Articles

Has Japan lost its way without Abenomics?

Under Abenomics, former PM Shinzo Abe helped the Japan equity market to move on from the two lost decades of the 1990s and 2000s, with TOPIX outperforming the MSCI All Country World index for four consecutive years from 2012 to 2015, returning 131% and 48% respectively over that period.

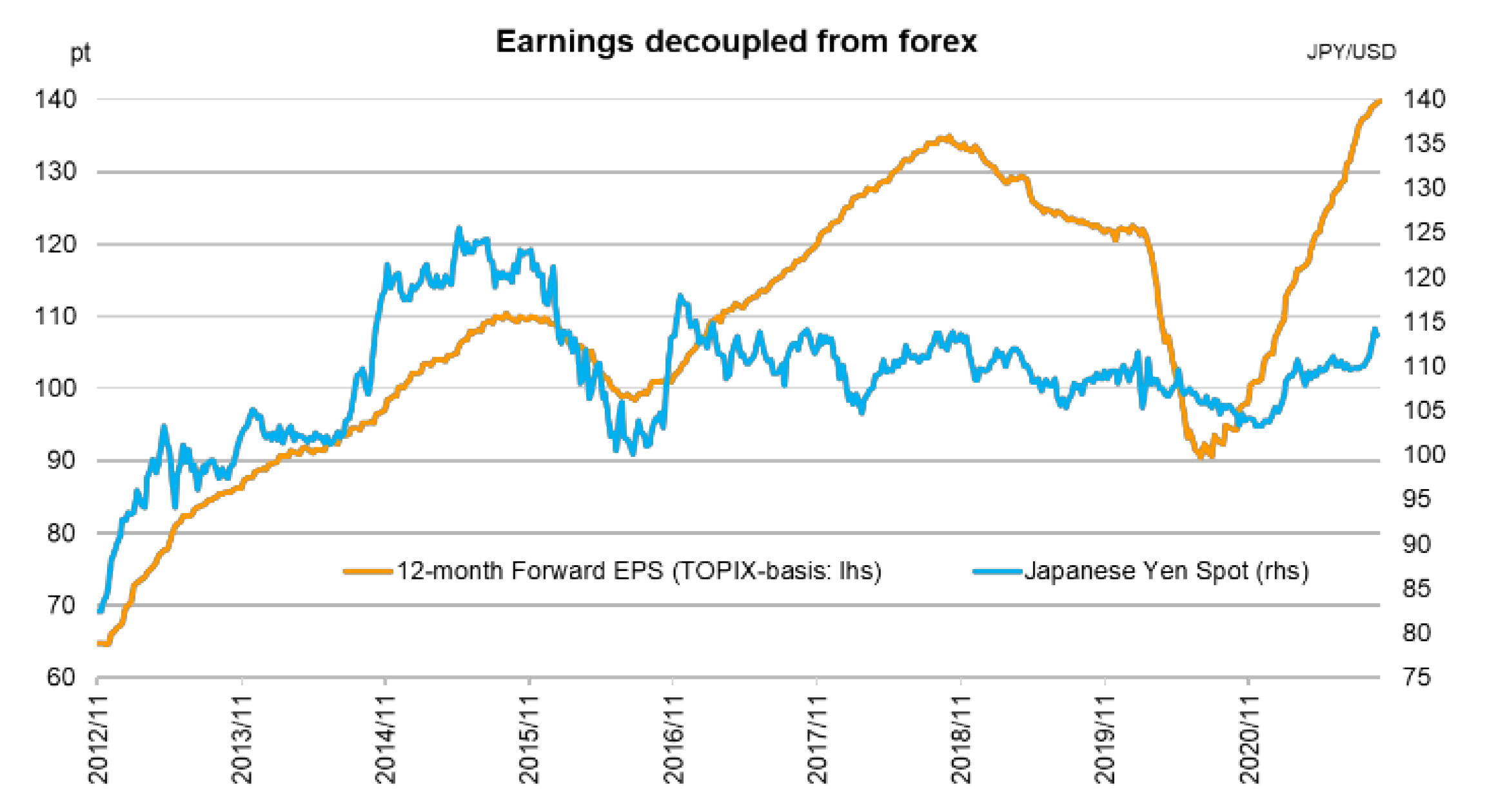

Assisted by the Bank of Japan's easy money policy, USD/JPY depreciated from below 80 to above 120 in under three years, in a boost to exporters. Many companies continued to increase their earnings as the rate hovered around 110.

