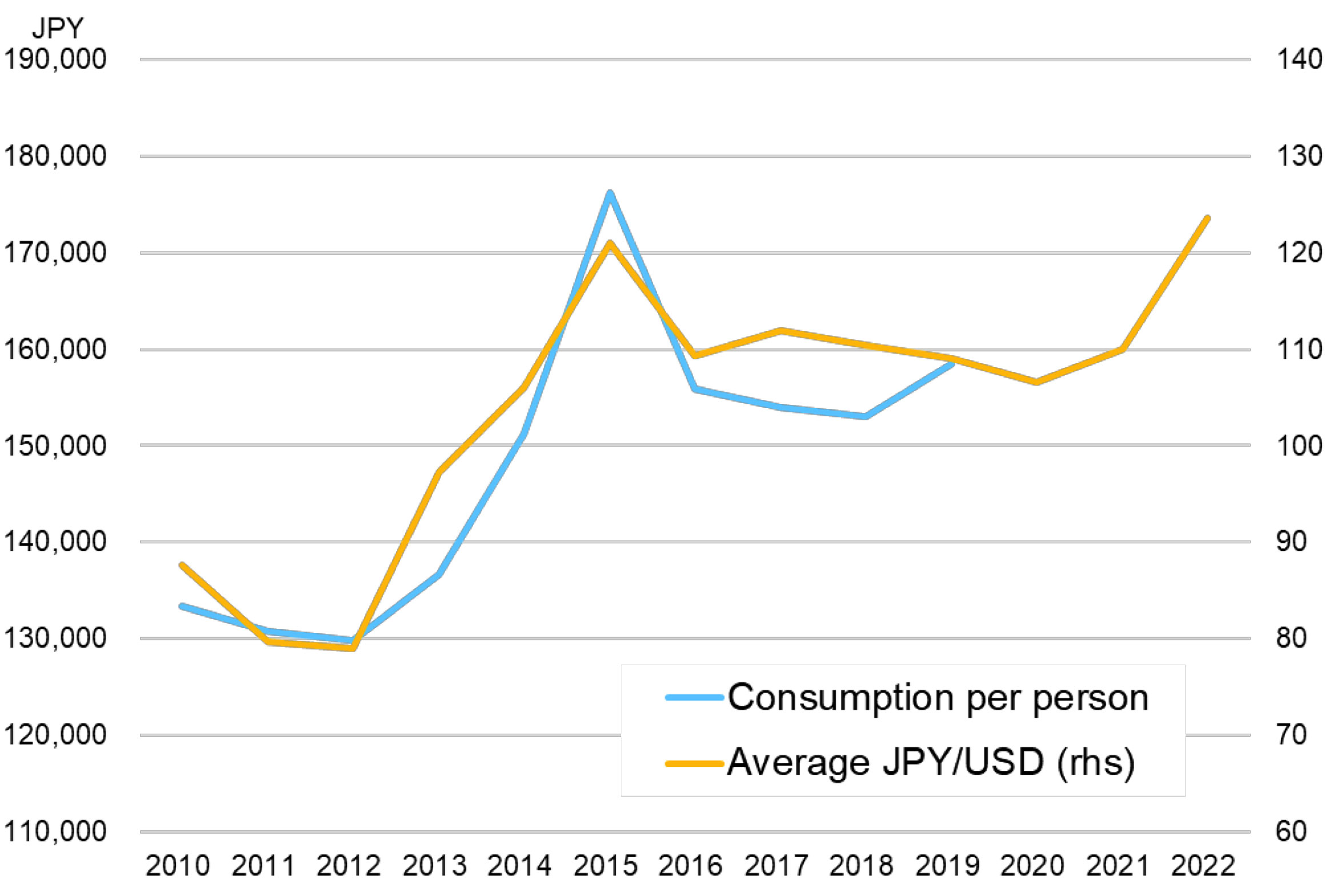

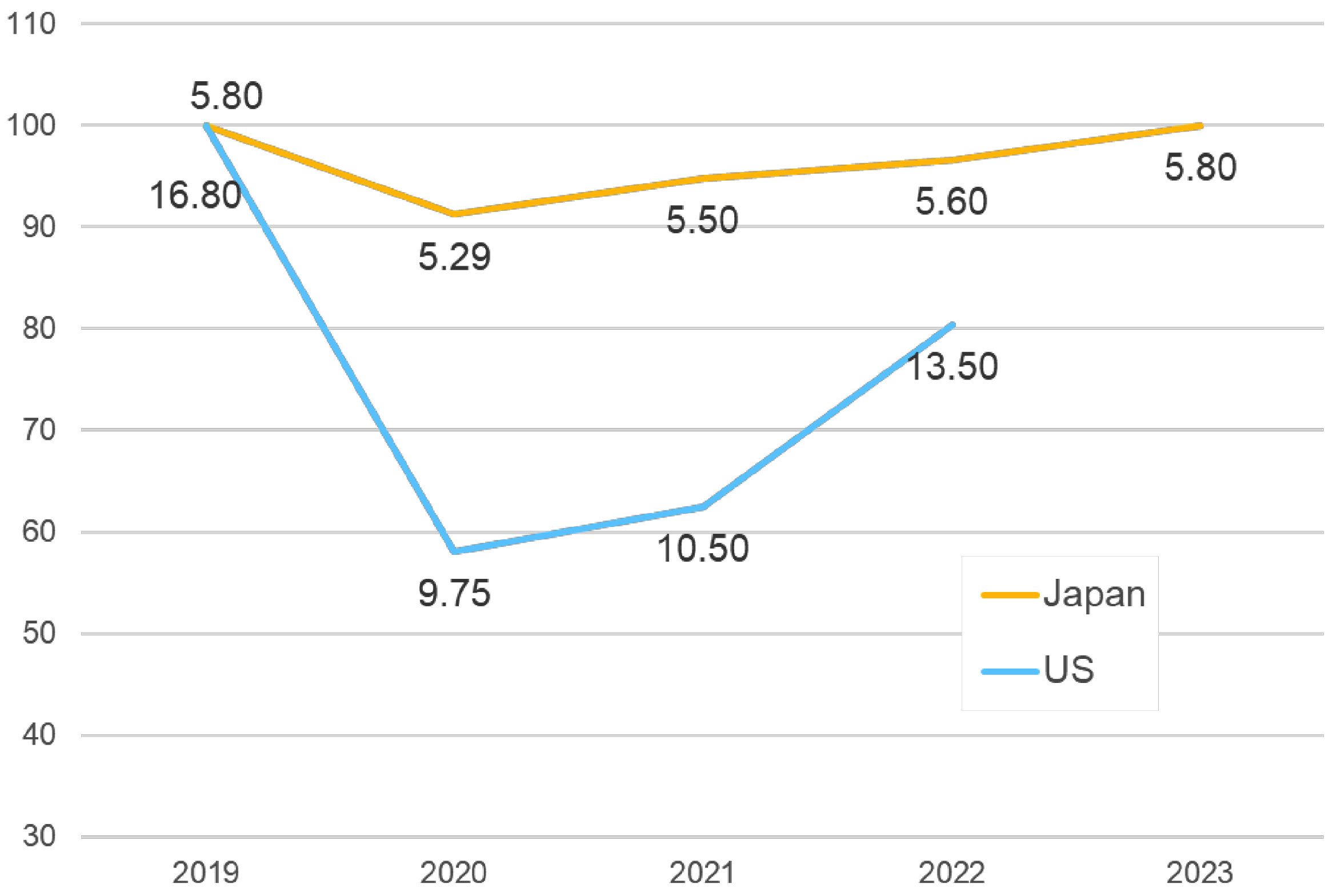

Japan had 31.2 million and 31.9 million foreign visitors in 2018 and 2019, with around 85% arriving from Asia: specifically China (30% in 2019), Korea (18%) and Taiwan (15%), followed by North America (7%) and Europe (6%). More than three quarters came for sightseeing purposes, particularly from Asia, where growth has been supported by rapidly climbing income levels, short flight times and easier visa requirements. Foreign visitors spent a combined JPY 4.8 trillion (USD 44 billion at 2019 rates), averaging JPY 159,000 per person, on shopping (JPY 53,000), lodging (JPY 47,000), and dining (JPY 35,000). Chinese tourists tend to shop more (JPY 109,000), while Western tourists generally spend more on lodging and dining.

