Articles

Executive summary

Japan has been back on investors’ radars for the past year as the country transformed from an unremarkable allocation in global equity portfolios to a hotbed of market news, which is increasingly viewed as worthy of a dedicated regional approach.

As investors, we constantly monitor the markets, but more importantly, we try to anticipate what the longer-term market trajectory is likely to be. In this article, we lay out our arguments in favour of a major change in the type of stocks that outperform the broader market, which, in our view, is only a question of time. The longer it takes for growth to lead value, the more pronounced we expect the shift to growth outperformance to be.

In a nutshell, we believe that companies with growing earnings will become more rewarding investments than stable businesses that lack upside. After several years of value outperformance, we are witnessing some of the widest spreads between growth and value that some of our portfolio managers have seen in their entire careers. This is part of the reason why we believe that a major reversal to a growth market is around the corner in Japan. We have so far observed that the negative impact of recent market volatility was less pronounced for growth stocks than value. This market correction might turn out to be the catalyst for a trend change in the prevailing market style.

Japan has changed and now provides a supportive environment for growth

We believe the underperformance of growth stocks over the past few years is the result of multiple factors linked to the lockdown-induced supply chain shock and the ensuing higher inflation/higher interest rate environment globally. But it is precisely this environment that is stacking the fundamentals in favour of growth. This is in addition to the fact that while fundamentals for growth companies have been improving, they have not been recognised by the market. We also think investor sentiment has overpriced value stocks, setting the stage for a reversal.

Looking at the macro economy, the environment is changing from deflationary to inflationary. EPS has been trending higher for some years, but the structure of this growth is changing. Until recently, EPS was improving on the back of gradually increasing operating margins, while revenues stayed more or less flat. Cost-cutting was the key driver, and Japanese companies mastered keeping expenses low. This was possible thanks to a combination of deflation and low interest rates which made refinancing easy. But as inflation picked up and revenues started growing, companies began to change the way they do business. Now, they can offer products and services with a higher profit margin, as higher prices are becoming accepted as a fact of life. This will be helpful to companies as refinancing costs increase due to higher interest rates.

The new growth environment is underpinned by structural changes

We believe the new growth climate will persist for years to come because the trends that drive it are long term and irreversible.

1. Demographics

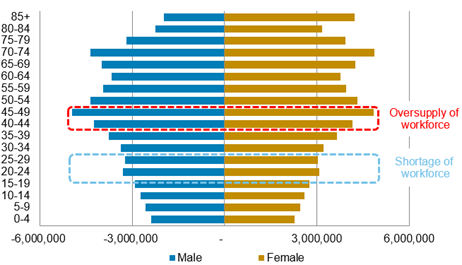

One of these trends is demographics. Japan went from an oversupply of workers in the 1990s to a serious shortage in recent years. The structure of Japan’s population is such that there are still too many workers in their late 40s and 50s. Having gone through the experience of three lost decades, they tend to be risk-averse, and happy for their compensation to stay practically unchanged until retirement. These workers have been the big drag that kept wages barely changed.

Younger workers are becoming increasingly scarce, however, and competition to secure them is now fierce. We saw manifestations of that in 2023 when some firms offered uncommonly high increases in new joiner salaries. There were some examples where university graduates’ pay rose by 20-40% in a wide range of industries from steel to fashion to semiconductors (DIGITIMES Asia, Yomiuri1), even though most firms offered more modest increases. This trend will continue as immigration remains far too low to change the balance of power and put upward pressure on wages.

