Articles

Executive summary

- External inflationary pressures have helped Japan escape the decades-long spiral of deflation

- Japanese companies can now raise prices, and invest in both physical and human capital for better productivity and improved margins

- Evidence so far points to higher prices and wages, but sustained growth will take time

- Other good news is the shift to shareholder-oriented management, with capital efficiency set to improve

- Active management will work better to select winners who can raise prices and wages, and/or improve capital efficiency

Decades of deflation ending at last?

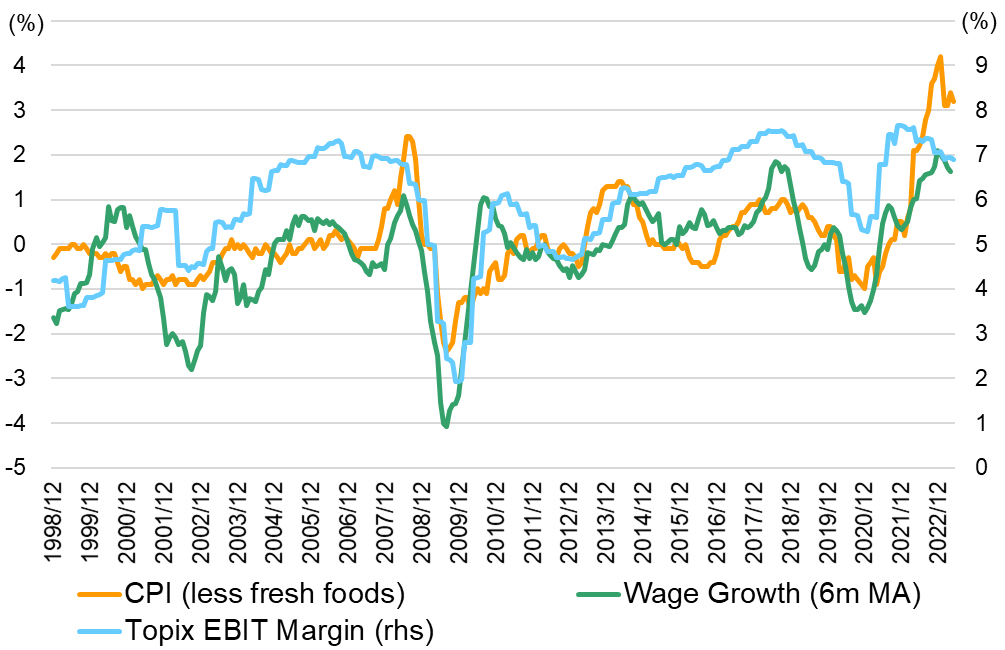

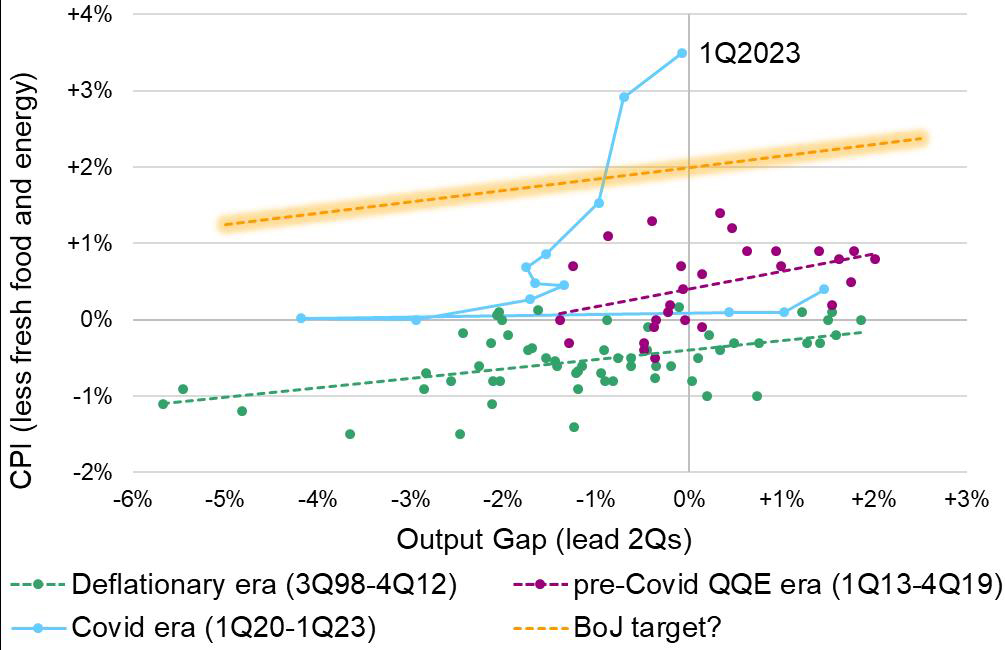

Japan has been plagued by a deflationary cycle since the collapse of the bubble economy at the beginning of the 1990s. A reluctance to raise prices and risk losing market share led companies to instead focus on cutting costs – including wages, R&D and investment – resulting in reduced consumption, underinvestment and lagging productivity. Workers were unable to request wage hikes in an inflation-free environment, and companies kept prices flat. This state of stagnation became the norm for Japanese companies through decades of deflation, with globalisation and a strong JPY piling on further pressure. Companies shifted production overseas and reduced investment at home. Some changes were seen in the Abenomics era of the 2010s, with aggressive monetary policy at the Bank of Japan (BoJ) bolstering the economy; CPI turned positive and corporate profits increased to historic highs, but this failed to translate to higher wages.

