Articles

How 1H2024 panned out till end of May?

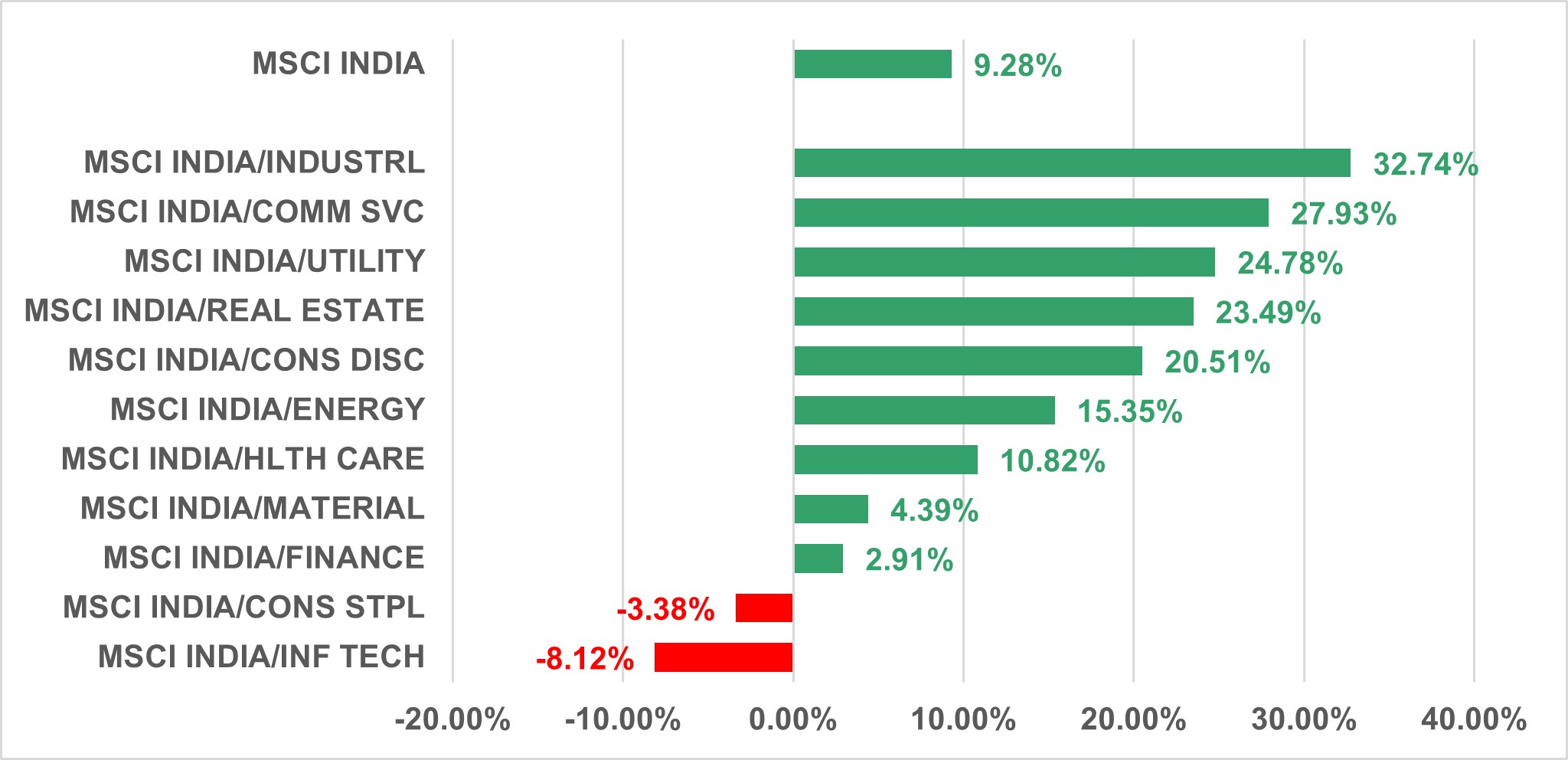

Indian market performed well year-to-date (till end-May) despite election related uncertainty and volatility. Industrials and Utilities performed well driven by capex cycle and energy transition related investments. Communication Services continued to enjoy consolidated industry structure and market is expecting tariff hikes post-election. On the other side Information Technology sector corrected due to uncertainty of demand from developed markets. Consumer Staples also underperformed due to lagging rural consumption.

