Articles

ASEAN Equities: Foreign Direct Investment Reaches New Heights, Unlocking the Region’s Potential

Continued Foreign Direct Investments (FDIs) is a key accelerator of ASEAN economic growth

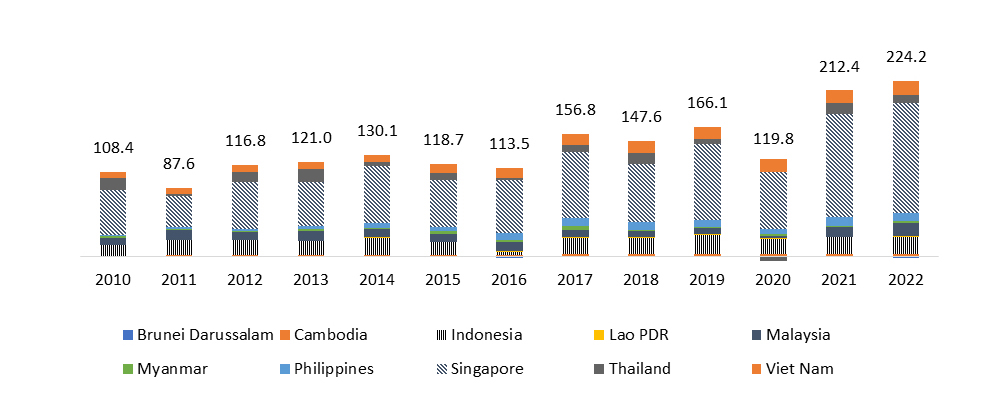

Over the years, ASEAN has emerged as a leading recipient of FDI1 among developing regions. In 2022, the region achieved a significant milestone, with FDI reaching an all-time high of US$224.2 billion. This amount accounted for a considerable 17% share of global FDI, far surpassing its 7% share of the global GDP. Such a robust influx of foreign capital underscores the region's attractiveness as a lucrative investment destination, making it a key driver for future growth and economic development.

Source: data.aseanstats.org, TMAMI

1: FDI includes greenfield investment, international project finance, and cross border mergers & acquisitions

In 2022, Singapore emerged as the largest recipient of FDI within ASEAN, with a total of US$141 billion. However, it is important to note that a substantial portion of investments in the region is directed through regional headquarters and holding companies domiciled in Singapore, which can inflate the apparent FDI inflows. Overall, the FDI inflows are predominantly driven by the growth of the semiconductor and electric vehicle (EV) manufacturing industries, as well as the digital economy.

A significant factor contributing to the surge in FDI within the ASEAN region is the implementation of the "China Plus One" strategy. Heightened geopolitical uncertainties, such as the US-China trade war in 2018, and supply chain disruptions during the Covid pandemic prompted companies to seek diversification of their manufacturing bases away from China, which accounted for more than 30% of global manufacturing capacity.

1. FDI in the EV value chain

Indonesia and the Philippines together possess a significant 27% share of the global nickel reserves, a key material for batteries. This has significantly increased FDI activities in Indonesia, and in recent times, in the Philippines. EV and battery manufacturers from Japan, Korea, and China have invested billions of dollars in battery production ecosystem in Indonesia. The surge in investments was further catalysed by Indonesia's government decision to ban the exports of primary ores and incentivised downstream processing industry.

At the ASEAN Summit 2023, leaders of ASEAN nations collectively drafted the declaration on developing the regional EV ecosystem, unifying set of standards for EVs, covering various aspects such as technology, safety standards, charging infrastructure, and battery disposal.

2. FDI in the semiconductor industry

The proportion of greenfield investments dedicated to semiconductors in ASEAN has seen a substantial increase. Furthermore, the global shortage of semiconductors has compelled electronics multinational corporations (MNCs) to boost their production capacities within the ASEAN region.

Notably, Malaysia has successfully attracted investments in the semiconductor industry, with prominent MNCs such as Intel, Micron Technology, and Infineon expanding their semiconductor operations in the country, covering both backend and front-end manufacturing. Intel Corp alone has made a substantial commitment by pledging to invest US$6.7 billion over the course of the next decade.

Penang: A Beneficiary of FDI in the Manufacturing Sector

Penang is dubbed as the “Silicon Valley of the East” with a thriving semiconductor and medical devices manufacturing sector. The tiny state packs a punch, contributing 30% of Malaysia’s exports with less than 6% of the country’s population. During 2019-2022 Penang attracted US$29 billion investments compared to US$7 billion in the prior 4 years (2015-2018).

3. FDI in the digital economy

Cloud computing, advanced data centres, e-commerce and fintech ventures have been attracting investments in the region as well. Leading companies such as Alibaba, Tencent, Amazon AWS, and Microsoft have invested to capitalize on robust growth in the digital economy. According to Bloomberg, Indonesia’s data centre market is expected to witness more than US$3 billion worth of investment by 2028.

Conclusion

ASEAN’s attractiveness as an investment destination remains strong, with Singapore, Indonesia, and Vietnam leading the way, driven by the thriving sectors of semiconductors, battery materials, and the digital economy.

About the author

Disclaimer

The information contained in this document is intended solely for the purposes of information only and is not intended as an offer or solicitation by anyone in any jurisdiction in which such an

offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. This report has not been reviewed by the Monetary Authority of Singapore.