Articles

India remains the fastest growing major economy

Investors around the world always view India as a growth market. The reasons are compelling - right demographics, improving infrastructure, digital adoption, rising per capita income and strong corporate balance sheets – to name a few. India remains the fastest growing major economy in the world in an environment where the debate is on how shallow or deep a potential recession would be in the developed world.

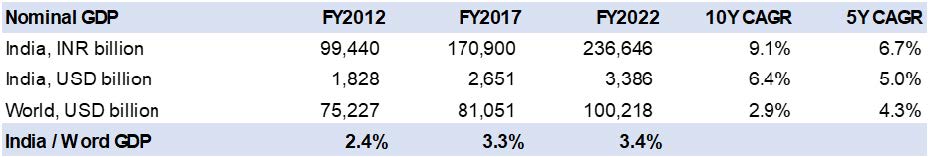

In the last decade (FY2012 to FY2022), India’s nominal GDP grew at a 6.4% Compounded Annual Growth Rate (CAGR) in US Dollar terms (Fig 1) . The headline growth appears subdued, but the period includes the impact of major global events like Covid-19 pandemic, severe supply chain disruption and high commodity inflation. At the country level, the Indian economy also saw disruptions from painful reforms like bankruptcy code, GST implementation and demonetization. Going forward the prospects are much brighter, as evident from the recent IMF update where India is projected to grow at 9% CAGR nominally in US Dollar terms till FY2028. Consequently, India’s contribution of global GDP will rise from 3.4% in FY22 to 4.1% by 2028.

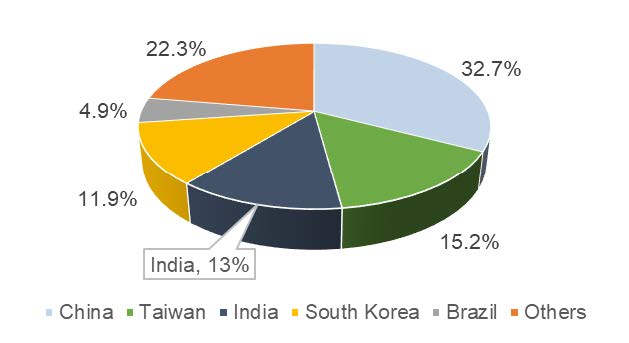

Some long-term investors are drawing parallels between China and North Asia’s historic growth path to India’s future. Currently China (32.7%), Taiwan (15.2%), and South Korea (11.9%) account for 59.8% of the MSCI Emerging Market Index (Fig 2) and arguably India at (13.0%) has much catch up to do, considering its population size of 1.4 billion. While North Asia predominantly grew on exports, India offers opportunity on both domestic and export themes.

Factors supporting India's multi-year growth

India has leapfrogged in creation of digital infrastructure across segments like payments (UPI), identification (KYC/Aadhaar), subsidies (Direct Benefit Transfer), and new age businesses (e-commerce and online platforms). Rapid proliferation of the mobile broadband has propelled India among the highest per capital data consumers in the world. Cumulatively these factors are helping to improve productivity, efficiency and greater accessibility of goods and services.

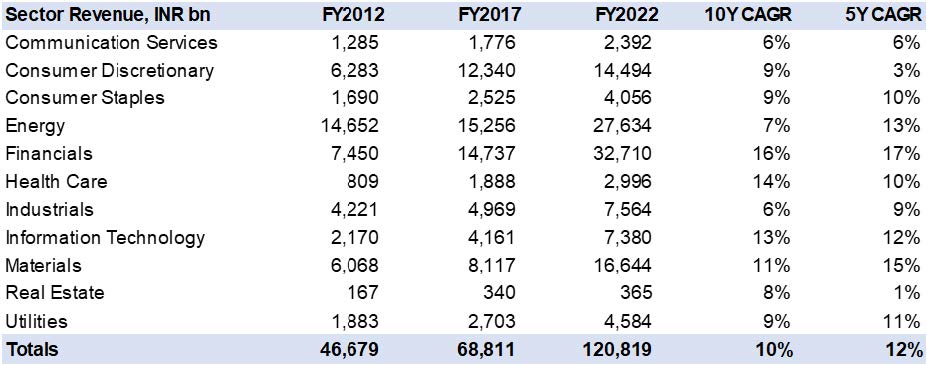

Financial inclusion has been an ongoing key theme as more mid-low-income population got access to banking services, credit facility, insurance, and investment products. This trend is visible in 16% revenue CAGR of BFSI (Banking and Financial Services) companies from FY2012-2022 (Fig 3).

Traditionally India has been an offshoring destination for both services and products. Export-driven sectors like Information Technology and Healthcare delivered revenue growth of 13% and 14% CAGR respectively for the last ten financial years. India’s manufacturing base is expanding as global supply chain reorients in a post-pandemic era and that will keep the export engine running.

The domestic consumption-oriented sectors’ revenue growth has been subpar. But per capita income is at a critical inflection point and India is ready to reap its demographic dividend. Half of the population is under the age of 30 and as they enter the labor force consumption across segments will witness rapid growth.

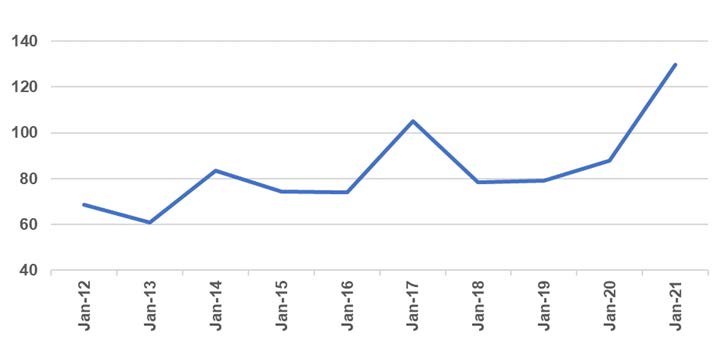

An increasing number of companies joined the public market in recent years. At the same time large institutional flows and active participation by the domestic retail investors expanded the market. The number of retail brokerage accounts grew exponentially, from 41 million during pre-pandemic days to 110 million by January 2023. India’s market capitalization to GDP expanded from a mere 68% in Dec-2012 to 129% in Dec-2022 (Fig 4).

In summary, acceleration of growth prospects in a slowing world makes India an attractive investment destination. Both the export and domestic oriented sectors are key drivers of the growth going forward. At the same time, expansion of the domestic equity market presents a wider opportunity set for investors. The coming year will not be devoid of global macro challenges, but the relative attractiveness warrants an active India allocation strategy.

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an

offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.