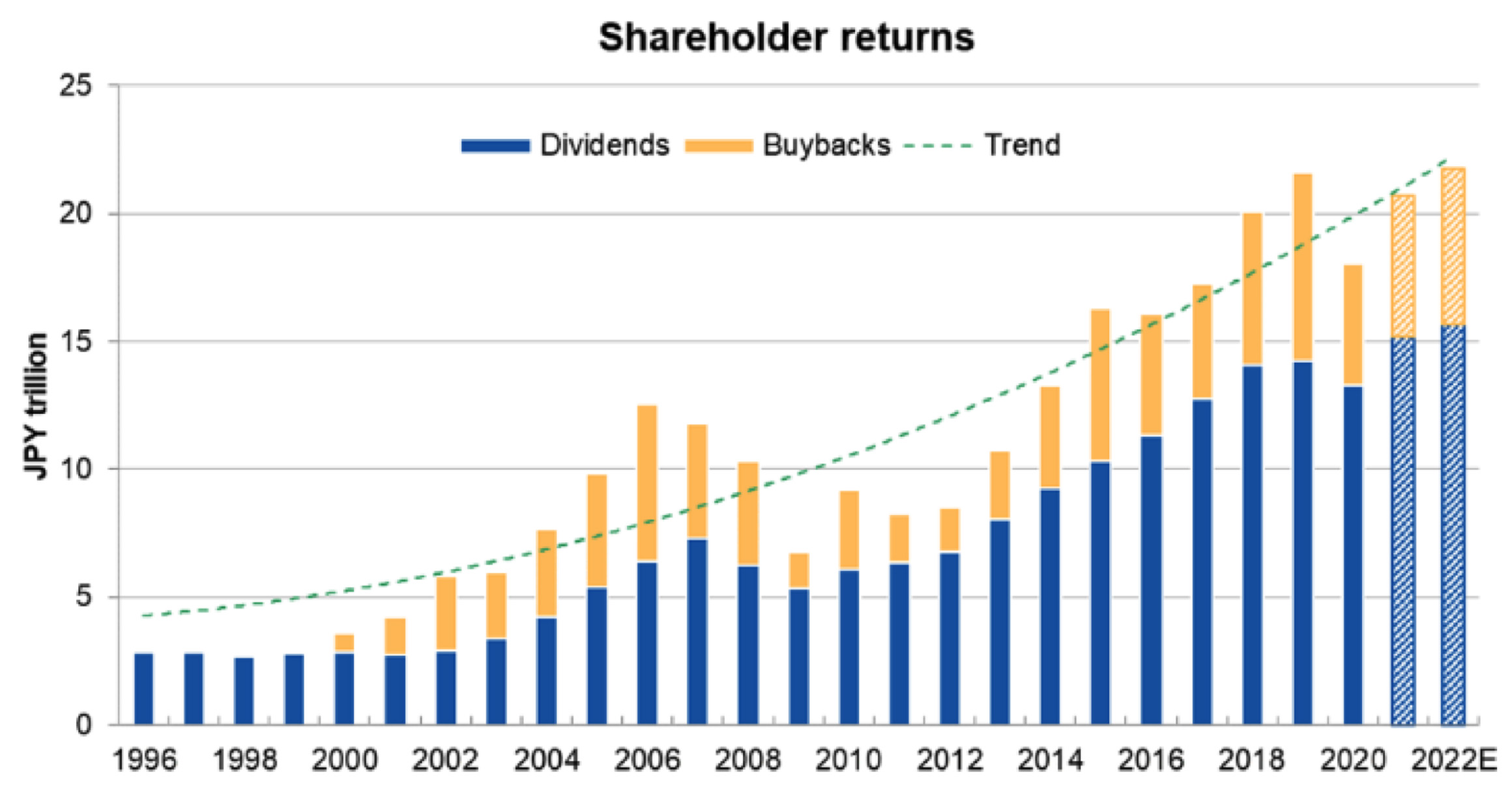

Progress was made in corporate governance reform, meanwhile, with an eye to foreign investors, who own around 30% of Japanese equities and make up nearly 70% of the average daily trading volume; the introduction of a new corporate governance code, a Japan version of the UK’s stewardship code, and the ROE-focused JPX400 index all helped increase shareholders returns in the form of dividends and share buybacks (doubling from below JPY 10 trillion in 2012 by 2018). Another notable achievement was making Japan a top destination for foreign tourists: the number of visitors reached 32 million in 2019, just behind the UK.

