Insights

Articles

Articles

Depreciation of the Japanese Yen

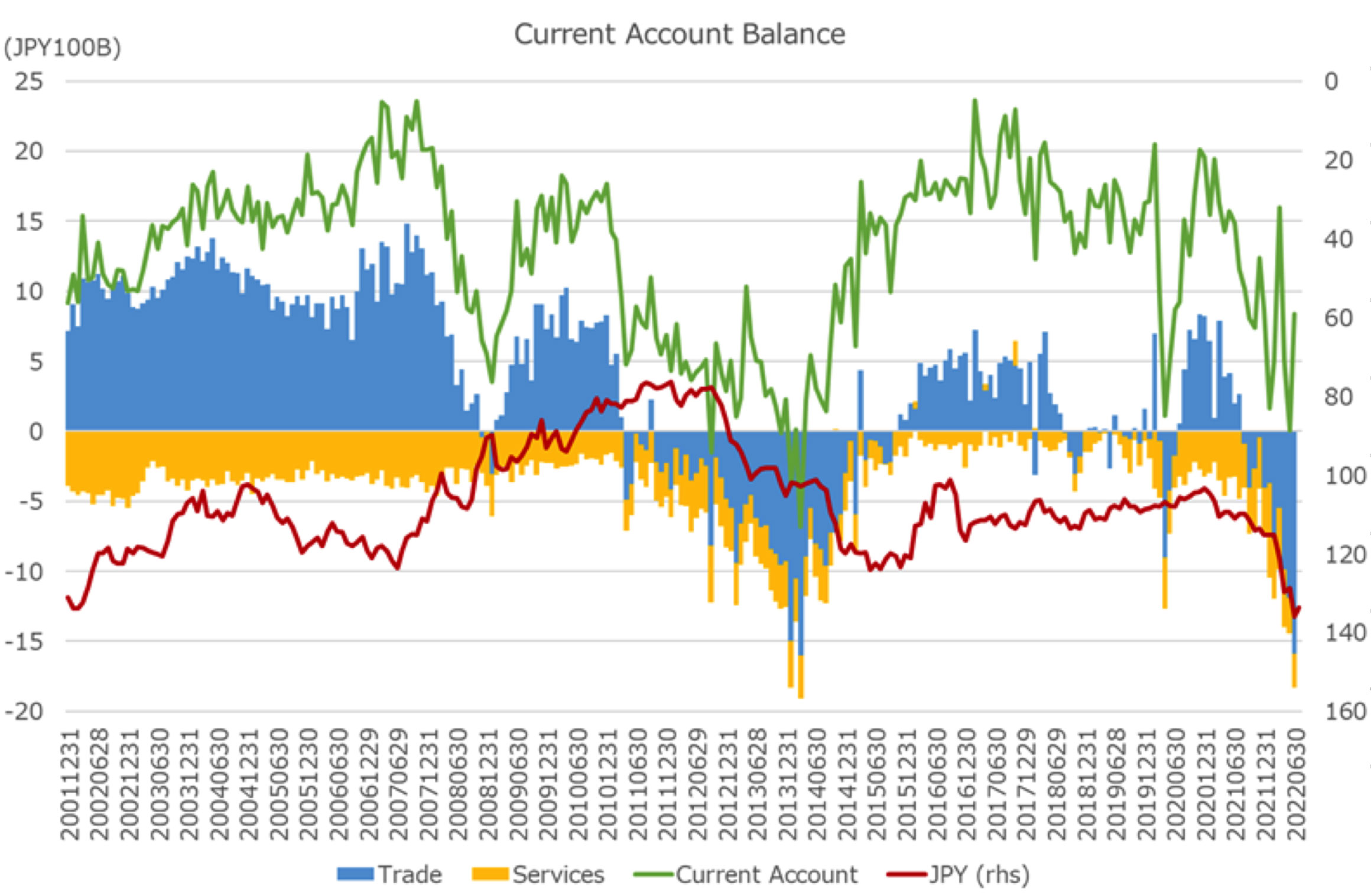

Multiple Factors at Play

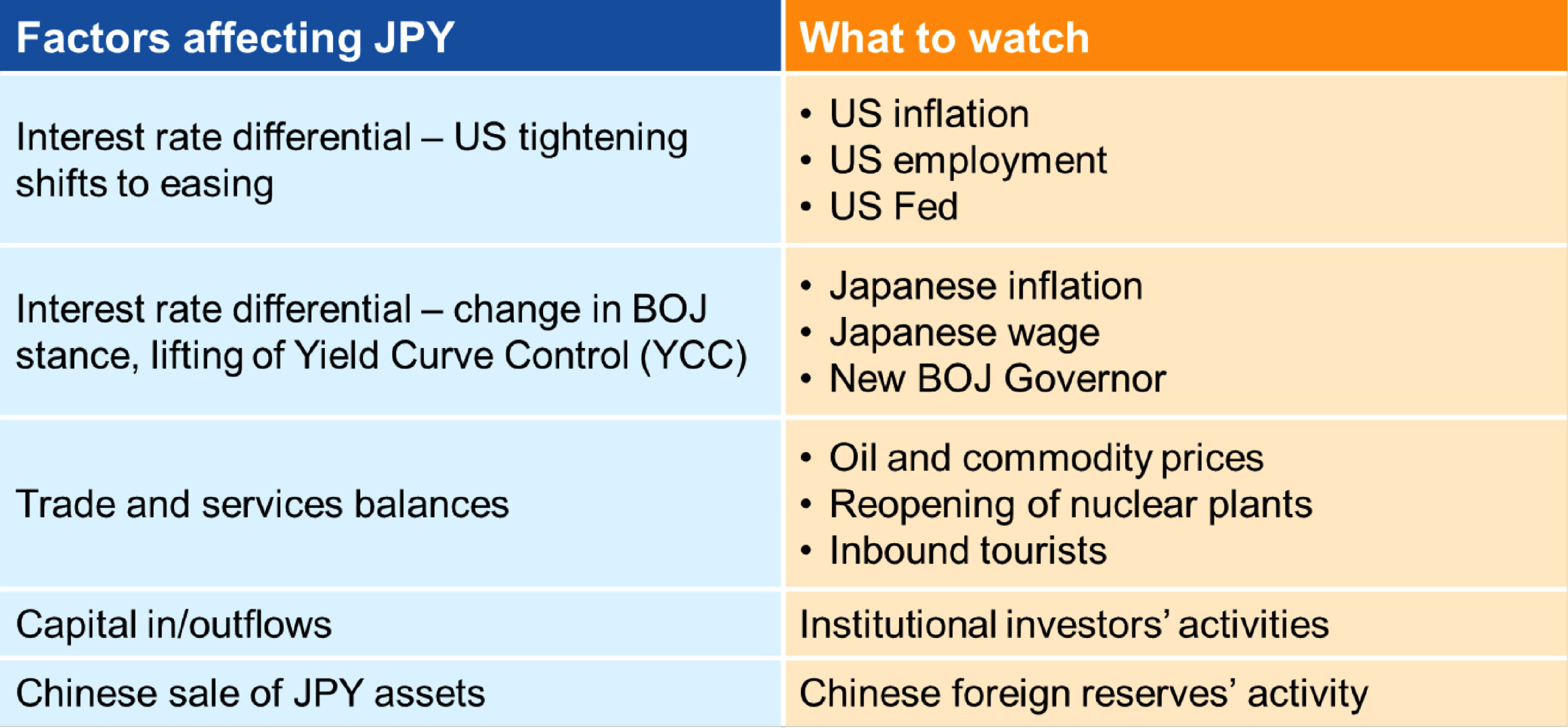

- Interest rate differential caused by monetary policy gap.

- Deteriorating trade and service balances amid high commodity prices.

- Hedge unwinding as Japanese institutional investors repatriate funds.

- Chinese foreign reserve shifting out of JPY assets.