Public and private efforts to attract tourists from overseas mean that Japan is now ranked No. 1 in the World Economic Forum’s Travel & Tourism Development Index for 2021, based on factors including safety, transportation, and natural and cultural resources . The restoration of Japan’s reputation as a tourist destination was also recently announced as official Kishida administration policy ; the government is maintaining its pre-pandemic goals of 60 million inbound tourists spending JPY 15 trillion a year by 2030, with the expectation that the industry will stimulate regional economies in particular. International travel should also shore up the currency to an extent – although of course the recent weakness in the yen has made Japan more attractive to visitors.

Impact on domestic demand and prices

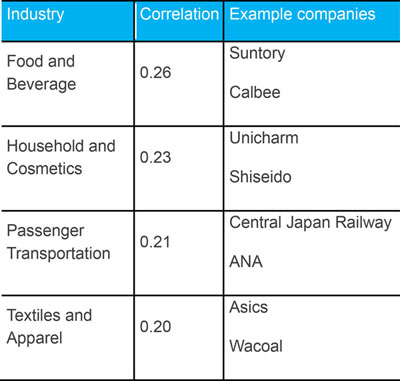

Any increase in inbound tourism will boost domestic consumption, with the JPY 4.8 trillion foreign visitors spent in 2019 accounting for 0.86% of Japan’s GDP that year. While no one expects a full recovery in 2022, if we assume five million tourists (one sixth of pre-pandemic levels, around 28,000 a day for the second half of the year) spending at 2018/2019 levels, estimates suggest direct spending of JPY 780 billion or JPY 1 trillion including secondary effects , adding some 0.18% p.a. to GDP. Lodging and dining will be the largest beneficiaries of this spending, followed by retailers and transportation, as well as food and cosmetics manufacturers. Unsurprisingly perhaps, historical data also suggests a higher correlation between inbound travel and the domestic travel industry.

A weak currency should prove a further tailwind to spending in yen terms, as happened previously from 2013 to 2015. This brings an opportunity for price hikes in service sectors such as hotels and dining, where Japan continues to lag behind global peers.