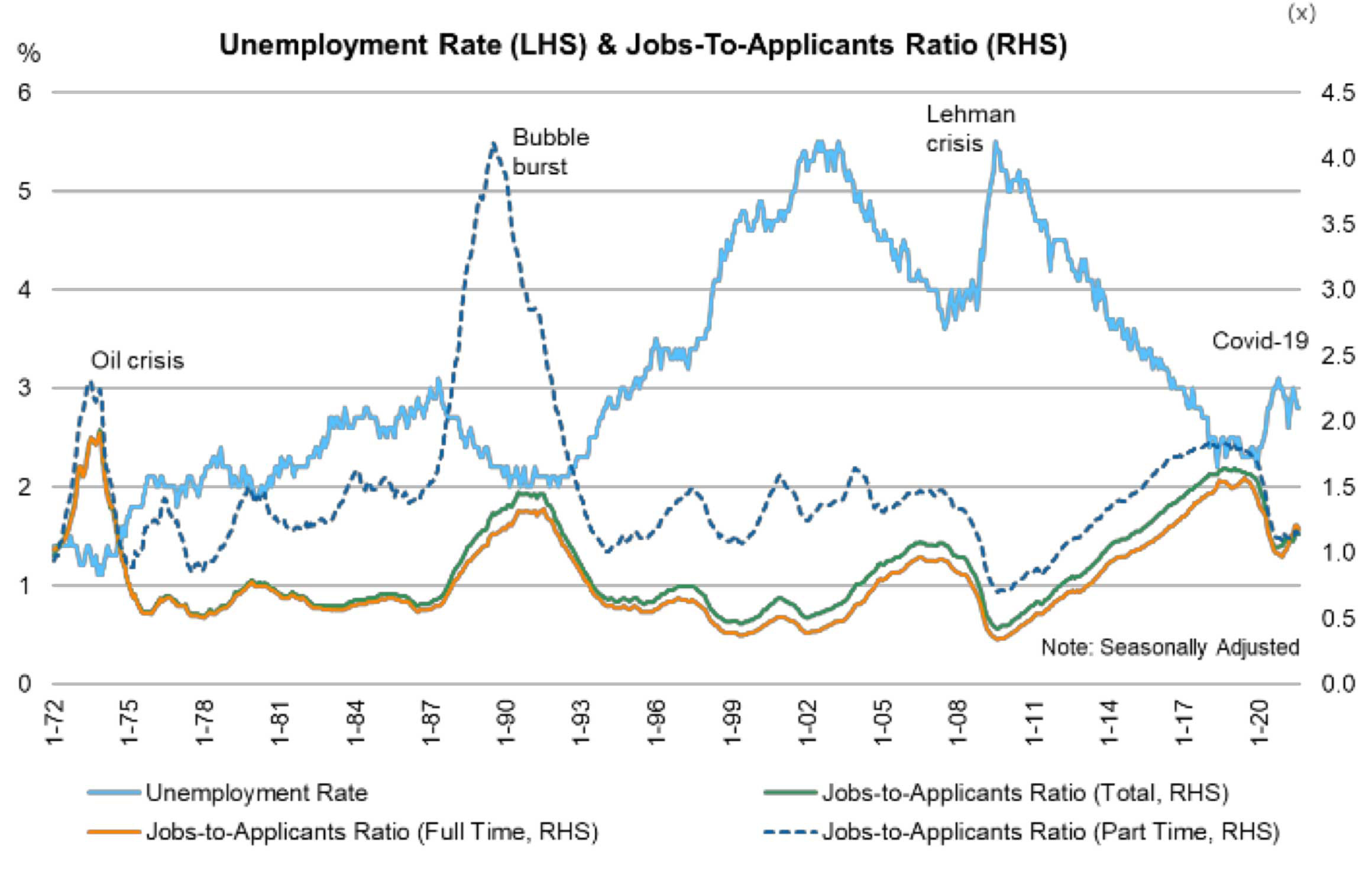

Ultimately, Abe’s economic legacy was an improved environment for Japanese corporations to make further progress. There is, however, some unfinished business from Abenomics for PM Fumio Kishida to inherit. Despite a considerable improvement in the labour market, with unemployment declining from 4.3% to 2.2% before the Covid-19 crisis, inflation led by wage increase was never achieved – let alone the 2% inflation target set by the Bank of Japan's governor during his tenure, which is set to end in March 2023; inflation is now hovering around zero. For economic growth, the lack of wage increases amid an ageing population is an ongoing conundrum for the government, when personal consumption makes up nearly 50% of GDP against just 20% from exports.