Fast forward to early 2020 and the dawn of the Covid era. External triggers brought inflation alongside recovery, helping Japan at last to escape its decades-long deflationary spiral. While it took some time for Japanese companies to pass on rising input costs, CPI excluding fresh food and energy is now growing at over 3%, a rate Japan has not seen for three decades.

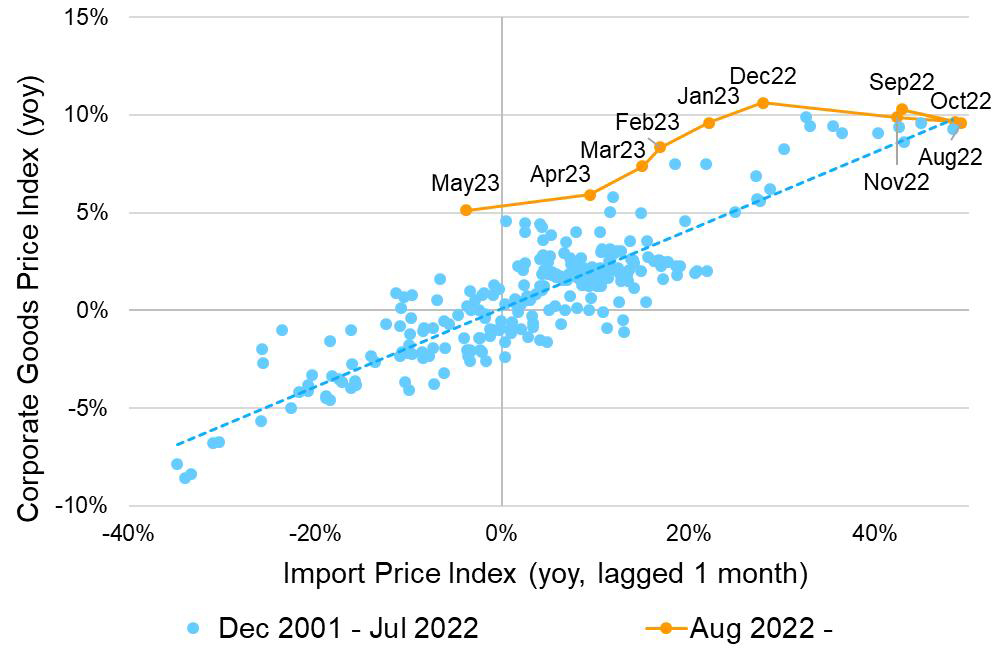

Prices remain sticky in areas but are gradually shifting upwards. Items seeing hikes of 5% or more made up 30% of the CPI basket in April 2023, against only 6% five years ago and 4% another five years before that. Meanwhile, annual wage negotiations in spring 2023 saw management and unions agreeing wage table hikes around 2%, in a first since 1993, after CPI rose 2.2% in 2022. Whether this newly inflationary cycle will be sustained even if CPI growth slows as expected due to declining input prices remains uncertain; deflationary era norms do seem to be changing, however, as evidenced by the continued steady growth of corporate goods prices even following a slowdown in import prices as companies gradually pass on higher costs.

Alongside rising prices, a tight labour market has been working as a factor to push up wages. Japan continues to face demographic challenges, as a declining and ageing population shrinks the workforce. The 2010s saw more women and post-retirement age workers offset shortages, but the low-hanging fruit has already been picked here. Other factors contributing to tighter labour conditions include a growing emphasis on work-life balance and a reopening economy, with the impact being felt most clearly in the market for essential workers and those with the skills to implement the country’s long-overdue digital transformation.