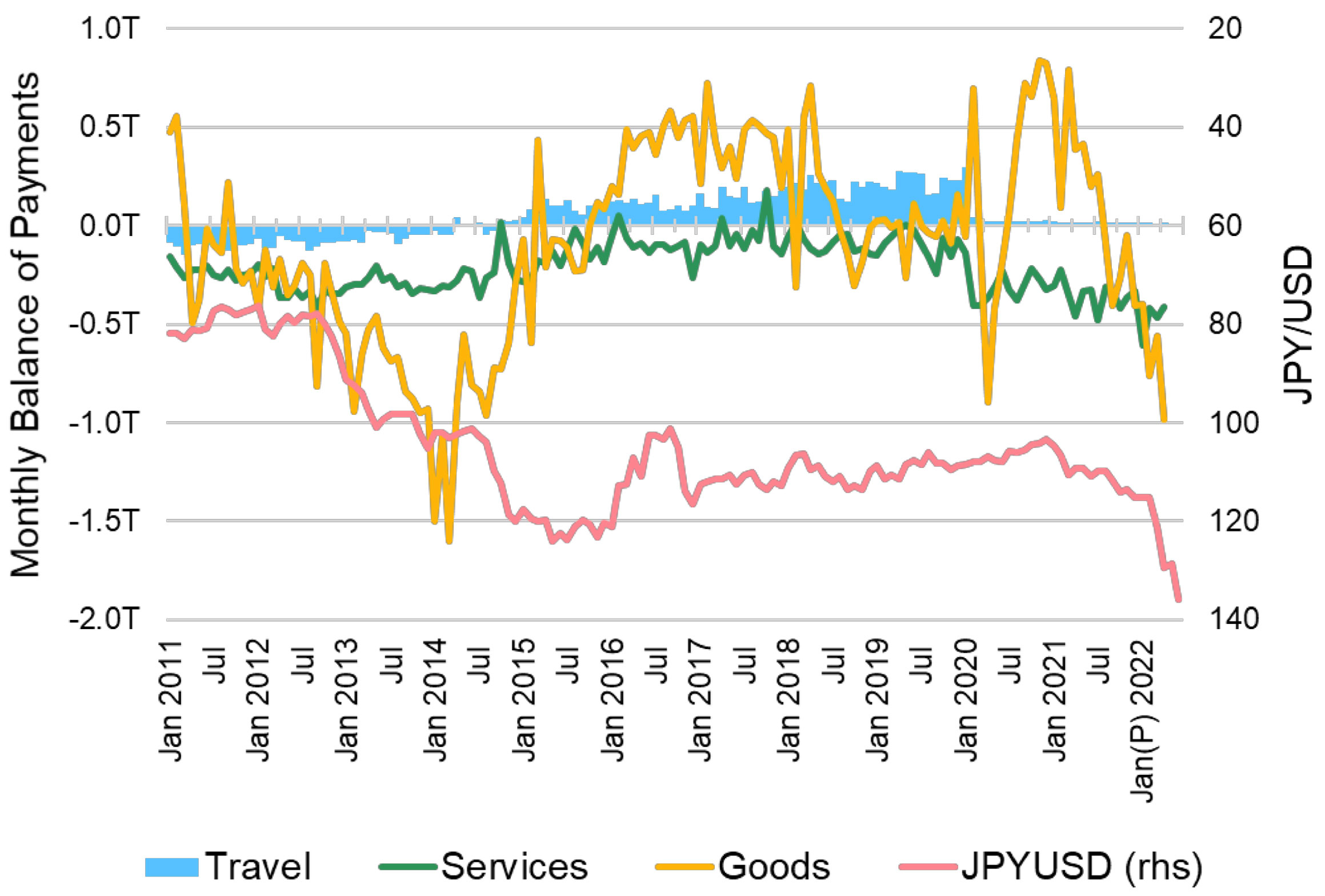

Impact on current account and JPY

Japan’s travel balance – a subsection of services in the current account – shifted into the black in 2015 on the increase in inbound travel, reaching JPY 2.7 trillion in 2019, but dropping down to JPY 208 billion in 2021. A fascinating comparison can be made with goods exports: a travel balance credit of JPY 5 trillion in 2019 was larger than exports of electronic parts (JPY 4 trillion), and second only to that of automobiles. Given this scale, it is natural to assume that a sharp drop in the travel balance as part of the country’s current account (JPY 18.8 trillion surplus in 2019) had an impact on the currency. Other factors have also been at play, of course, including central bank policy, the trade balance and capital flows , but the tourism recovery will be worth watching – with the caveat that Japanese tourists heading overseas will also be selling currency.

Inbound tourism going forward

A surge in travel demand across Europe and the US has laid bare capacity shortages in airlines, airports and hotels, creating chaos for would-be holidaymakers. Japan looks set to avoid similar issues, however: the country’s softly-softly approach to easing of border restrictions should prevent demand from overheating, while travel industry workers have largely stood their ground, thanks to government subsidies and a flexible approach of seconding many employees to other industries. Further good news: even in the event of a labour shortage, Japan still has room for wage increases, which could help stimulate the domestic economy.

While there is still no telling for sure when border controls will be fully lifted, Japan continues to hold an allure for overseas travellers, and numbers will recover in time. We may see changes relative to pre-pandemic times – spending on services is expected to grow more than spending on goods – but growth opportunities appear rife for Japan’s domestic sector, and the travel industry looks set to be a major story to follow over the coming decade.

- Travel & Tourism Development Index 2021: Rebuilding for a Sustainable and Resilient Future, World Economic Forum

- Basic Policy on Economic and Fiscal Management and Reform 2022, Cabinet Decision on 7 June 2022

- Macro Focus Vol. 58, 2 June 2022, Daiwa Securities

- One capital flow of note is the sale of Japanese short-term bills by China, amounting to JPY 4.5 trillion in March 2022 alone. China is estimated to hold in its foreign reserve more than JPY 50 trillion Japanese short-term bills as at April 2022.

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.