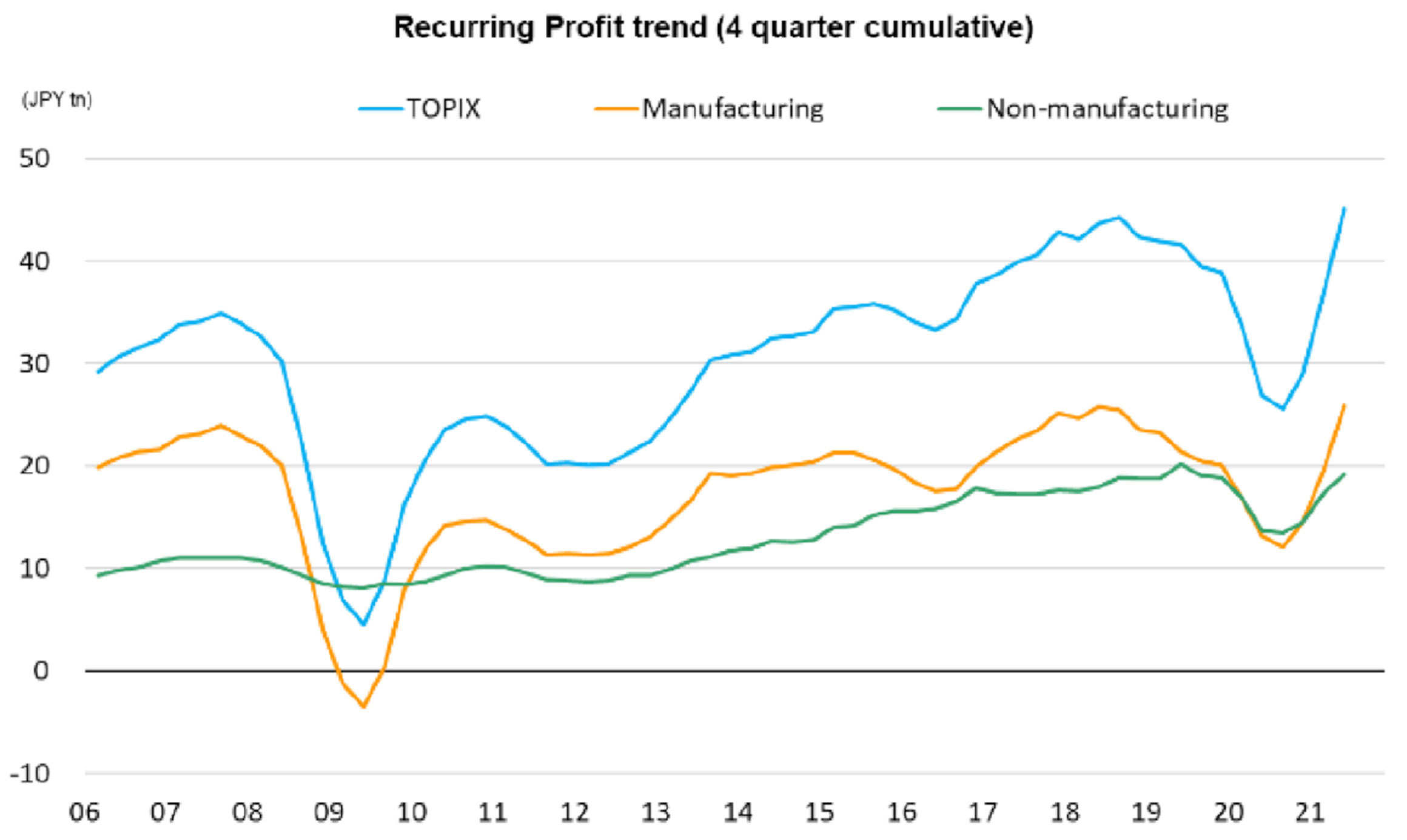

What is clear is that we are not going to have an equity market-supportive Abenomics Part Two under the less market-friendly Kishida, but Japan continues to have one of the most stable governments in the developed world, making policy implementation easier. However, it should also be pointed out that the correlation between GDP growth and market movement is not high; the TOPIX rose 342% from 2012 to October 2021, but annual GDP growth was only 0.8% during this period.

