Articles

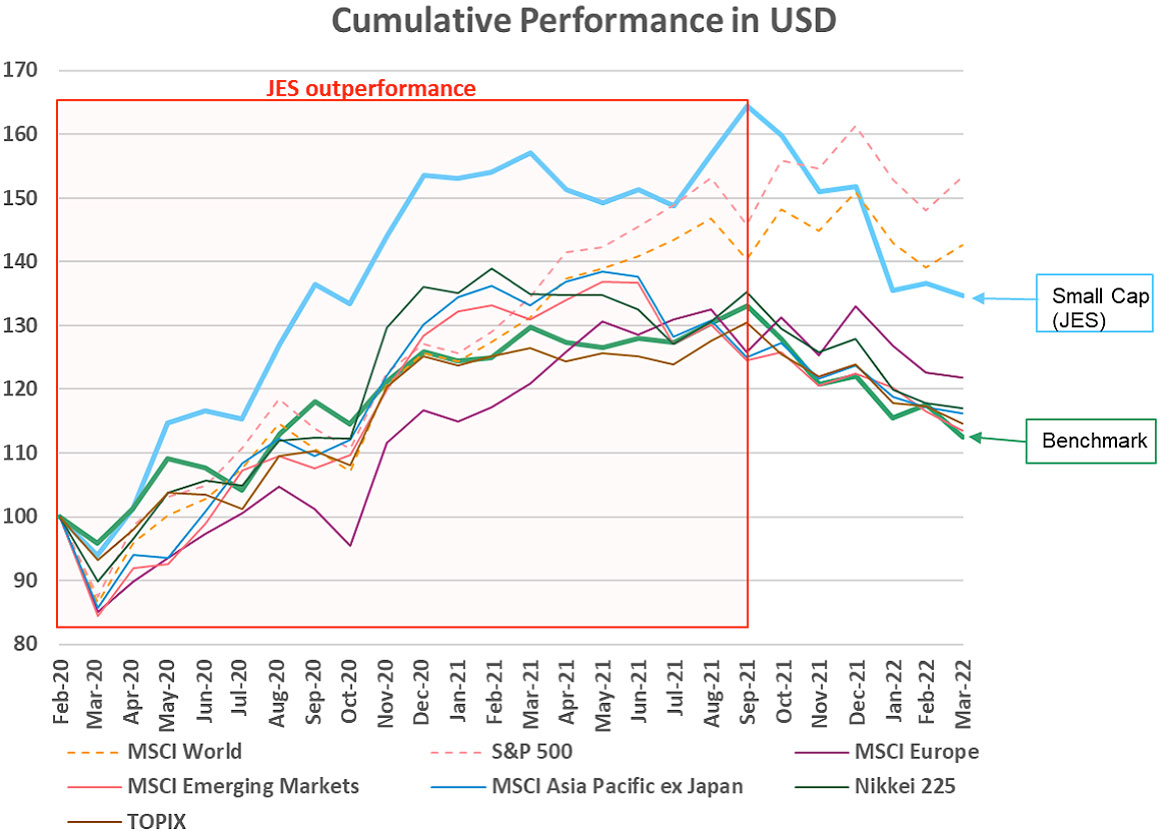

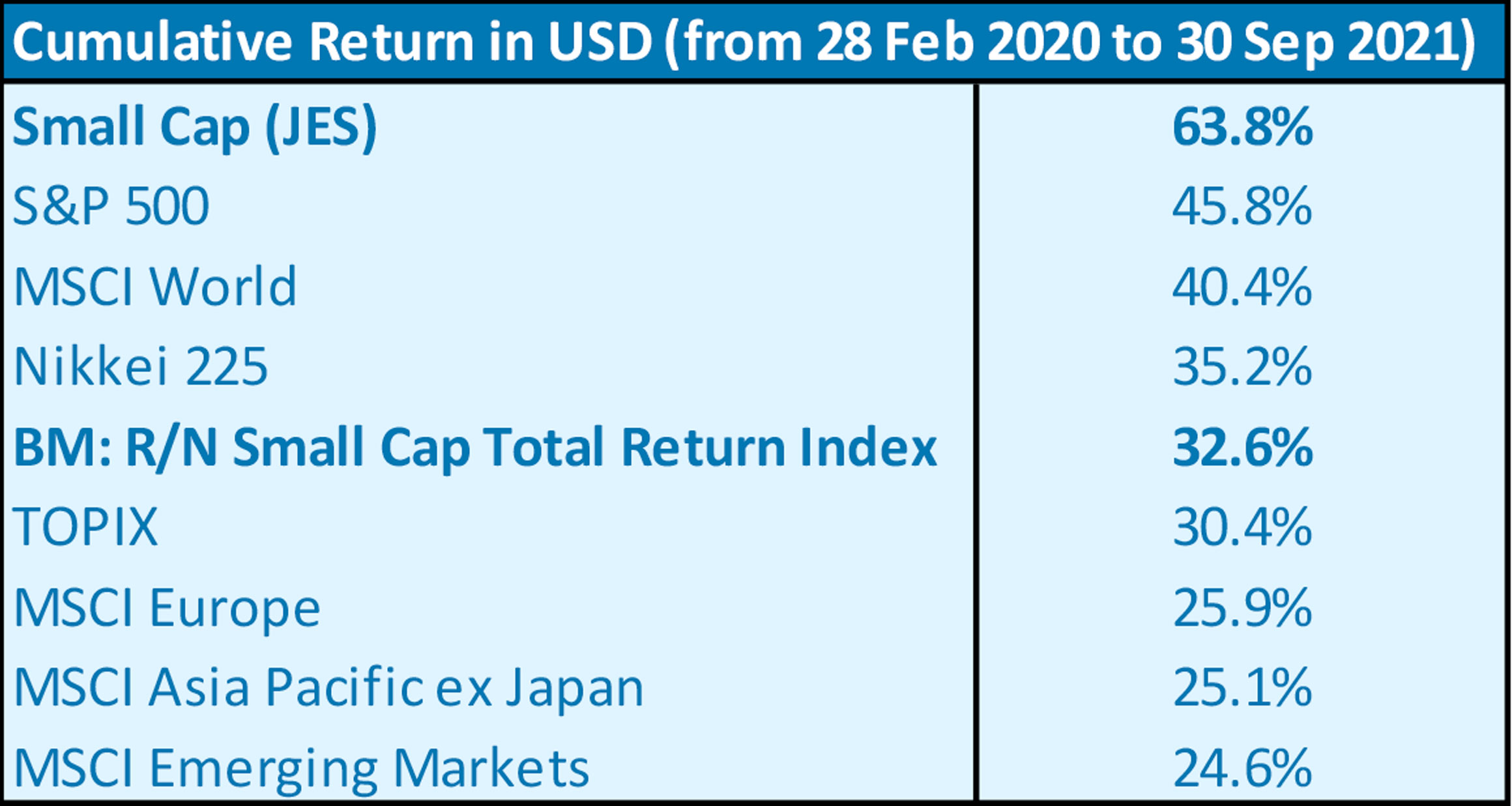

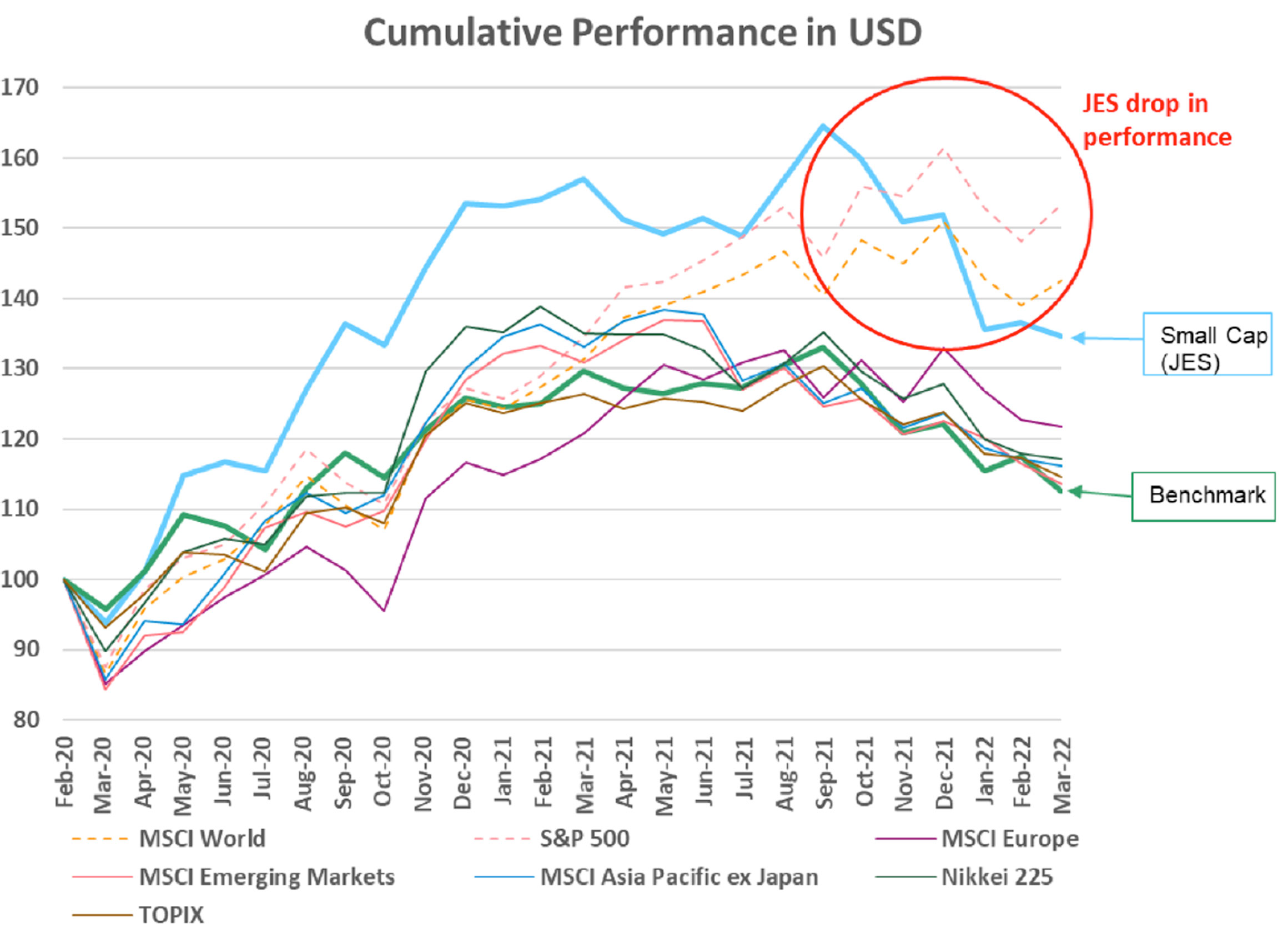

In this report, we will investigate the reason for our JES outperformance from the start of Covid-19 (28 February 2020) to 30 September 2021, the reason for the drop in performance from 4Q 2021, and the catalysts, views and positioning moving ahead for small caps.

JES outperformance from start of Covid-19 to 30 September 2021

During the Year 2020

In the first half of the year, fears over the spread of the coronavirus drove a flight to quality, and our Fund Manager actively adjusted the portfolio to include more names either with high earnings visibility or likely to benefit from the new normal created by the pandemic. In the second half of the year, our Fund Manager prioritized reasonably priced names over what was judged to be overheated small cap growth stocks.

Top contributors included global leader in motor core manufacturing Mitsui High-Tec, drawing attention for its green credentials; online store builder Base, meeting user needs in the new normal and experiencing high growth as a result; and e-commerce furniture specialist Vega Corporation, also benefitting from pandemic demand. Main detractors, meanwhile, included casual dining