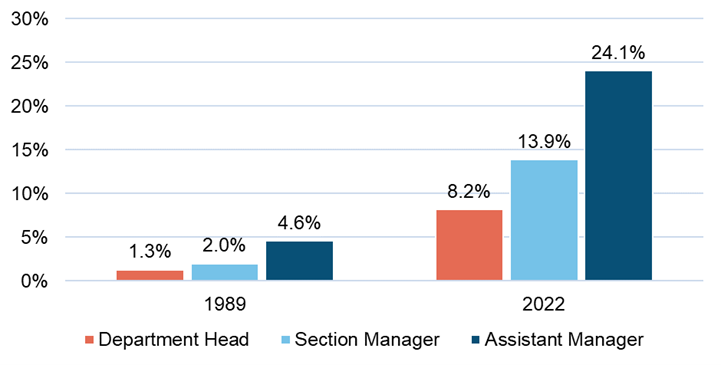

A recent positive sign is the increase in female workers' compensation. In the past, very few women chose to continue their career after childbirth, as it was very difficult to have both a family and meaningful career progression. Instead, they preferred to work in temporary positions, where the pay was lower but there was more flexibility with working hours. This also created an environment where very few female workers got promoted to managerial positions.

For a long time, this was socially accepted, but as both corporate governance reform and foreign investors increased pressure for more gender diversity and female board participation, companies started improving working conditions. As a result, the share of female managers has crept up over the years, as shown in the chart below. While still much lower than in Europe and North America, it has contributed to pushing overall wages higher. It is continuing to increase as companies work to ensure higher female participation in the ranks of management, for example by forming special committees.

At the individual company level, rising wages imply higher costs, and are not good for growth. However, on the back of the diminishing size of the overall workforce, companies are forced to improve the efficiency of their work processes and increase investment in IT, leading to an uptick in planned capital expenditure. This in turn drives expansion, as higher capex enables further growth.

There are also companies that build their business models around the ageing population, pharmaceuticals being one prominent example. It is no coincidence that the country with the most advanced population by age boasts several major players in areas such as cancer and Alzheimer’s disease treatment.

2. Abandonment of negative interest rates

Another change is the abandonment of negative interest rates. Combined with sustained inflation, it is a decision that is highly unlikely to be reversed. While the number may be higher or lower over time, it is hard to imagine a scenario where it is as low as it had been for years before the first hike earlier this year.

This makes companies shift gears. They have to be more profitable because the cost of capital will be higher. Some companies will fail, but many more will have to better utilise their abundant cash to invest. This is likely to lead to redistribution of market share among peers, where the more successful companies will be getting a larger slice of the pie, even if the size of the pie is unchanged. Furthermore, we believe that this will be another catalyst to encourage sustained growth outperformance.

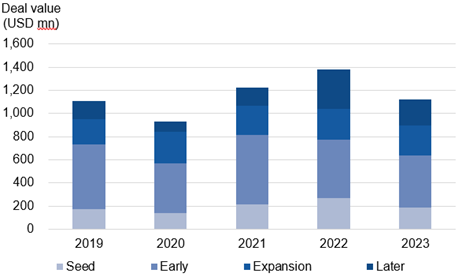

In such an environment, we might even see small- to mid-sized, innovative companies outcompeting dominant players in the sector and growing aggressively. However, we may need to see the budding Japanese VC sector step up to the plate. There are encouraging signs – the total amount of VC deals in Japan has tripled over the past decade, but much more is needed.

Where to look for growth

At TMAM, we adhere to the pragmatic view of growth. If a company shows consistent earnings growth, it is a growth company. Where can we find such companies?

The answer is that possibilities exist in most sectors, but we tend to find more in some industries than others. The sectors aligned with the aforementioned structural changes, tend to have more growth companies. For example, if we look at demographics, we can find companies that support productivity gains (IT, factory automation) and companies that cater to the ageing society (pharmaceuticals).

Other examples include sectors supporting AI (semiconductors) and electric vehicles (chemicals for batteries, auto component manufacturers for parts, and again, semiconductors). Also, despite its reputation as a value sector, one industry that supports business expansion is banking, and we may occasionally find growth companies there.

Growth overshadowed by value

You may wonder if opportunities are so plentiful, why have value stocks outperformed growth stocks? The big drivers can be traced back to the pandemic. Stay at home beneficiaries and increased global liquidity sent growth stocks skyrocketing beyond their fundamentals. When the economy re-opened and inflation/interest rates picked up, an even bigger downswing occurred in response.