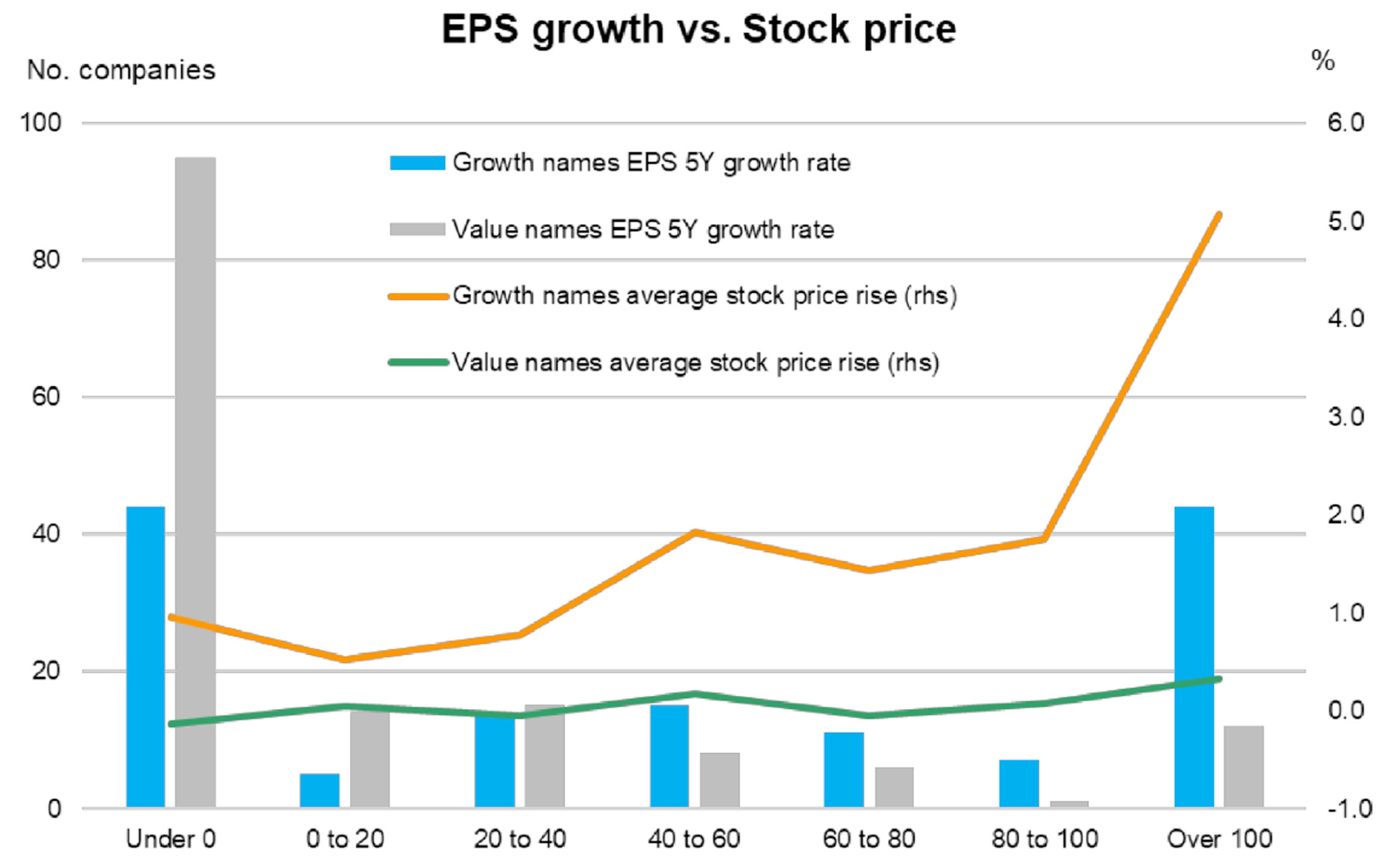

Corporate earnings are now back to pre-Covid levels despite weak GDP growth, but there are concerns about global commodity price increases and the negative impact of yen depreciation on terms of trade. Under such circumstances, we expect to see a widening gap in the coming months and years between corporate winners (driving earnings growth themselves through innovation and pricing power) and losers (with little pricing power, and dependent for growth on government policies). What is clear from past data is that there is a good company-level correlation between earnings growth and share price movements. Hence, active portfolio management, and in particular earnings growth-focused stock picking, is likely to provide a good source of alpha.

Note: The above figures (as applicable) are past performance and do not guarantee future results.

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

This report has not been reviewed by the Monetary Authority of Singapore.