chain Torikizoku, badly hit by Covid-19; social media marketing firm Allied Architects, failing to make a mark with a much-hyped new service offering; and local shopping app operators Locoguide, following disappointing earnings.

Start of the Year 2021 to 30 September 2021

Our Fund Manager actively searched for innovative names building unique business models with high barriers to entry and a high competitive edge, in line with our basic policy. Alpha largely came as a result of these names posting solid earnings. Performance was hurt by exposure to economic reopening names, however, with the emergence of two significant Covid variants during the year.

Best performers included industrial insulation fibre manufacturer Isolite Insulating Products, on economic reopening and the announcement of a takeover bid by parent company Shinagawa Refractories; celebrity fan club site operators M-Up, with the firm’s e-ticketing business growing; and semiconductor name Ferrotec, benefitting from rapid improvements in the segment. Main detractors, meanwhile, included prestressed concrete giant Br. Holdings Corporation, on a slowdown in order growth; image recognition AI developer Neural Pocket, following delays to a new service offering; and mobile gaming company Mynet, hurt by a competitor’s megahit game.

Reasons for the drop in performance from 4Q 2021

The fund was doing well till mid Nov, but with the expectation of early rate hike by the Federal Reserve increasing, the value stocks started to outperform growth stocks led by large cap stocks, which was a headwind to the fund. With rising inflation globally, and the expectation of the Federal Reserve to quicken the pace of rate hikes meant the high valuation stocks continue to be out of favor regardless of their fundamentals. The Russia’s invasion of Ukraine caused risk off movements with rising natural resource prices also leading to quality stocks being sold. However, once the oil price has started to stabilize and the US 10-Year treasury rate has factored in the expected target rate, quality growth stocks have started to outperform value stocks, and the fund performance has been recovering strongly.

What are the catalysts, views and positioning moving ahead for small caps?

Catalysts

- Small Cap PER is already at a discount to Large Cap (TOPIX500 13.5, TOPIX SMALL 12.5);if large caps were to outperform small caps going forward, it is likely to lead to further valuation discrepancies as earnings outlook of small caps are not inferior to large caps, giving more reasons to look at small caps.