While the Bank of Japan took their time to hike interest rates, the US and Europe started raising rates fairly quickly. This turned market sentiment pro-value and further amplified the knee-jerk reaction from supply chain shocks that followed the re-opening.

There were also some smaller drivers. For example, the Tokyo Stock Exchange’s appeal in spring 2023 to raise low price-to-book companies’ valuations produced balance sheet improvement at the lower end of the valuation spectrum. The fact that some value names were improving their earnings at a better rate than their growth peers last year did not help either.

The reversal is nigh

There are indications that this trend could be reversing. There are several data sets to look at. If we use a sports metaphor, we can be confident that a record can be broken if the athletes are all in good health, and their results have been trending higher, suggesting new personal bests.

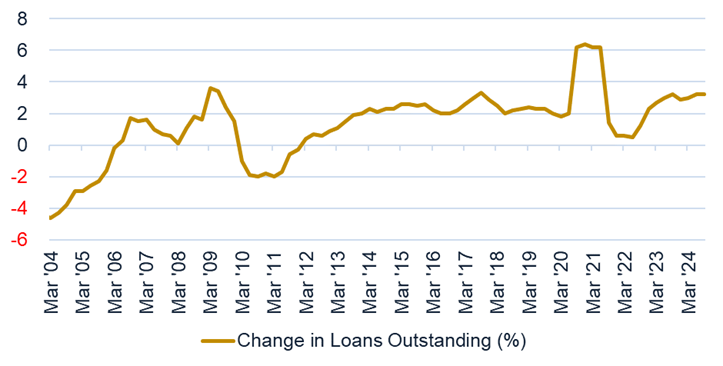

Looking at business health, bank lending, the main engine of growth for all Japanese firms, continues to increase at a steady pace. On top of this, looking at companies' abilities to convert this capital into earnings, EPS growth is strong. Companies continue to report solid earnings that surprise on the upside and, within the context of the broader macroeconomic environment, business sentiment is still on the expansionary side of the spectrum.

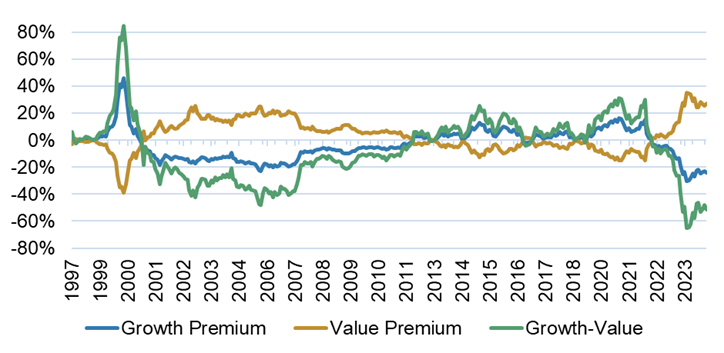

Looking at recent trends, the gap between growth and value indices is at a level unseen in decades and in our opinion, unjustified when we look at the fundamentals of these companies. A reversal would be a logical resolution of the pandemic-induced dislocation back to the long-term trend. In addition, if we zoom in on corporate EPS trends, growth stocks are projected to achieve higher EPS growth rates than value names this year – a potential catalyst for a trend reversal.

Conclusion

After several years of a value-led market, with spreads between growth and value at levels not seen in over 30 years, we believe the time is nigh for a major trend reversal.

Japan has undergone some fundamental changes. Corporate governance continues to improve apace. The economy is moving from a deflationary to an inflationary environment. Bank lending is increasing, and interest rates are finally nudging upwards. The often-discussed demographic issues are not only helping these shifts but are also providing opportunities for growth, if you know where to look.

We believe the board is set and the pieces are moving. While the game has been long and complex, in our view, growth is the key factor to watch in Japan, and we at TMAM are doing just that.

About the author

|

Yoshihisa Nakagawa

Chief Portfolio Manager, GARP Strategy Co-author: Oleg Kapinos Investment Strategist |

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.