Source: Bank of Japan, Factset

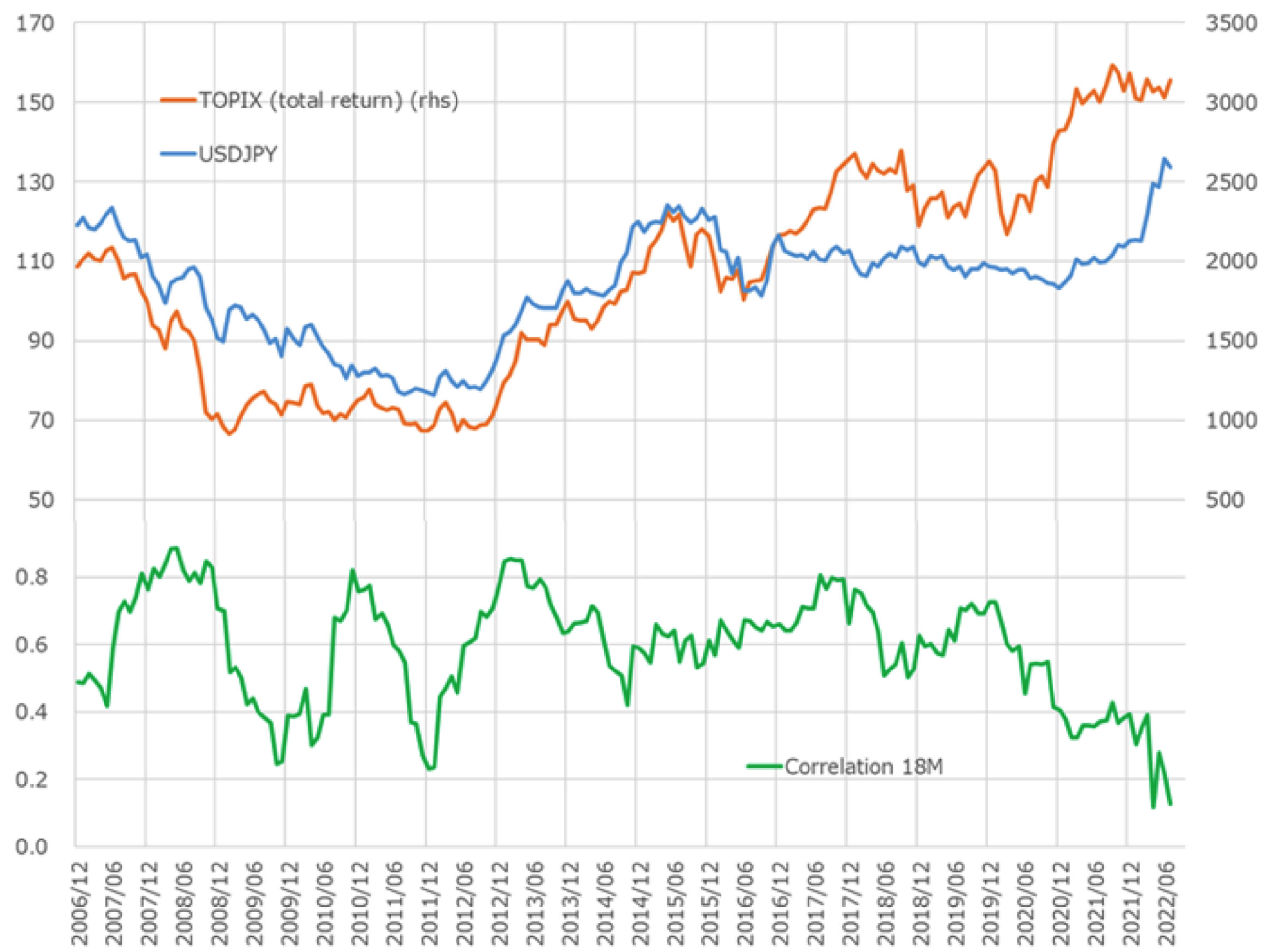

Effects on Equity Market

- JPY and TOPIX less correlated than previously, but weak JPY helps corporate profits.

- Beneficiaries include autos, steel & metals, and machinery; weak JPY hurts utilities and retailers.