While labour shortages are a constraint for growth, the good news is increasing job mobility amid a cultural shift and changing attitudes among employers. Companies are gradually transitioning from the traditional lifetime employment model, which considered workers as semi-fungible human capital, to a more specialised role-based approach, where career progression is more likely to involve moving to a different firm. The government is promoting this shift to greater job mobility, with the twin benefits of structural wage increases and more efficient allocation of limited labour resources.

Employment practices will not change overnight, but it will be interesting to watch what happens in the labour market. Evolving norms will empower companies to set higher prices for competitive products and provide an incentive to invest in developing new products with higher added value; higher wages will enable firms to attract and retain the talent they need for growth. Crucially, this should contribute to an upward shift in inflation expectations, which the BoJ has identified as an important factor in escaping the deflationary outlook and shifting to a new paradigm.

A weaker JPY and more competitive wage levels in Japan are prompting companies to think about reshoring production, with a rise in geopolitical risks and a shift away from globalisation also accelerating factors – although this too will be a time-consuming process.

Inflationary expectations may also induce a shift in Japanese household assets, with more than half of a gargantuan JPY 2000 trillion (USD 14 trillion) currently held in cash and bank deposits – a rational financial strategy across decades of deflation, but less so in this new inflationary era. The government has recently upgraded tax incentives for investing in equities and other risk assets to promote a shift from savings to investment. Foreign equities have attracted the most inflows so far, but a stronger Japanese stock market has the potential to boost interest in domestic retail investment.

Not all companies will benefit from the new inflationary era, however: smaller and less efficient firms kept afloat during the pandemic by easy monetary policy and government subsidies are particularly likely to see profits squeezed by higher wages and labour shortages. Normalisation and price competition will accelerate realignment in some industries, where players with weak productivity and pricing power may need to merge with stronger ones.

Shareholder-conscious management

Another change taking place in Japan is a shift to more shareholder-oriented management, with corporate governance and stewardship codes introduced in the mid-2010s having now largely gained acceptance from both companies and investors. The pecking order at Japanese firms has traditionally been customers and business partners first, then employees, and shareholders last. However, just as the US is seeing a departure from shareholder supremacy, Japan is gradually shifting towards the middle. ROE levels remain generally low, but climbed in the 2010s thanks to improved margins. Company executives are increasingly conscious of capital efficiency and shareholder returns; share buybacks and dividends are increasing steadily, helped by high corporate profits and cash holdings.

There is still room for improvement, however, with about half of listed companies trading below book value. In March 2023, the Tokyo Stock Exchange (TSE) took the unusual step of requesting that all companies listed on its Prime and Standard markets take steps to implement management that is conscious of the cost of capital and of stock price. In its request, the TSE suggested key points for analysis: cost of capital (WACC, cost of equity), balance sheet profitability (ROE, ROIC) and market valuation (stock price, market cap, P/B, P/E), noting that “a price-to-book ratio below one is an indicator that the company has not achieved profitability in excess of its cost of capital, or that investors are not seeing enough growth potential”. A number of companies included the P/B target in earnings announcements, mentioning ROE, ROIC, payout ratios, and share buybacks. More firms are expected to include measures to address the issue, implicitly or explicitly, in corporate governance reports come June/July. The TSE’s push may work to accelerate the trend by creating a sense that companies should view trading below book as a source of shame.

The most straightforward way to raise P/B is to boost ROE by buying back shares and paying out dividends, which is how most companies have responded so far. Given that P/B = ROE x P/E, however, firms also need to be conscious of price-to-earnings – the growth perspective.

Turning tides call for expert navigation

What’s going on in Japan? In a word, change – or at least signs of it. Deflation is giving way to inflation, pushing firms to pivot from a defensive to a proactive stance (likewise households, from saving to investment). Labour markets and employment practices are evolving. Management teams are shifting to a greater focus on shareholders and capital efficiency. The wheels of the inflationary cycle are only just starting to turn, of course, and it will take time for norms and practices to change. Japanese companies have a strong tendency to stand side-by-side, however, and to move rapidly when changes reach a certain level. Active managers are best positioned to monitor these shifts at the individual company level and across the broader economy – and to help smart investors act ahead of the tipping point.

About the author

|

Hiro Kasai, Senior Strategist

A founding figure in TMAM’s investment process, with three and a half decades’ experience in asset management, including spells as CIO of TMAM and CEO of its New York subsidiary, as well as head of Asian investment for the Tokio Marine Group. When not providing macroeconomic and market insights, Hiro enjoys onsen trips and countryside walks. |

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.