Macro-economic parameters have been on a strong footing and gaining strength. Real GDP growth for 1Q 2024 (Mar-end) came at 7.8% , much ahead of expectations. Current Account and Fiscal Balance also have been better than expected.

Ahead of the election, Foreign Institutional Investors were net-sellers in the market (US$ 3.0 billion year-to-date till 30 May 2024). While domestic inflows remained strong and managed to absorb the foreign outflows without impacting the market.

How has been corporate financial result for FY2024 (March 2024)?

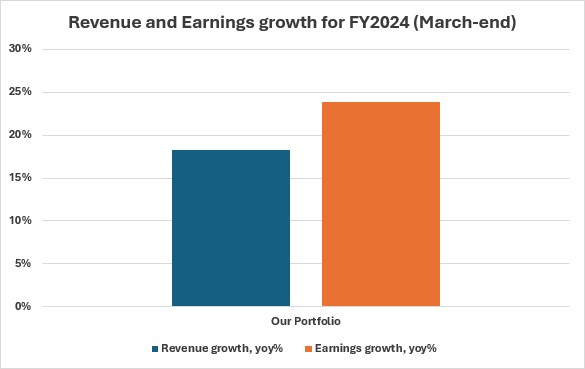

The earnings season for the financial year FY2024 just ended and the growth outcome has been satisfactory. In our core India Equities strategy, revenue and earnings growth in our portfolio has been up 18.3% yoy and 23.8% yoy respectively for FY2024 (March-end). Earnings growth outpaced revenue growth as input cost normalization and operating leverage improved margin profile.

Outlook for FY2025 also remains resilient driven by resumption of public spend, corporate capex cycle, above-normal predicted monsoon, and recovery in the mass consumption (higher end discretionary consumption will continue to be steady). But it is worth noting that 1QFY25 will witness some weakness due to long election cycle and intense heat wave that gripped northern part of the country.

What happened in the 2024 General Election?

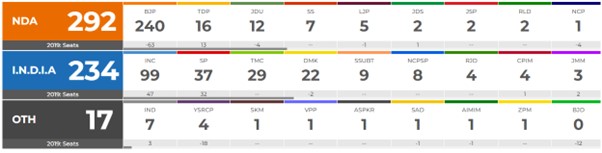

The general election (lower-house of the central government) results were announced on 4th June 2024. Contrary to expectations and exit polls the ruling BJP party’s performance was weaker than expected. BJP own 240 seats on its own which is 32 seats short of the majority mark of 272 in the house with 543 total seats. But along with the coalition partners NDA is comfortably above the 272 seats needed. The government formation will take a few weeks and unless there is major reshuffle among the coalition partners, Modi should come back as the Prime Minister for the third term.

What are our expectations for 2H2024 based on above election outcome?

Ruling BJP party’s election performance was weak in the rural parts of the country, particularly in Uttar Pradesh and Maharastra. We feel BJP will allocate more funds towards the rural and social schemes to regain its support base with the view of upcoming state elections. The government is in a good position to make such policy tweak;

- Reserve Bank of India announced highest ever dividend transfer of INR 2.1trn for FY2024 (~0.5% of GDP) leading to better fiscal headroom

- Government did not spend too much in pre-election populist measures

- S&P’s upgrade of India’s sovereign outlook to “positive” from “stable”

That said, focus on capex and infrastructure will also remain as construction is the largest source of employment after agriculture. During 2HFY25 ongoing project execution will gain momentum, corporates will also move ahead with decision making as election uncertainty is largely out of the way. But some longer-term structural reforms (land, labour and judicial) will take a backseat. The newly elected government’s first 100-day plan which will be the near-term catalyst.

Foreign capital has been cautious as volatility increased ahead of election, that should resume inflows. On the domestic front progress of the monsoons will be keenly watched for near-term recovery in the rural consumption.

In summary, we expect FY25 real GDP growth to be resilient between 6.5-7.0% yoy. But within that contribution of household consumption will be higher and that of public capex will be lower, compared to previous expectations.

How is our portfolio positioned?

We expect market to undergo a rebalancing in the medium-term. Excessive frothy valuations of some of the sectors (power, capital goods, defence etc.) will correct, while mass consumption-oriented segments will do well.

Our portfolio is well positioned to benefit from recovery in mass consumption, rural and semi-urban areas. We believe mass-end consumption will get a boost from potential policy support, which will play through two-wheeler sales, affordable housing, value retailing, agriculture dependant sectors and fast-moving consumer goods.

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

This report has not been reviewed by the Monetary Authority of Singapore.