- Because of on-going uncertainties over global inflation, Ukraine/Russia situation and the implications of the Federal Reserve rate hikes, corporate winners and losers over the next year and beyond will become more apparent than now, hence stock picking will be a key to generate strong returns; alpha generation is easier with small caps.

- As Japan has ended its semi-lockdown measures on 21 March, Japan is finally on a re-opening economy stage and this will start with the recovery of the domestic economy and personal spending, and small caps, which include many domestic demand related names, are the key beneficiaries.

- Re-introduction of GoTo Travel campaign or its equivalent to encourage Japanese people to travel and spend to support the damaged tourism industry; the earliest is probably May.

- Eventual acceptance of foreign tourists; currently only business travelers are allowed; possibly from Autumn this year (foreign tourists spent roughly 1% of GDP before Covid).

Positioning

- Yen weakness is more positive for larger caps, and the fund tends to invest in less foreign sensitive stocks, which have high sensitivity to exchange rates and interest rates.

- With strong inflationary pressure, have higher exposure to IT/service companies which have lower cost bases to manufacturing companies.

- Also wary of companies with high European economic exposure considering the Ukraine situation; hence reduce exposure to such companies and increase domestic exposure companies.

- With the above background, the fund’s basic policy to invest in names with a competitive edge based on innovation, knowhow and technological superiority, building unique business models with high barriers to entry; and in names building new markets by creating new products and services, are likely to lead to strong outperformance of the benchmark in the coming year and beyond.

- Continue to monitor geopolitical risks and inflationary pressures and whether the invested companies continue to have barriers to entry, pricing power to pass on the extra costs to keep margins etc., and adjust the portfolio accordingly.

Commentary and Outlook

Market Review

Small and mid (SMID) caps rose again in March 2022. The month began with oil prices up and SMID caps down on geopolitical havoc following Russia’s invasion of Ukraine. Japanese equities made a subsequent comeback as crude cooled and the yen continued to weaken against the dollar, but large cap exporters were the main beneficiaries, and SMID caps were left lagging.

The Russell/Nomura (RN) Small Cap Total Return Index climbed 1.09% over the month, underperforming the RN Large Cap Index, which was up 5.06%.

Performance Review

Portfolio activity: This month we added three names to the portfolio and sold off two holdings. We did not subscribe to any IPOs this month. The portfolio now includes 57 companies.

Performance analysis: The portfolio outperformed the benchmark over the month. Top contributors included special needs employment services provider S-Pool (2471) and global weather forecasting service provider Weathernews (4825), both on strong earnings growth prospects; and global leader in motor core manufacturing Mitsui High-Tec (6966), with guidance significantly above consensus. Main detractors, meanwhile, included construction equipment rental firm Kanamoto (9678), on disappointing quarterly results; hospital construction consultancy Ship Healthcare (3360), following a sell-side downgrading; and shrink wrap packaging maker Fuji Seal (7864), amid concerns that rising materials prices could hurt future earnings. An overweight position in software and underweighting in banks contributed positively, while overexposure to chemicals/oil refining and underexposure to industrial electronics weighed on performance.

Outlook and Investment Strategy

This month saw small caps continue to trade at a slight P/E ratio discount to large caps. Corporate earnings will likely see larger stocks reap the benefits of a weak yen, leaving SMID caps somewhat subdued. Economic reopening names continue to offer some prospects. Heightened geopolitical risk could mean inflation pressures, however, and we will need to monitor the impact of material and service price hikes on demand.

Our basic policy is unchanged: we look to invest in names with a competitive edge based on innovation, knowhow and technological superiority, building unique business models with high barriers to entry; and in names building new markets by creating new products and services, with the aim of outperforming the small cap benchmark in the longer-term.

Source: Bloomberg. Small Cap and benchmark converted from JPY to USD using WM/Reuters FX rate every month. Performance return as of 31 March 2022, net of fees. Small Cap uses UCITS representative share class D in JPY and converted to USD. Fees deducted proportionately every month end since inception. Indices converted to USD using Bloomberg FX rate.

Note: The above figures (as applicable) are past performance and do not guarantee future results.

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report does not constitute an invitation or an offer to make an investment in any funds mentioned therein.

Any investment decision should be made based solely upon the information contained in Prospectus and/or Placing Memorandum with independent analyses of your investment and financial situation and objectives.

An investment in the fund carries a significant degree of risk and therefore should be undertaken only by investors capable of evaluating and bearing the risks. The nature of the fund's investments involves certain risks and the fund may utilize investment techniques such as leverage and the use of derivatives, which will carry additional risks. The past performance of the fund may not be indicative of its future results.

This document is produced solely for your internal use. This report may not be transmitted, reproduced or made available to any.

This report has not been reviewed by the Monetary Authority of Singapore.