Source: Factset

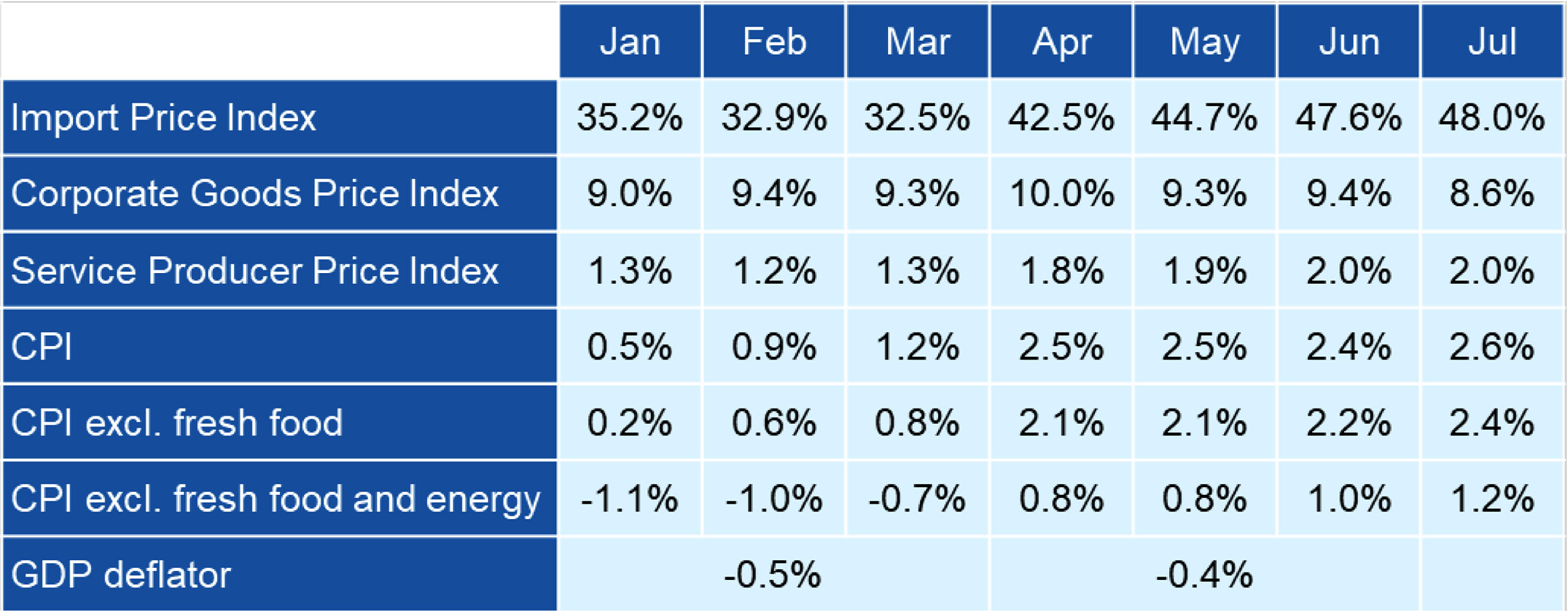

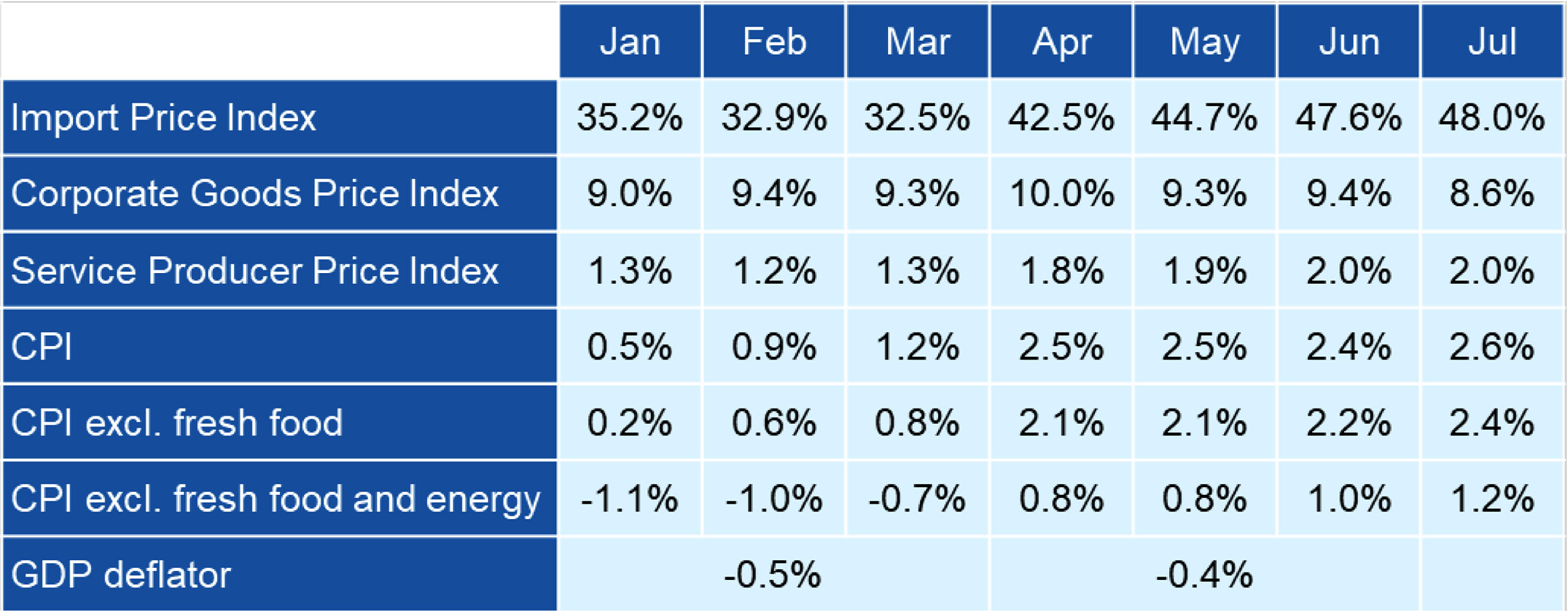

Outlook

- Narrower interest rate gap looks unlikely.

- BOJ’s easy stance based on still modest core inflation.

- Fed anti-inflation stance confirmed at Jackson Hole.

- BOJ waiting for wage hikes to confirm turnaround in deflationary environment.

- For FX to appreciate, BOJ would need to raise interest rates, which seems unlikely under current condition.

- US slowdown or lower commodity prices may weaken USD.

- Effective Yen rate is strongly negatively correlated with commodity prices represented by CRB Index.

Japanese Price Indices

Source: BOJ, Cabinet Office

Correlation with CRB Index

Source: Factset, BIS

What to Watch

We highlight below the factors that are affecting the Japanese Yen.

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.